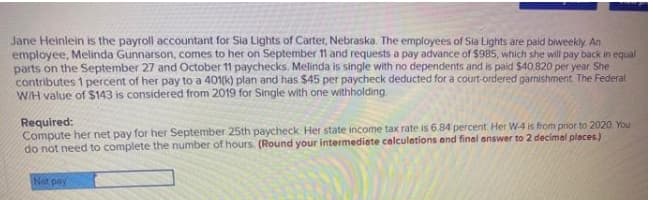

Jane Heinlein is the payroll accountant for Sia Lights of Carter, Nebraska. The employees of Sia Lights are paid biweekly. An employee, Melinda Gunnarson, comes to her on September 1 and requests a pay advance of $985, which she will pay back in equal parts on the September 27 and October 11 paychecks. Melinda is single with no dependents and is paid $40.820 per year She contributes 1 percent of her pay to a 401k) plan and has $45 per paycheck deducted for a court-ordered gamishment The Federal WH value of $143 is considered from 2019 for Single with one withholding Required: Compute her net pay for her September 25th paycheck Her state income tax rate is 6.84 percent Her W-4 is from prior to 2020 You do not need to complete the number of hours. (Round your intermediete celculations and finel answer to 2 decimel places) Net pay

Jane Heinlein is the payroll accountant for Sia Lights of Carter, Nebraska. The employees of Sia Lights are paid biweekly. An employee, Melinda Gunnarson, comes to her on September 1 and requests a pay advance of $985, which she will pay back in equal parts on the September 27 and October 11 paychecks. Melinda is single with no dependents and is paid $40.820 per year She contributes 1 percent of her pay to a 401k) plan and has $45 per paycheck deducted for a court-ordered gamishment The Federal WH value of $143 is considered from 2019 for Single with one withholding Required: Compute her net pay for her September 25th paycheck Her state income tax rate is 6.84 percent Her W-4 is from prior to 2020 You do not need to complete the number of hours. (Round your intermediete celculations and finel answer to 2 decimel places) Net pay

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter7: Employee Earnings And Deductions

Section: Chapter Questions

Problem 2E

Related questions

Question

Transcribed Image Text:Jane Heinlein is the payroll accountant for Sia Lights of Carter, Nebraska. The employees of Sia Lights are paid biweekly An

employee, Melinda Gunnarson, comes to her on September 11 and requests a pay advance of $985, which she will pay back in equal

parts on the September 27 and October 11 paychecks. Melinda is single with no dependents and is paid $40,820 per year. She

contributes 1 percent of her pay to a 401(k) plan and has S45 per paycheck deducted for a court-ordered garnishment. The Federal

WIH value of $143 is considered from 2019 for Single with one withholding

Required:

Compute her net pay for her September 25th paycheck. Her state income tax rate is 6.84 percent. Her W-4 is from prior to 2020. You

do not need to complete the number of hours. (Round your intermediete celculations and final answer to 2 decimal places.)

Net pay

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning