Olivia, a mortgage broker, has a client, Grayson, who meets all of the requirements for approval by Olivia's private lender. Joe. Joe has had issues with borrowers missing payments in the past, and has decided to charge NSF fees of $300, a condition that is much higher than normal. However Joe also offers lower rates than Olivia's other investors. Since Grayson has very good credit and debt servicing ratios, would this be a good option for Grayson?

Olivia, a mortgage broker, has a client, Grayson, who meets all of the requirements for approval by Olivia's private lender. Joe. Joe has had issues with borrowers missing payments in the past, and has decided to charge NSF fees of $300, a condition that is much higher than normal. However Joe also offers lower rates than Olivia's other investors. Since Grayson has very good credit and debt servicing ratios, would this be a good option for Grayson?

Practical Management Science

6th Edition

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:WINSTON, Wayne L.

Chapter9: Decision Making Under Uncertainty

Section: Chapter Questions

Problem 36P

Related questions

Question

Pls help ASAP for both

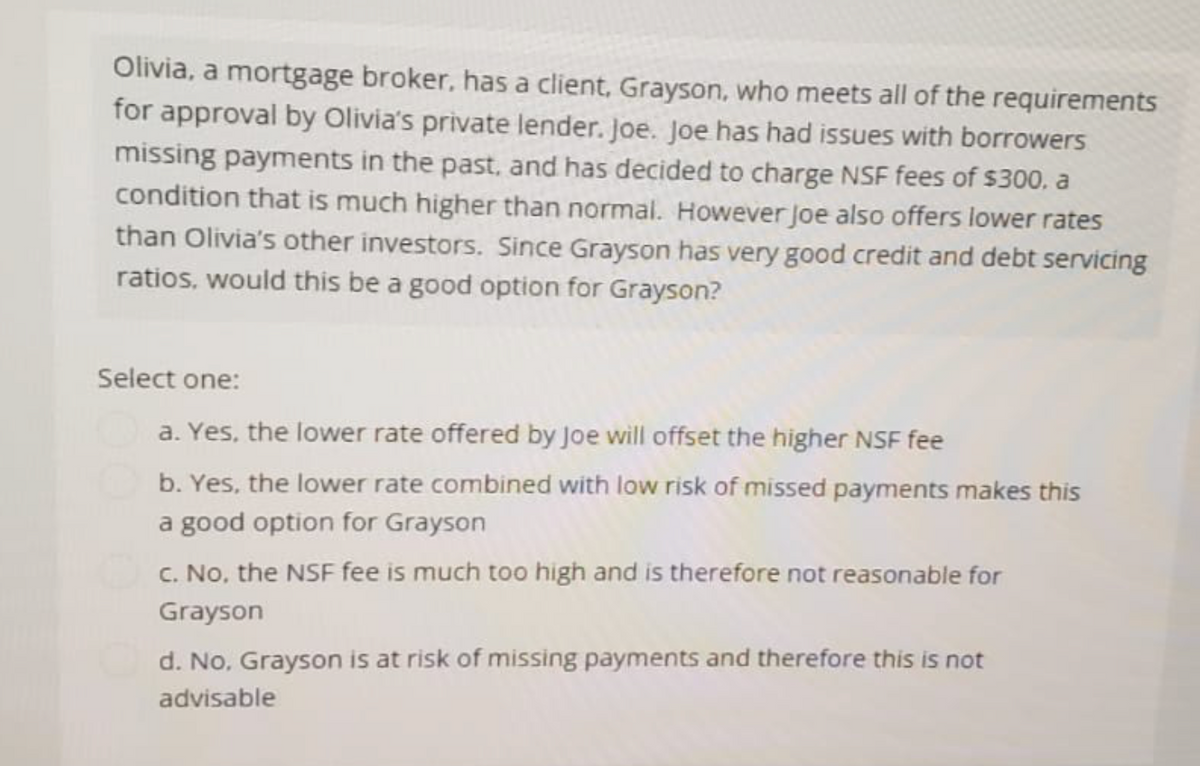

Transcribed Image Text:Olivia, a mortgage broker, has a client, Grayson, who meets all of the requirements

for approval by Olivia's private lender. Joe. Joe has had issues with borrowers

missing payments in the past, and has decided to charge NSF fees of $300, a

condition that is much higher than normal. However Joe also offers lower rates

than Olivia's other investors. Since Grayson has very good credit and debt servicing

ratios, would this be a good option for Grayson?

Select one:

a. Yes, the lower rate offered by Joe will offset the higher NSF fee

b. Yes, the lower rate combined with low risk of missed payments makes this

a good option for Grayson

c. No, the NSF fee is much too high and is therefore not reasonable for

Grayson

d. No, Grayson is at risk of missing payments and therefore this is not

advisable

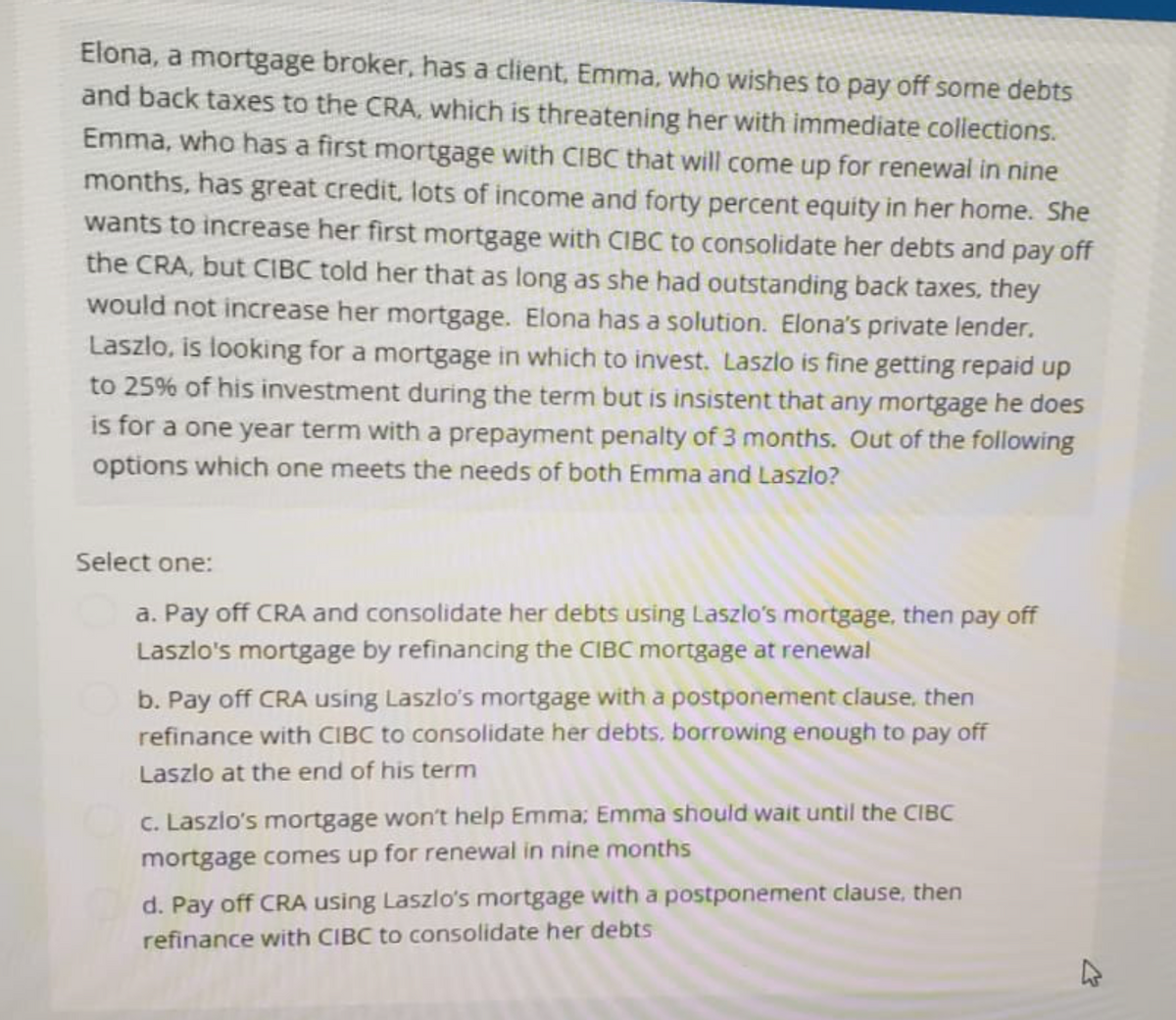

Transcribed Image Text:Elona, a mortgage broker, has a client, Emma, who wishes to pay off some debts

and back taxes to the CRA, which is threatening her with immediate collections.

Emma, who has a first mortgage with CIBC that will come up for renewal in nine

months, has great credit, lots of income and forty percent equity in her home. She

wants to increase her first mortgage with CIBC to consolidate her debts and pay off

the CRA, but CIBC told her that as long as she had outstanding back taxes, they

would not increase her mortgage. Elona has a solution. Elona's private lender.

Laszlo, is looking for a mortgage in which to invest. Laszlo is fine getting repaid up

to 25% of his investment during the term but is insistent that any mortgage he does

is for a one year term with a prepayment penalty of 3 months. Out of the following

options which one meets the needs of both Emma and Laszlo?

Select one:

a. Pay off CRA and consolidate her debts using Laszlo's mortgage, then pay off

Laszlo's mortgage by refinancing the CIBC mortgage at renewal

b. Pay off CRA using Laszlo's mortgage with a postponement clause, then

refinance with CIBC to consolidate her debts, borrowing enough to pay off

Laszlo at the end of his term

c. Laszlo's mortgage won't help Emma; Emma should wait until the CIBC

mortgage comes up for renewal in nine months

d. Pay off CRA using Laszlo's mortgage with a postponement clause, then

refinance with CIBC to consolidate her debts

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Recommended textbooks for you

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,

Practical Management Science

Operations Management

ISBN:

9781337406659

Author:

WINSTON, Wayne L.

Publisher:

Cengage,