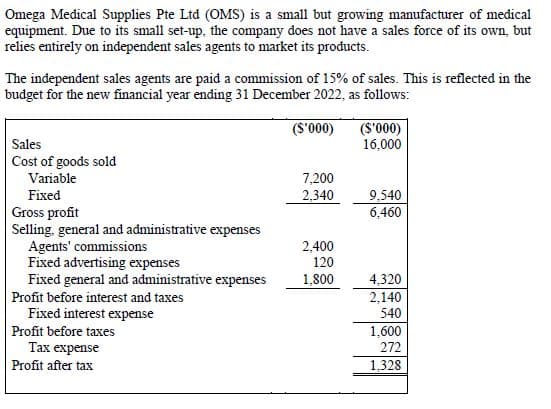

Omega Medical Supplies Pte Ltd (OMS) is a small but growing manufacturer of medical equipment. Due to its small set-up, the company does not have a sales force of its own, but relies entirely on independent sales agents to market its products. The independent sales agents are paid a commission of 15% of sales. This is reflected in the budget for the new financial year ending 31 December 2022, as follows: (S'000) Sales Cost of goods sold 16,000 (000.$) Variable 7,200 Fixed Gross profit Selling, general and administrative expenses Agents' commissions Fixed advertising expenses Fixed general and administrative expenses Profit before interest and taxes 2.340 9,540 6,460 2,400 120 1,800 4,320 2,140 540 Fixed interest expense Profit before taxes Тах ехpense Profit after tax 1,600 272 1.328

Omega Medical Supplies Pte Ltd (OMS) is a small but growing manufacturer of medical equipment. Due to its small set-up, the company does not have a sales force of its own, but relies entirely on independent sales agents to market its products. The independent sales agents are paid a commission of 15% of sales. This is reflected in the budget for the new financial year ending 31 December 2022, as follows: (S'000) Sales Cost of goods sold 16,000 (000.$) Variable 7,200 Fixed Gross profit Selling, general and administrative expenses Agents' commissions Fixed advertising expenses Fixed general and administrative expenses Profit before interest and taxes 2.340 9,540 6,460 2,400 120 1,800 4,320 2,140 540 Fixed interest expense Profit before taxes Тах ехpense Profit after tax 1,600 272 1.328

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter18: Cost-volume-profit Analysis (cvp)

Section: Chapter Questions

Problem 1R: Poleski Manufacturing, which maintains the same level of inventory at the end of each year, provided...

Related questions

Question

Compute the breakeven point in sales dollars for the financial year ending 31 December 2022 under the following scenarios:

(i) Using independent sales agents’ commission at 15%.

(ii) Using independent sales agents’ commission at 20%.

Transcribed Image Text:Omega Medical Supplies Pte Ltd (OMS) is a small but growing manufacturer of medical

equipment. Due to its small set-up, the company does not have a sales force of its own, but

relies entirely on independent sales agents to market its products.

The independent sales agents are paid a commission of 15% of sales. This is reflected in the

budget for the new financial year ending 31 December 2022, as follows:

(S'000)

(000.s)

16,000

Sales

Cost of goods sold

Variable

7,200

9,540

6,460

Fixed

2,340

Gross profit

Selling, general and administrative expenses

Agents' commissions

Fixed advertising expenses

Fixed general and administrative expenses

2,400

120

1,800

4,320

2,140

540

Profit before interest and taxes

Fixed interest expense

Profit before taxes

1,600

272

Тах еxpense

Profit after tax

1,328

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Business/Professional Ethics Directors/Executives…

Accounting

ISBN:

9781337485913

Author:

BROOKS

Publisher:

Cengage

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT