Problem 12-14 Expected Returns (LO2) Consider the following two scenarios for the economy and the expected returns in each scenario for the market portfolio, an aggressive stock A, and a defensive stock D. Rate of Return Scenario Bust Boom Aggressive Defensive Stock A 10% Market -7% 19 Stock D 5% 25 15 Pequired: Find the beta of each stock. If each scenario is equally likely, find the expected rate of return on the market portfolio and on each stock. If the T-bill rate is 4%, what does the CAPM say about the fair expected rate of return on the two stocks? Which stock seems to be a better buy on the basis of your answers to (a) through (c)?

Problem 12-14 Expected Returns (LO2) Consider the following two scenarios for the economy and the expected returns in each scenario for the market portfolio, an aggressive stock A, and a defensive stock D. Rate of Return Scenario Bust Boom Aggressive Defensive Stock A 10% Market -7% 19 Stock D 5% 25 15 Pequired: Find the beta of each stock. If each scenario is equally likely, find the expected rate of return on the market portfolio and on each stock. If the T-bill rate is 4%, what does the CAPM say about the fair expected rate of return on the two stocks? Which stock seems to be a better buy on the basis of your answers to (a) through (c)?

Chapter11: The Cost Of Capital

Section: Chapter Questions

Problem 5PROB

Related questions

Question

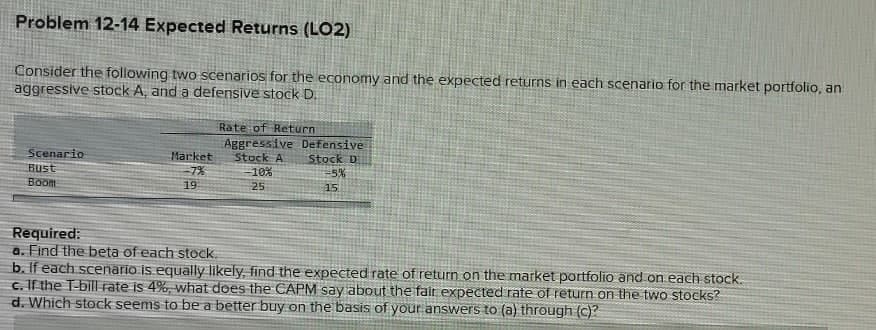

Transcribed Image Text:Problem 12-14 Expected Returns (LO2)

Consider the following two scenarios for the economy and the expected returns in each scenario for the market portfolio, an

aggressive stock A, and a defensive stock D.

Rate of Return

Aggressive Defensive

Stock A

10%

Scenario

Bust

Market

7%

19

Stock D

-5%

Boom

25

15

Required:

a. Find the beta of each stock.

b. If each scenario is equally likely, find the expected rate of return on the market portfolio and on each stock.

c. If the T-bill rate is 4%, what does the CAPM say about the fair expected rate of return on the two stocks?

d. Which stock seems to be a better buy on the basis of your answers to (a) through (c)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you