omplete the following: FLASH TRUCKING SERVICES INCOME STATEMENT DECEMBER 31, 2014 FLASH TRUCKING SERVICES STATEMENT OF CHANGES TO OWNER'S EQUITY DECEMBER 31, 2014 FLASH TRUCKING SERVICES BALANCE SHEET DECEMBER 31, 2014

omplete the following: FLASH TRUCKING SERVICES INCOME STATEMENT DECEMBER 31, 2014 FLASH TRUCKING SERVICES STATEMENT OF CHANGES TO OWNER'S EQUITY DECEMBER 31, 2014 FLASH TRUCKING SERVICES BALANCE SHEET DECEMBER 31, 2014

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter2: T Accounts, Debits And Credits, Trial Balance, And Financial Statements

Section: Chapter Questions

Problem 1PA: During December of this year, G. Elden established Ginnys Gym. The following asset, liability, and...

Related questions

Topic Video

Question

Complete the following: FLASH TRUCKING SERVICES

INCOME STATEMENT

DECEMBER 31, 2014

FLASH TRUCKING SERVICES

STATEMENT OF CHANGES TO OWNER'S EQUITY

DECEMBER 31, 2014

FLASH TRUCKING SERVICES

BALANCE SHEET

DECEMBER 31, 2014

Transcribed Image Text:FLASH TRUCKING SERVICES

FLASH TRUCKING SERVICES

FLASH TRUCKING SERVICES

INCOME STATEMENT

STATEMENT OF CHANGES TO OWNER'S EQUITY

BALANCE SHEET

DECEMBER 31, 2014

DECEMBER 31, 2014

DECEMBER 31, 2014

NOTE

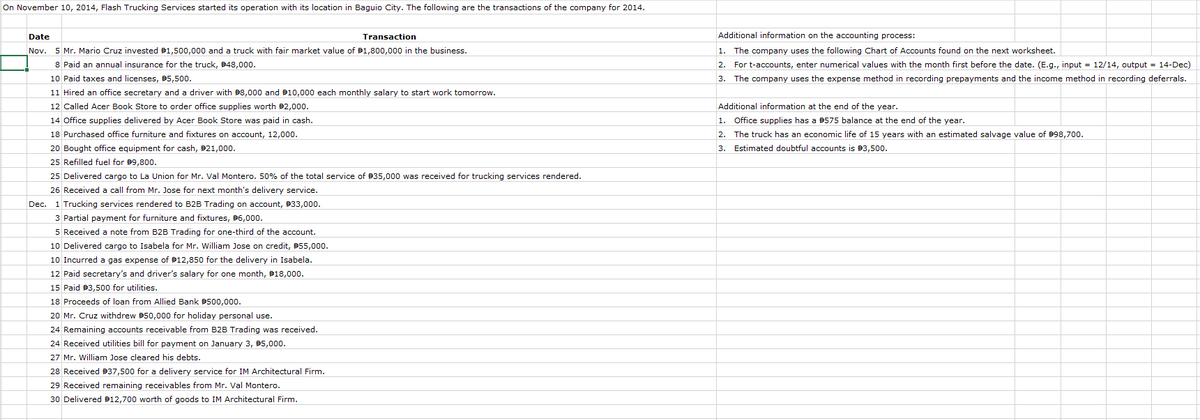

Transcribed Image Text:On November 10, 2014, Flash Trucking Services started its operation with its location in Baguio City. The following are the transactions of the company for 2014.

Date

Transaction

Additional information on the accounting process:

Nov. 5 Mr. Mario Cruz invested B1,500,000 and a truck with fair market value of B1,800,000 in the business.

1.

The company uses the following Chart of Accounts found on the next worksheet.

8 Paid an annual insurance for the truck, B48,000.

2.

For t-accounts, enter numerical values with the month first before the date. (E.g., input = 12/14, output = 14-Dec)

10 Paid taxes and licenses, B5,500.

3. The company uses the expense method in recording prepayments and the income method in recording deferrals.

11 Hired an office secretary and

driver with B8,000 and B10,000 each monthly salary to start work tomorrow.

12 Called Acer Book Store to order office supplies worth #2,000.

Additional information at the end of the year.

14 Office supplies delivered by Acer Book Store was paid in cash.

1.

Office supplies has a B575 balance at the end of the year.

18 Purchased office furniture and fixtures on account, 12,000.

2.

The truck has an economic life of 15 years with an estimated salvage value of 898,700.

20 Bought office equipment for cash, #21,000.

3. Estimated doubtful accounts is 3.500.

25 Refilled fuel for #9,800.

25 Delivered cargo to La Union for Mr. Val Montero. 50% of the total service of B35,000 was received for trucking services rendered.

26 Received a call from Mr. Jose for next month's delivery service.

Dec.

1 Trucking services rendered to B2B Trading on account, B33,000.

3 Partial payment for furniture and fixtures, 86,000.

5 Received a note from B2B Trading for one-third of the account.

10 Delivered cargo to Isabela for Mr. William Jose on credit, B55,000.

10 Incurred a gas expense of B12,850 for the delivery in Isabela.

12 Paid secretary's and driver's salary for one month, #18,000.

15 Paid B3,500 for utilities.

18 Proceeds of loan from Allied Bank B500,000.

20 Mr. Cruz withdrew B50,000 for holiday personal use.

24 Remaining accounts receivable from B2B Trading was received.

24 Received utilities bill for payment on January 3, 85,000.

27 Mr. William Jose cleared his debts.

28 Received B37,500 for a delivery service for IM Architectural Firm.

29 Received remaining receivables from Mr. Val Montero.

30 Delivered B12,700 worth of goods to IM Architectural Firm.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning