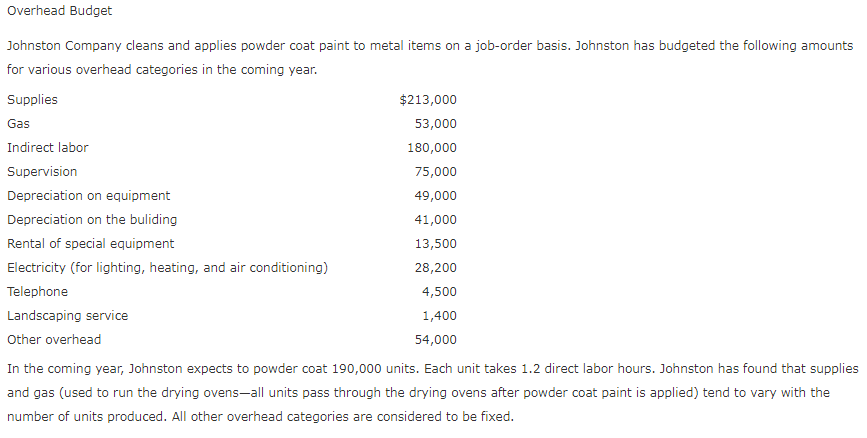

Overhead Budget Johnston Company cleans and applies powder coat paint to metal items on a job-order basis. Johnston has budgeted the following amounts for various overhead categories in the coming year. Supplies $213,000 Gas 53,000 Indirect labor 180,000 Supervision 75,000 Depreciation on equipment 49,000 Depreciation on the buliding 41,000 Rental of special equipment 13,500 Electricity (for lighting, heating, and air conditioning) 28,200 Telephone 4,500 Landscaping service 1,400 Other overhead 54,000 In the coming year, Johnston expects to powder coat 190,000 units. Each unit takes 1.2 direct labor hours. Johnston has found that supplies and gas (used to run the drying ovens-all units pass through the drying ovens after powder coat paint is applied) tend to vary with the number of units produced. All other overhead categories are considered to be fixed.

Overhead Budget Johnston Company cleans and applies powder coat paint to metal items on a job-order basis. Johnston has budgeted the following amounts for various overhead categories in the coming year. Supplies $213,000 Gas 53,000 Indirect labor 180,000 Supervision 75,000 Depreciation on equipment 49,000 Depreciation on the buliding 41,000 Rental of special equipment 13,500 Electricity (for lighting, heating, and air conditioning) 28,200 Telephone 4,500 Landscaping service 1,400 Other overhead 54,000 In the coming year, Johnston expects to powder coat 190,000 units. Each unit takes 1.2 direct labor hours. Johnston has found that supplies and gas (used to run the drying ovens-all units pass through the drying ovens after powder coat paint is applied) tend to vary with the number of units produced. All other overhead categories are considered to be fixed.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter8: Budgeting For Planning And Control

Section: Chapter Questions

Problem 5CE: Johnston Company cleans and applies powder coat paint to metal items on a job-order basis. Johnston...

Related questions

Question

100%

3.3

Transcribed Image Text:Overhead Budget

Johnston Company cleans and applies powder coat paint to metal items on a job-order basis. Johnston has budgeted the following amounts

for various overhead categories in the coming year.

Supplies

$213,000

Gas

53,000

Indirect labor

180,000

Supervision

75,000

Depreciation on equipment

49,000

Depreciation on the buliding

41,000

Rental of special equipment

13,500

Electricity (for lighting, heating, and air conditioning)

28,200

Telephone

4,500

Landscaping service

1,400

Other overhead

54,000

In the coming year, Johnston expects to powder coat 190,000 units. Each unit takes 1.2 direct labor hours. Johnston has found that supplies

and gas (used to run the drying ovens-all units pass through the drying ovens after powder coat paint is applied) tend to vary with the

number of units produced. All other overhead categories are considered to be fixed.

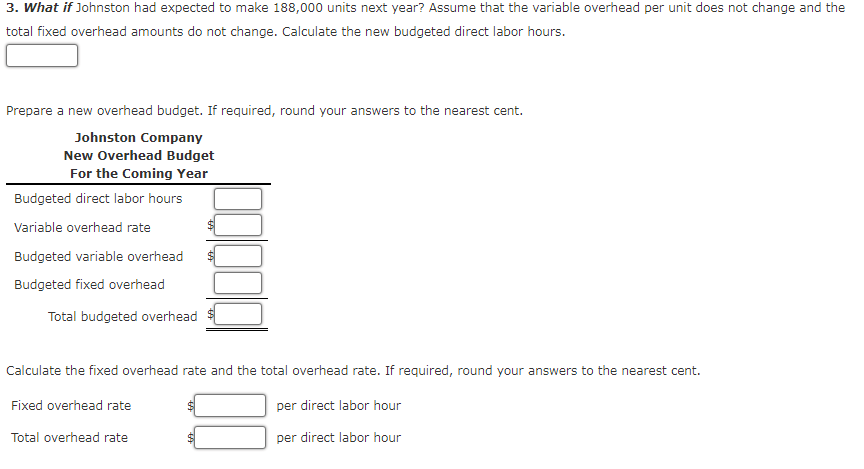

Transcribed Image Text:3. What if Johnston had expected to make 188,000 units next year? Assume that the variable overhead per unit does not change and the

total fixed overhead amounts do not change. Calculate the new budgeted direct labor hours.

Prepare a new overhead budget. If required, round your answers to the nearest cent.

Johnston Company

New Overhead Budget

For the Coming Year

Budgeted direct labor hours

Variable overhead rate

Budgeted variable overhead

Budgeted fixed overhead

Total budgeted overhead

Calculate the fixed overhead rate and the total overhead rate. If required, round your answers to the nearest cent.

Fixed overhead rate

per direct labor hour

Total overhead rate

per direct labor hou

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning