ompute Costco’s current ratio and quick ratio for 2006 and 2005. (Round answers two decimal places.) 2006 current ratio =? 2005 current ratio =? 2006 quick ratio =? 2005 quick ratio =? (b) Compute Target's times interest earned and its liabilities-to-equity ratios for 2006 and 2005. (Round your answers to two decimal places.) 2006 times interest earned =? 2005 times interest earned =? 2006 liabilities-to-equity =? 2005 liabilities-to-equity =? Comment on any observed trends. Which of the following statements best describes any trend in Target's liabilities-to-equity ratios? Choose the right Option from below a)The decrease in Target's liabilities-to-equity ratio remained constant. b)Target's liabilities-to-equity ratio decreased slightly in 2006, we have no concerns about Target's's ability to meet its debt obligations. c)Target's liabilities-to-equity ratio increased during the year primarily due to a decrease in its equity. d)Target's liabilities-to-equity ratio decreased due to a decrease in its equity.

ompute Costco’s current ratio and quick ratio for 2006 and 2005. (Round answers two decimal places.) 2006 current ratio =? 2005 current ratio =? 2006 quick ratio =? 2005 quick ratio =? (b) Compute Target's times interest earned and its liabilities-to-equity ratios for 2006 and 2005. (Round your answers to two decimal places.) 2006 times interest earned =? 2005 times interest earned =? 2006 liabilities-to-equity =? 2005 liabilities-to-equity =? Comment on any observed trends. Which of the following statements best describes any trend in Target's liabilities-to-equity ratios? Choose the right Option from below a)The decrease in Target's liabilities-to-equity ratio remained constant. b)Target's liabilities-to-equity ratio decreased slightly in 2006, we have no concerns about Target's's ability to meet its debt obligations. c)Target's liabilities-to-equity ratio increased during the year primarily due to a decrease in its equity. d)Target's liabilities-to-equity ratio decreased due to a decrease in its equity.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 24E

Related questions

Question

a) Compute Costco’s

2006 current ratio =?

2005 current ratio =?

2006 quick ratio =?

2005 quick ratio =?

(b) Compute Target's times interest earned and its liabilities-to-equity ratios for 2006 and 2005. (Round your answers to two decimal places.)

2006 times interest earned =?

2005 times interest earned =?

2006 liabilities-to-equity =?

2005 liabilities-to-equity =?

Comment on any observed trends. Which of the following statements best describes any trend in Target's liabilities-to-equity ratios? Choose the right Option from below

a)The decrease in Target's liabilities-to-equity ratio remained constant.

b)Target's liabilities-to-equity ratio decreased slightly in 2006, we have no concerns about Target's's ability to meet its debt obligations.

c)Target's liabilities-to-equity ratio increased during the year primarily due to a decrease in its equity.

d)Target's liabilities-to-equity ratio decreased due to a decrease in its equity.

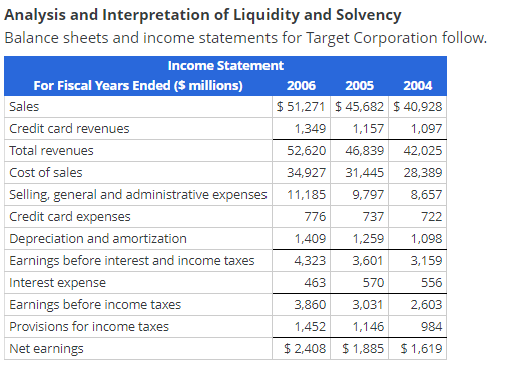

Transcribed Image Text:Analysis and Interpretation of Liquidity and Solvency

Balance sheets and income statements for Target Corporation follow.

For Fiscal Years Ended ($ millions)

Sales

Credit card revenues

Income Statement

Total revenues

Cost of sales

Selling, general and administrative expenses

Credit card expenses

Depreciation and amortization

Earnings before interest and income taxes

Interest expense

Earnings before income taxes

Provisions for income taxes

Net earnings

2006 2005

2004

$51,271 $45,682 $ 40,928

1,349

1,157

1,097

52,620 46,839

42,025

34,927 31,445

28,389

11,185

9,797

8,657

776

737

722

1,409

1,259

1,098

4,323

3,601

3,159

463

570

556

3,860

3,031

2,603

1,452

1,146

984

$2,408 $1,885

$1,619

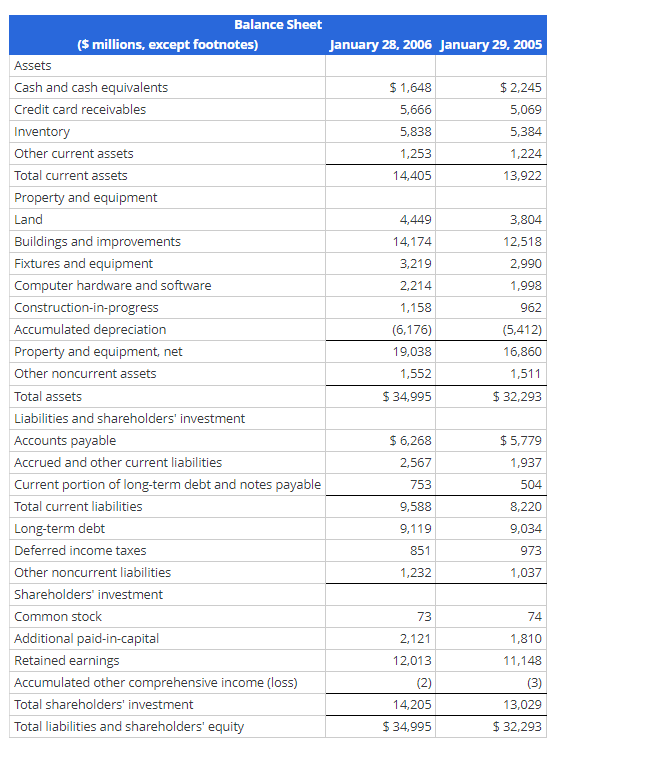

Transcribed Image Text:($ millions, except footnotes)

Assets

Cash and cash equivalents

Credit card receivables

Inventory

Other current assets

Total current assets

Property and equipment

Land

Buildings and improvements

Fixtures and equipment

Computer hardware and software

Construction-in-progress

Accumulated depreciation

Property and equipment, net

Other noncurrent assets

Total assets

Balance Sheet

Liabilities and shareholders' investment

Accounts payable

Accrued and other current liabilities

Current portion of long-term debt and notes payable

Total current liabilities

Long-term debt

Deferred income taxes

Other noncurrent liabilities

Shareholders' investment

Common stock

Additional paid-in-capital

Retained earnings

Accumulated other comprehensive income (loss)

Total shareholders' investment

Total liabilities and shareholders' equity

January 28, 2006 January 29, 2005

$1,648

5,666

5,838

1,253

14,405

4,449

14,174

3,219

2,214

1,158

(6,176)

19,038

1,552

$ 34,995

$ 6,268

2,567

753

9,588

9,119

851

1,232

73

2,121

12,013

(2)

14,205

$ 34,995

$2,245

5,069

5,384

1,224

13,922

3,804

12,518

2,990

1,998

962

(5,412)

16,860

1,511

$ 32,293

$5,779

1,937

504

8,220

9,034

973

1,037

74

1,810

11,148

(3)

13,029

$ 32,293

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning