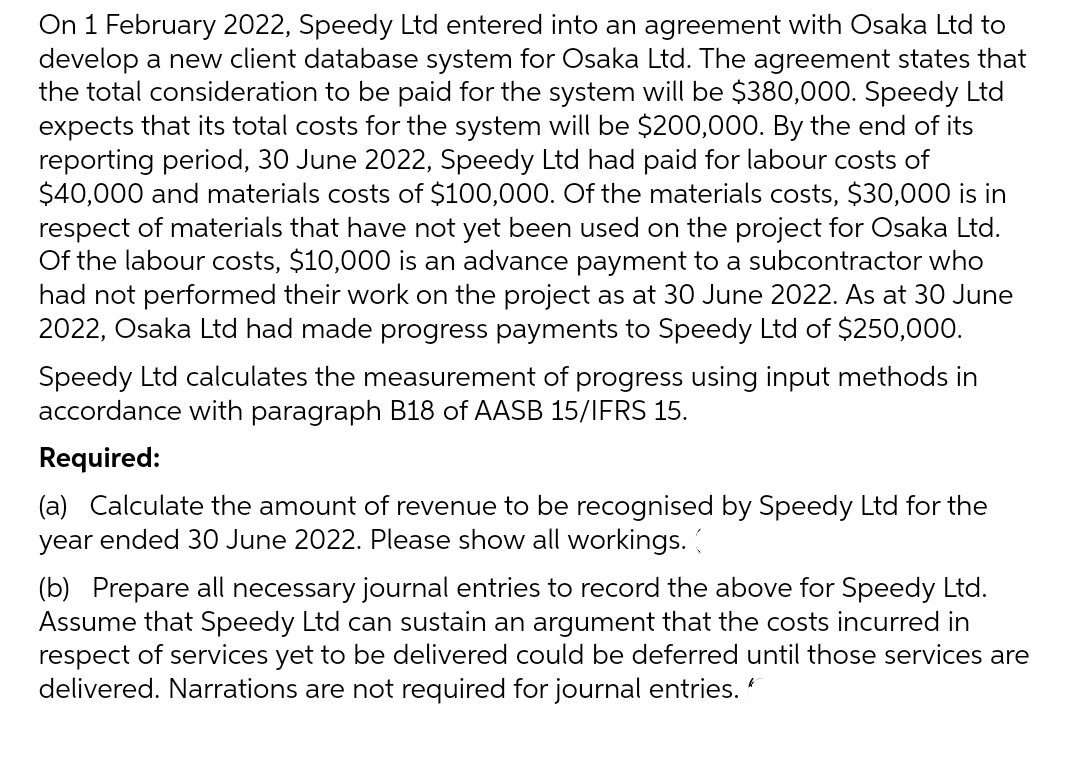

On 1 February 2022, Speedy Ltd entered into an agreement with Osaka Ltd to develop a new client database system for Osaka Ltd. The agreement states that the total consideration to be paid for the system will be $380,000. Speedy Ltd expects that its total costs for the system will be $200,000. By the end of its reporting period, 30 June 2022, Speedy Ltd had paid for labour costs of $40,000 and materials costs of $100,000. Of the materials costs, $30,000 is in respect of materials that have not yet been used on the project for Osaka Ltd. Of the labour costs, $10,000 is an advance payment to a subcontractor who had not performed their work on the project as at 30 June 2022. As at 30 June 2022, Osaka Ltd had made progress payments to Speedy Ltd of $250,000. Speedy Ltd calculates the measurement of progress using input methods in accordance with paragraph B18 of AASB 15/IFRS 15. Required: (a) Calculate the amount of revenue to be recognised by Speedy Ltd for the year ended 30 June 2022. Please show all workings. ( (b) Prepare all necessary journal entries to record the above for Speedy Ltd. Assume that Speedy Ltd can sustain an argument that the costs incurred in respect of services yet to be delivered could be deferred until those services are delivered. Narrations are not required for journal entries. *

On 1 February 2022, Speedy Ltd entered into an agreement with Osaka Ltd to develop a new client database system for Osaka Ltd. The agreement states that the total consideration to be paid for the system will be $380,000. Speedy Ltd expects that its total costs for the system will be $200,000. By the end of its reporting period, 30 June 2022, Speedy Ltd had paid for labour costs of $40,000 and materials costs of $100,000. Of the materials costs, $30,000 is in respect of materials that have not yet been used on the project for Osaka Ltd. Of the labour costs, $10,000 is an advance payment to a subcontractor who had not performed their work on the project as at 30 June 2022. As at 30 June 2022, Osaka Ltd had made progress payments to Speedy Ltd of $250,000. Speedy Ltd calculates the measurement of progress using input methods in accordance with paragraph B18 of AASB 15/IFRS 15. Required: (a) Calculate the amount of revenue to be recognised by Speedy Ltd for the year ended 30 June 2022. Please show all workings. ( (b) Prepare all necessary journal entries to record the above for Speedy Ltd. Assume that Speedy Ltd can sustain an argument that the costs incurred in respect of services yet to be delivered could be deferred until those services are delivered. Narrations are not required for journal entries. *

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 19RE

Related questions

Question

5

Transcribed Image Text:On 1 February 2022, Speedy Ltd entered into an agreement with Osaka Ltd to

develop a new client database system for Osaka Ltd. The agreement states that

the total consideration to be paid for the system will be $380,000. Speedy Ltd

expects that its total costs for the system will be $200,000. By the end of its

reporting period, 30 June 2022, Speedy Ltd had paid for labour costs of

$40,000 and materials costs of $100,000. Of the materials costs, $30,000 is in

respect of materials that have not yet been used on the project for Osaka Ltd.

Of the labour costs, $10,000 is an advance payment to a subcontractor who

had not performed their work on the project as at 30 June 2022. As at 30 June

2022, Osaka Ltd had made progress payments to Speedy Ltd of $250,000.

Speedy Ltd calculates the measurement of progress using input methods in

accordance with paragraph B18 of AASB 15/IFRS 15.

Required:

(a) Calculate the amount of revenue to be recognised by Speedy Ltd for the

year ended 30 June 2022. Please show all workings. (

(b) Prepare all necessary journal entries to record the above for Speedy Ltd.

Assume that Speedy Ltd can sustain an argument that the costs incurred in

respect of services yet to be delivered could be deferred until those services are

delivered. Narrations are not required for journal entries.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT