Concept explainers

Self-Construction Olson Machine Company manufactures small and large milling machines. Selling prices of these machines range from $35,000 to $200,000. During the 5-month period from August 1, 2019, through December 31, 2019, Olson manufactured a milling machine for its own use. This machine was built as part of the regular production activities. The project required a large amount of time front planning and supervisory personnel, as well as that of some of the company’s officers, because it was a more sophisticated type of machine than the regular production models.

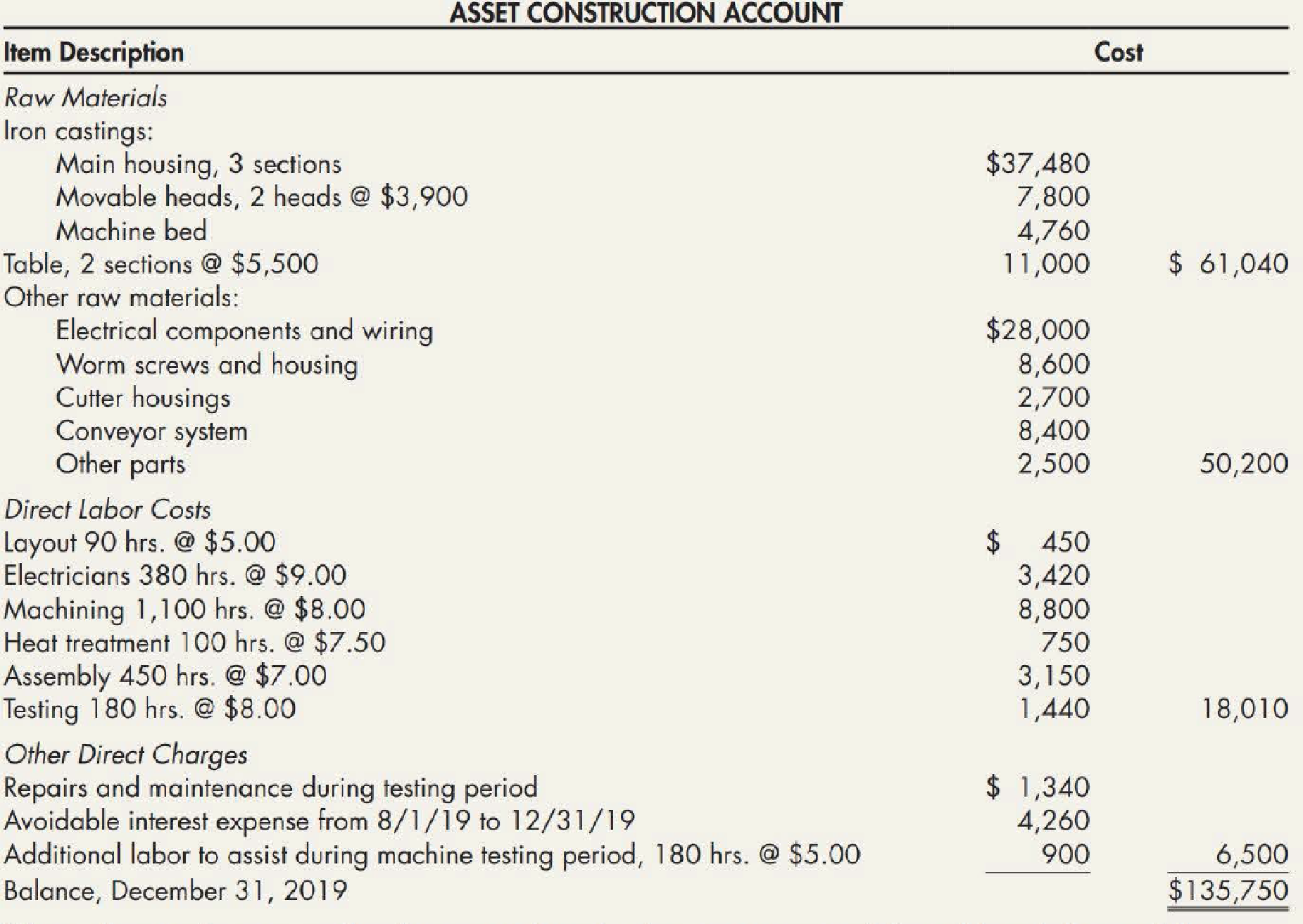

Throughout the 5-month period, Olson charged all costs directly associated with the construction of the machine to a special account entitled “Asset Construction Account.” An analysis of the charges to this account as of December 31, 2019, follows:

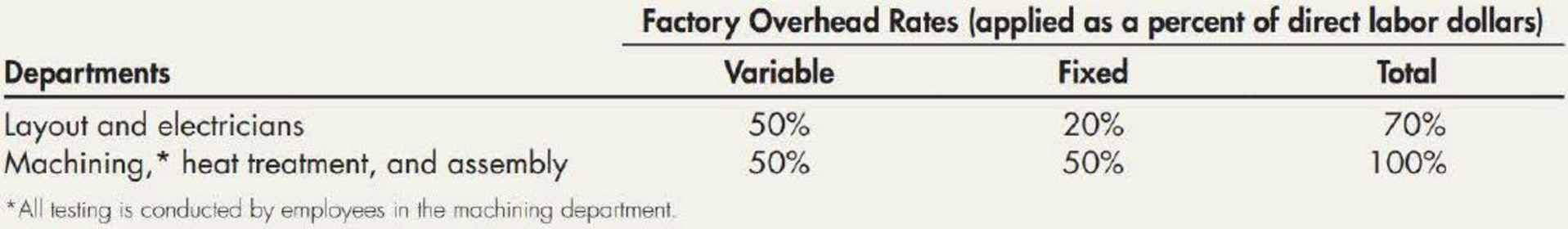

Olson allocates factory overhead to normal production as a percent of direct labor dollars as follows:

Olson uses a flat rate of 40% of direct labor dollars to allocate general and administrative overhead.

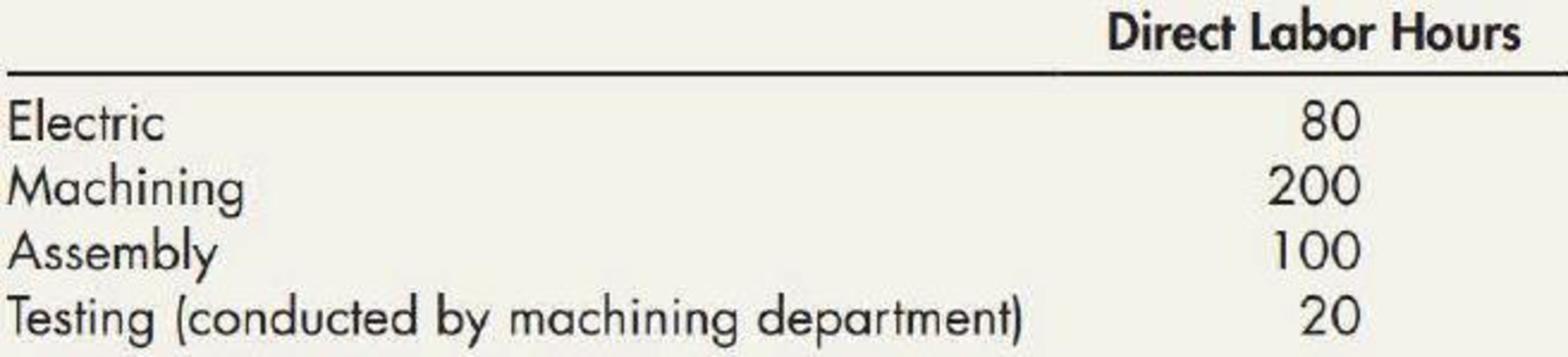

During the machine testing period, a cutter head malfunctioned and did extensive damage to the machine table and one cutter housing. This damage was not anticipated and was the result of an error in the assembly operation. Although no additional raw materials were needed to make the machine operational after the accident, the following labor for rework was required:

Olson has included all these labor charges in the asset construction account. In addition, it included in the account the repairs and maintenance charges of $1,340 that it incurred as a result of the malfunction.

Required:

- 1. Compute, consistent with GAAP and common practice, the amount that Olson should capitalize for the milling machine as of December 31, 2019, when it declares the machine operational.

- 2. Next Level Identify the costs you included in Requirement 1 for which there are acceptable alternative procedures. Describe the alternative procedure(s) in each case.

1.

Calculate the amount that Company O must capitalize for the milling machine as of December 31, 2019.

Explanation of Solution

Cost of self-constructed assets:

Company sometimes constructs an item of “property, plant and equipment” which is used in the business operations and these are known as self-constructed assets. The cost of self-constructed assets comprises of expenses that are required to build an asset and put it in operating condition.

| Particulars | Amount ($) | Amount ($) |

| Raw materials: | ||

| Iron castings | 61,040 | |

| Other raw materials. | 50,200 | $111,240 |

| Direct labor: | ||

| Layout (1) | $450 | |

| Electricians (2) | 2,700 | |

| Machinery (3) | 7,200 | |

| Heat treatment (4) | 750 | |

| Assembly (5) | 2,450 | |

| Testing (6) | 1,280 | |

| Additional testing labor (7) | 800 | 15,630 |

| Factory overhead: | ||

| Layout and electricians (8) | $2,205 | |

| Machining, heat treatment, assembly, testing (9) | ||

| 12,480 | 14,685 | |

| Interest paid | 4,260 | |

| Total amount to be capitalized | 145,815 |

Table (1)

Working notes:

(1)Calculate the amount of direct labor costs for layout:

(2)Calculate the amount of direct labor costs for electricians:

(3)Calculate the amount of direct labor costs for machinery:

(4)Calculate the amount of direct labor costs for Heat treatment:

(5)Calculate the amount of direct labor costs for assembly:

(6)Calculate the amount of direct labor costs for testing:

(7)Calculate the amount of direct labor costs for additional testing labor:

(8)Calculate the factory overhead for layout and electricians:

(9)Calculate the factory overhead for machinery, heat treatment, assembly and testing:

2.

Ascertain the costs included in requirement 1 for which there are acceptable alternative procedures and explain the alternative procedures for each case.

Explanation of Solution

“Alternate procedures are probable for two costs— factory overhead and rework costs (affects direct labor, repairs and maintenance, and factory overhead)”

- Rework costs must be taken as cost for the period in which they are nonstandard. Rework costs rising from errors that must not have incurred should be considered as losses of the period. Seemingly, this was the case in this condition since the impairment resulted from a type of error that is not expected. Accordingly, related repairs, maintenance expenses and rework costs are not capitalized in requirement 1.

- Two alternative ways are there to allocate overhead costs to self-constructed assets. The method followed in “requirement 1” is to allot a portion of all overhead costs to the self-constructed asset. The reason which justifies this particular treatment is that all productive output must absorb its proportionate share of all factory overhead costs. Additionally, this method result in a cost of the constructed asset that approximates the cost of the equivalent asset acquired.

- Capitalizing the incremental overhead, that is traceable fixed and variable overhead is the second method that increases as a result of construction. Additional costs occurred in production of the fixed asset (part of the assets’ cost) are included in this method. Traceable fixed overhead and variable overhead are occurred to build the asset and it will be advantageous in the upcoming periods therefore, these costs must be capitalized.

- If there is no relationship between the self-constructed asset and fixed overhead costs, non-traceable fixed overhead costs will be incurred so, these costs must not be capitalized.

Want to see more full solutions like this?

Chapter 10 Solutions

Intermediate Accounting: Reporting And Analysis

- Otero Fibers, Inc., specializes in the manufacture of synthetic fibers that the company uses in many products such as blankets, coats, and uniforms for police and firefighters. Otero has been in business since 1985 and has been profitable every year since 1993. The company uses a standard cost system and applies overhead on the basis of direct labor hours. Otero has recently received a request to bid on the manufacture of 800,000 blankets scheduled for delivery to several military bases. The bid must be stated at full cost per unit plus a return on full cost of no more than 10 percent after income taxes. Full cost has been defined as including all variable costs of manufacturing the product, a reasonable amount of fixed overhead, and reasonable incremental administrative costs associated with the manufacture and sale of the product. The contractor has indicated that bids in excess of 30 per blanket are not likely to be considered. In order to prepare the bid for the 800,000 blankets, Andrea Lightner, cost accountant, has gathered the following information about the costs associated with the production of the blankets. Direct machine costs consist of items such as special lubricants, replacement of needles used in stitching, and maintenance costs. These costs are not included in the normal overhead rates. Otero recently developed a new blanket fiber at a cost of 750,000. In an effort to recover this cost, Otero has instituted a policy of adding a 0.50 fee to the cost of each blanket using the new fiber. To date, the company has recovered 125,000. Lightner knows that this fee does not fit within the definition of full cost, as it is not a cost of manufacturing the product. Required: 1. Calculate the minimum price per blanket that Otero Fibers could bid without reducing the companys operating income. 2. Using the full-cost criteria and the maximum allowable return specified, calculate Otero Fibers bid price per blanket. 3. Without prejudice to your answer to Requirement 2, assume that the price per blanket that Otero Fibers calculated using the cost-plus criteria specified is greater than the maximum bid of 30 per blanket allowed. Discuss the factors that Otero Fibers should consider before deciding whether or not to submit a bid at the maximum acceptable price of 30 per blanket. (CMA adapted)arrow_forwardJonfran Company manufactures three different models of paper shredders including the waste container, which serves as the base. While the shredder heads are different for all three models, the waste container is the same. The number of waste containers that Jonfran will need during the following years is estimated as follows: The equipment used to manufacture the waste container must be replaced because it is broken and cannot be repaired. The new equipment would have a purchase price of 945,000 with terms of 2/10, n/30; the companys policy is to take all purchase discounts. The freight on the equipment would be 11,000, and installation costs would total 22,900. The equipment would be purchased in December 20x4 and placed into service on January 1, 20x5. It would have a five-year economic life and would be treated as three-year property under MACRS. This equipment is expected to have a salvage value of 12,000 at the end of its economic life in 20x9. The new equipment would be more efficient than the old equipment, resulting in a 25 percent reduction in both direct materials and variable overhead. The savings in direct materials would result in an additional one-time decrease in working capital requirements of 2,500, resulting from a reduction in direct material inventories. This working capital reduction would be recognized at the time of equipment acquisition. The old equipment is fully depreciated and is not included in the fixed overhead. The old equipment from the plant can be sold for a salvage amount of 1,500. Rather than replace the equipment, one of Jonfrans production managers has suggested that the waste containers be purchased. One supplier has quoted a price of 27 per container. This price is 8 less than Jonfrans current manufacturing cost, which is as follows: Jonfran uses a plantwide fixed overhead rate in its operations. If the waste containers are purchased outside, the salary and benefits of one supervisor, included in fixed overhead at 45,000, would be eliminated. There would be no other changes in the other cash and noncash items included in fixed overhead except depreciation on the new equipment. Jonfran is subject to a 40 percent tax rate. Management assumes that all cash flows occur at the end of the year and uses a 12 percent after-tax discount rate. Required: 1. Prepare a schedule of cash flows for the make alternative. Calculate the NPV of the make alternative. 2. Prepare a schedule of cash flows for the buy alternative. Calculate the NPV of the buy alternative. 3. Which should Jonfran domake or buy the containers? What qualitative factors should be considered? (CMA adapted)arrow_forwardZippy Inc. manufactures a fuel additive, Surge, which has a stable selling price of 44 per drum. The company has been producing and selling 80,000 drums per month. In connection with your examination of Zippys financial statements for the year ended September 30, management has asked you to review some computations made by Zippys cost accountant. Your working papers disclose the following about the companys operations: Standard costs per drum of product manufactured: Materials: Costs and expenses during September: Chemicals: 645,000 gallons purchased at a cost of 1,140,000; 600,000 gallons used. Empty drums: 94,000 purchased at a cost of 94,000; 80,000 drums used. Direct labor: 81,000 hours worked at a cost of 816,480. Factory overhead: 768,000. Required: Calculate the following for September, using the formulas on pages 421422 and 424 (Round unit costs to the nearest whole cent and compute the materials variances for both Surge and for the drums.): 1. Materials quantity variance. 2. Materials purchase price variance. 3. Labor efficiency variance. 4. Labor rate variance.arrow_forward

- Cinnamon Depot bakes and sells cinnamon rolls for $1.75 each. The cost of producing 500,000 rolls in the prior year was: At the start of the current year, Cinnamon Depot received a special order for 18,000 rolls to be sold for $1.50 per roll. The company estimates it will incur an additional $1,000 in total fixed costs in order to lease a special machine that forms the rolls in the shape of a heart per the customers request. This order will not affect any of its other operations. Should the company accept the special order? (Show your work.)arrow_forwardSt. Johns Medical Center (SJMC) has five medical technicians who are responsible for conducting cardiac catheterization testing in SJMCs Cath Lab. Each technician is paid a salary of 36,000 and is capable of conducting 1,000 procedures per year. The cardiac catheterization equipment is one year old and was purchased for 250,000. It is expected to last five years. The equipments capacity is 25,000 procedures over its life. Depreciation is computed on a straight-line basis, with no salvage value expected. The reading of the catheterization results is conducted by an outside physician whose fee is 120 per test. The technicians report with the outside physicians note of results is sent to the referring physician. In addition to the salaries and equipment, SJMC spends 50,000 for supplies and other costs needed to operate the equipment (assuming 5,000 procedures are conducted). When SJMC purchased the equipment, it fully expected to perform 5,000 procedures per year. In fact, during its first year of operation, 5,000 procedures were run. However, a larger hospital has established a clinic in the city and will siphon off some of SJMCs business. During the coming years, SJMC expects to run only 4,200 cath procedures yearly. SJMC has been charging 850 for the procedureenough to cover the direct costs of the procedure plus an assignment of general overhead (e.g., depreciation on the hospital building, lighting and heating, and janitorial services). At the beginning of the second year, an HMO from a neighboring community approached SJMC and offered to send its clients to SJMC for cardiac catheterization provided that the charge per procedure would be 550. The HMO estimates that it can provide about 500 patients per year. The HMO has indicated that the arrangement is temporaryfor one year only. The HMO expects to have its own testing capabilities within one year. Required: 1. Classify the resources associated with the cardiac catheterization activity into one of the following: (1) committed resources, or (2) flexible resources. 2. Calculate the activity rate for the cardiac catheterization activity. Break the activity rate into fixed and variable components. Now, classify each activity resource as relevant or irrelevant with respect to the following alternatives: (1) accept the HMO offer, or (2) reject the HMO offer. Explain your reasoning. 3. Assume that SJMC will accept the HMO offer if it reduces the hospitals operating costs. Should the HMO offer be accepted? 4. Jerold Bosserman, SJMCs hospital controller, argued against accepting the HMOs offer. Instead, he argued that the hospital should be increasing the charge per procedure rather than accepting business that doesnt even cover full costs. He also was concerned about local physician reaction if word got out that the HMO was receiving procedures for 550. Discuss the merits of Jerolds position. Include in your discussion an assessment of the price increase that would be needed if the objective is to maintain total revenues from cardiac catheterizations experienced in the first year of operation. 5. Chandra Denton, SJMCs administrator, has been informed that one of the Cath Lab technicians is leaving for an opportunity at a larger hospital. She met with the other technicians, and they agreed to increase their hours to pick up the slack so that SJMC wont need to hire another technician. By working a couple hours extra every week, each remaining technician can perform 1,050 procedures per year. They agreed to do this for an increase in salary of 2,000 per year. How does this outcome affect the analysis of the HMO offer? 6. Assuming that SJMC wants to bring in the same revenues earned in the cardiac catheterization activitys first year less the reduction in resource spending attributable to using only four technicians, how much must SJMC charge for a procedure?arrow_forwardRegal Executive, Inc., produces executive motor coaches and currently manufactures the cent awnings that accompany them at these costs: The company received an offer from Saied Tents to produce the awnings for $3,200 per unit and supply 1,000 awnings for the coming years estimated production. If the company accepts this offer and shuts down production of this part of the business, production workers and supervisors will be reassigned to other areas. Assume that for the short-term decision-making process demonstrated in this problem, the companys total labor costs (direct labor and supervisor salaries) will remain the same if the bar inserts are purchased. The specialized equipment cannot be used and has no market value. However, the space occupied by the awning production can be used by a different production group that will lease it for $60,000 per year. Should the company make or buy the awnings?arrow_forward

- The activity of moving materials uses four forklifts, each leased for 18,000 per year. A forklift is capable of making 5,000 moves per year, where a move is defined as a round trip from the plant to the warehouse and back. During the year, a total of 18,000 moves were made. What is the cost of the unused capacity for the moving goods activity? a. 5,400 b. 1,800 c. 7,200 d. 3,600arrow_forwardJean and Tom Perritz own and manage Happy Home Helpers, Inc. (HHH), a house-cleaning service. Each cleaning (cleaning one house one time) takes a team of three house cleaners about 1.5 hours. On average, HHH completes about 15,000 cleanings per year. The following total costs are associated with the total cleanings: Next year, HHH expects to purchase 25,600 of direct materials. Projected beginning and ending inventories for direct materials are as follows: There is no work-in-process inventory; in other words, a cleaning is started and completed on the same day. Required: 1. Prepare a statement of services produced in good form. 2. What if HHH planned to purchase 30,000 of direct materials? Assume there would be no change in beginning and ending inventories of materials. Explain which line items on the statement of services produced would be affected and how (increase or decrease).arrow_forwardJean and Tom Perritz own and manage Happy Home Helpers, Inc. (HHH), a house-cleaning service. Each cleaning (cleaning one house one time) takes a team of three house cleaners about 1.5 hours. On average, HHH completes about 15,000 cleanings per year. The following total costs are associated with the total cleanings: Next year, HHH expects to purchase 25,600 of direct materials. Projected beginning and ending inventories for direct materials are as follows: There is no work-in-process inventory and no finished goods inventory; in other words, a cleaning is started and completed on the same day. HHH expects to sell 15,000 cleanings at a price of 45 each next year. Total selling expense is projected at 22,000, and total administrative expense is projected at 53,000. Required: 1. Prepare an income statement in good form. 2. What if Jean and Tom increased the price to 50 per cleaning and no other information was affected? Explain which line items in the income statement would be affected and how.arrow_forward

- Marcotti Cupcakes bakes and sells a basic cupcake for $1.25. The cost of producing 600,000 cupcakes in the prior year was: At the start of the current year, Marcotti received a special order for 15,000 cupcakes to be sold for $1.10 per cupcake. To complete the order, the company must incur an additional $700 in total fixed costs to lease a special machine that will stamp the cupcakes with the customers logo. This order will not affect any of Marcottis other operations and it has excess capacity to fulfill the contract. Should the company accept the special order? (Show your work.)arrow_forwardThe Expenditure Approval Process Roberto is the plant superintendent of a small manufacturing company that is owned by a large corporation. The corporation has a policy that any expenditure over $1,000 must be approved by the chief financial officer in the corporate headquarters. The approval process takes a minimum of three weeks. Roberto would like to order a new labeling machine that is expected to reduce costs and pay for itself in six months. The machine costs $2,200, but Roberto can buy the sales reps demo for $1,800. Roberto has asked the sales rep to send two separate bills for $900 each. What would you do if you were the sales rep? Do you agree or disagree with Robertos actions? What do you think about the corporate policy?arrow_forwardCashion Company produces chemical mixtures for veterinary pharmaceutical companies. Its factory has four mixing lines that mix various powdered chemicals together according to specified formulas. Each line can produce up to 5,000 barrels per year. Each line has one supervisor who is paid 34,000 per year. Depreciation on equipment averages 16,000 per year. Direct materials and power cost about 4.50 per unit. Required: 1. Prepare a graph for each of these three costs: equipment depreciation, supervisors wages, and direct materials and power. Use the vertical axis for cost and the horizontal axis for units (barrels). Assume that sales range from 0 to 20,000 units. 2. Assume that the normal operating range for the company is 16,000 to 19,000 units per year. How would you classify each of the three types of cost?arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning,

Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning