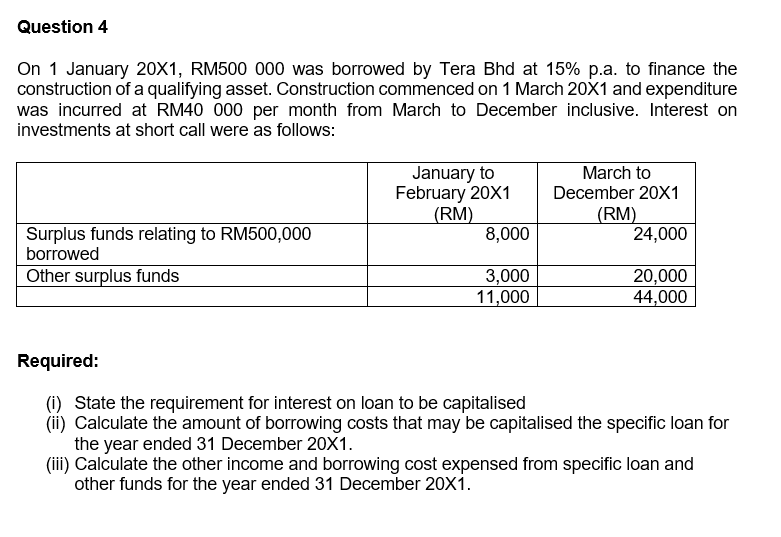

On 1 January 20X1, RM500 000 was borrowed by Tera Bhd at 15% p.a. to finance the construction of a qualifying asset. Construction commenced on 1 March 20X1 and expenditure was incurred at RM40 000 per month from March to December inclusive. Interest on investments at short call were as follows: January to February 20X1 (RM) March to December 20X1 (RM) 24,000 Surplus funds relating to RM500,000 borrowed Other surplus funds 8,000 3,000 11,000 20,000 44,000 Required: (i) State the requirement for interest on loan to be capitalised (ii) Calculate the amount of borrowing costs that may be capitalised the specific loan for the year ended 31 December 20X1. (iii) Calculate the other income and borrowing cost expensed from specific loan and other funds for the year ended 31 December 20X1.

On 1 January 20X1, RM500 000 was borrowed by Tera Bhd at 15% p.a. to finance the construction of a qualifying asset. Construction commenced on 1 March 20X1 and expenditure was incurred at RM40 000 per month from March to December inclusive. Interest on investments at short call were as follows: January to February 20X1 (RM) March to December 20X1 (RM) 24,000 Surplus funds relating to RM500,000 borrowed Other surplus funds 8,000 3,000 11,000 20,000 44,000 Required: (i) State the requirement for interest on loan to be capitalised (ii) Calculate the amount of borrowing costs that may be capitalised the specific loan for the year ended 31 December 20X1. (iii) Calculate the other income and borrowing cost expensed from specific loan and other funds for the year ended 31 December 20X1.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter1: Accounting And The Financial Statements

Section: Chapter Questions

Problem 39E: Exercise 1-39 Current Assets and Current Liabilities Hanson Construction has an operating cycle of...

Related questions

Question

100%

Please help me

Transcribed Image Text:Question 4

On 1 January 20X1, RM500 000 was borrowed by Tera Bhd at 15% p.a. to finance the

construction of a qualifying asset. Construction commenced on 1 March 20X1 and expenditure

was incurred at RM40 000 per month from March to December inclusive. Interest on

investments at short call were as follows:

March to

January to

February 20X1

(RM)

December 20X1

(RM)

24,000

Surplus funds relating to RM500,000

borrowed

Other surplus funds

8,000

3,000

11,000

20,000

44,000

Required:

(i) State the requirement for interest on loan to be capitalised

(ii) Calculate the amount of borrowing costs that may be capitalised the specific loan for

the year ended 31 December 20X1.

(iii) Calculate the other income and borrowing cost expensed from specific loan and

other funds for the year ended 31 December 20X1.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning