Purchased a $180,000 machine on January 1 of this year for $36,000 cash. A five-year note is signed for the balance. The note will be paid in five equal year-end payments starting on December 31 of this year. 4-a. In transaction (d), what is the amount of each of the equal annual payments that will be paid on the note? (Round your answer to nearest whole dollar.) 4-b. What is the total amount of interest expense that will be incurred? (Round your answer to nearest whole dollar.) I am unable to get it correct. Thanks for your help.

Purchased a $180,000 machine on January 1 of this year for $36,000 cash. A five-year note is signed for the balance. The note will be paid in five equal year-end payments starting on December 31 of this year. 4-a. In transaction (d), what is the amount of each of the equal annual payments that will be paid on the note? (Round your answer to nearest whole dollar.) 4-b. What is the total amount of interest expense that will be incurred? (Round your answer to nearest whole dollar.) I am unable to get it correct. Thanks for your help.

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 22MC: A company collects an honored note with a maturity date of 24 months from establishment, a 10%...

Related questions

Question

100%

On January 1, Boston Company completed the following transactions (use a 7% annual interest rate for all transactions): (FV of $1, PV of $1, FVA of $1, and PVA of $1) (Use the appropriate factor(s) from the tables provided.)

- Promised to pay a fixed amount of $8,000 at the end of each year for seven years and a one-time payment of $119,000 at the end of the 7th year.

- Established a plant remodeling fund of $493,000 to be available at the end of Year 8. A single sum that will grow to $493,000 will be deposited on January 1 of this year.

- Agreed to pay a severance package to a discharged employee. The company will pay $77,000 at the end of the first year, $114,500 at the end of the second year, and $152,000 at the end of the third year.

- Purchased a $180,000 machine on January 1 of this year for $36,000 cash. A five-year note is signed for the balance. The note will be paid in five equal year-end payments starting on December 31 of this year.

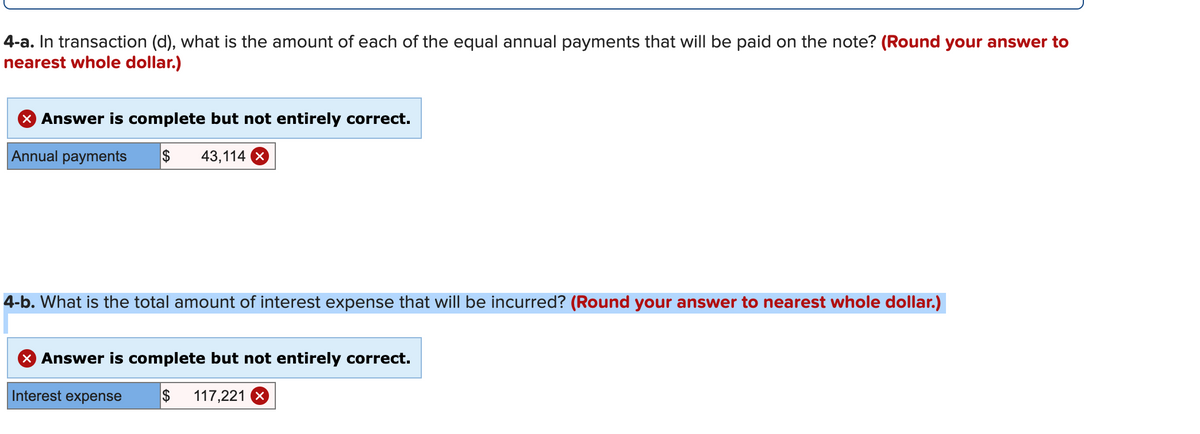

4-a. In transaction (d), what is the amount of each of the equal annual payments that will be paid on the note? (Round your answer to nearest whole dollar.)

4-b. What is the total amount of interest expense that will be incurred? (Round your answer to nearest whole dollar.)

I am unable to get it correct. Thanks for your help.

Transcribed Image Text:4-a. In transaction (d), what is the amount of each of the equal annual payments that will be paid on the note? (Round your answer to

nearest whole dollar.)

Answer is complete but not entirely correct.

Annual payments

$

43,114 X

4-b. What is the total amount of interest expense that will be incurred? (Round your answer to nearest whole dollar.)

X Answer is complete but not entirely correct.

Interest expense

$

117,221 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning