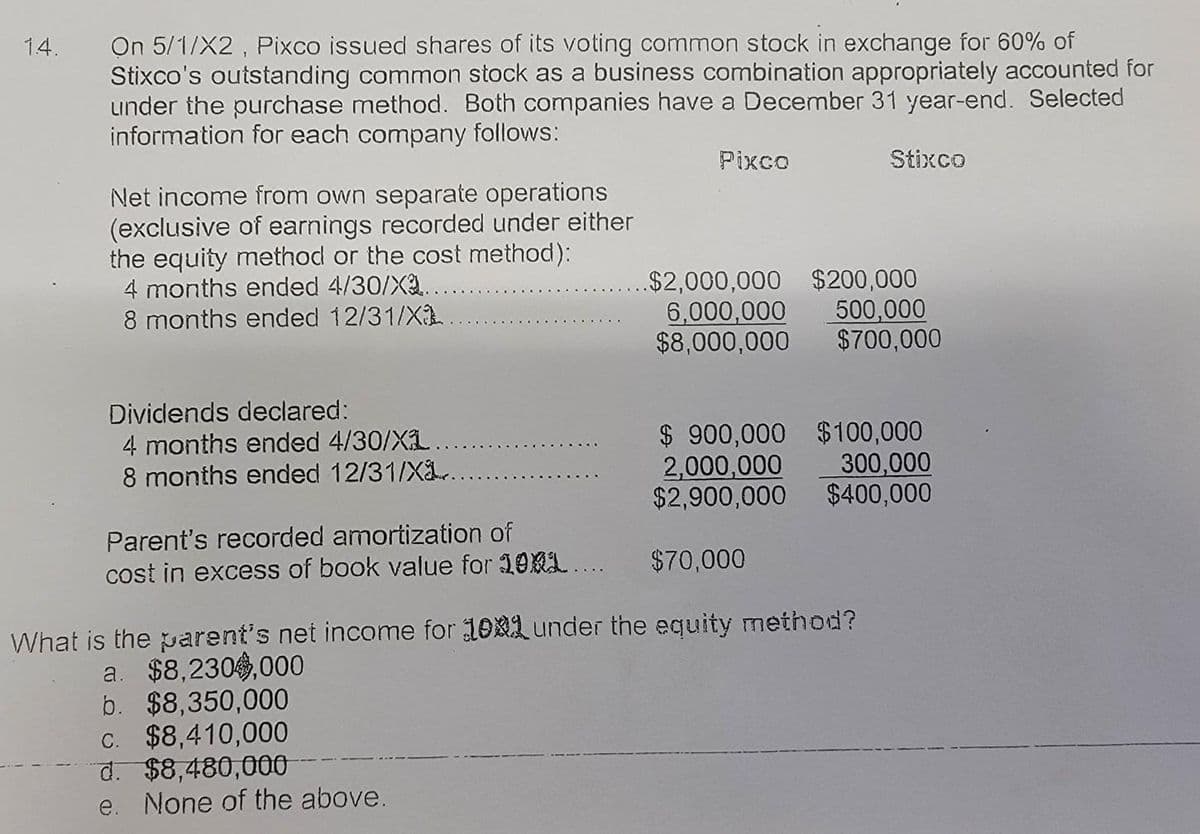

On 5/1/X2 , Pixco issued shares of its voting common stock in exchange for 60% of Stixco's outstanding common stock as a business combination appropriately accounted for under the purchase method. Both companies have a December 31 year-end. Selected information for each company follows: 14. Pixco Stixco Net income from own separate operations (exclusive of earnings recorded under either the equity method or the cost method): 4 months ended 4/30/X2. 8 months ended 12/31/X ..$2,000,000 $200,000 6,000,000 $8,000,000 $700,000 500,000 Dividends declared: 4 months ended 4/30/X1.. 8 months ended 12/31/X. $ 900,000 $100,000 300,000 $400,000 2,000,000 $2,900,000 Parent's recorded amortization of $70,000 cost in excess of book value for 191.... What is the parent's net income for 101 under the equity method? a. $8,230,000 b. $8,350,000 C. $8,410,000 d. $8,480,000 e. None of the above.

On 5/1/X2 , Pixco issued shares of its voting common stock in exchange for 60% of Stixco's outstanding common stock as a business combination appropriately accounted for under the purchase method. Both companies have a December 31 year-end. Selected information for each company follows: 14. Pixco Stixco Net income from own separate operations (exclusive of earnings recorded under either the equity method or the cost method): 4 months ended 4/30/X2. 8 months ended 12/31/X ..$2,000,000 $200,000 6,000,000 $8,000,000 $700,000 500,000 Dividends declared: 4 months ended 4/30/X1.. 8 months ended 12/31/X. $ 900,000 $100,000 300,000 $400,000 2,000,000 $2,900,000 Parent's recorded amortization of $70,000 cost in excess of book value for 191.... What is the parent's net income for 101 under the equity method? a. $8,230,000 b. $8,350,000 C. $8,410,000 d. $8,480,000 e. None of the above.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 24E

Related questions

Question

Transcribed Image Text:On 5/1/X2 , Pixco issued shares of its voting common stock in exchange for 60% of

Stixco's outstanding common stock as a business combination appropriately accounted for

under the purchase method. Both companies have a December 31 year-end. Selected

information for each company follows:

14.

Pixco

Stixco

Net income from own separate operations

(exclusive of earnings recorded under either

the equity method or the cost method):

4 months ended 4/30/X.

8 months ended 12/31/X

$2,000,000 $200,000

6,000,000

$8,000,000

500,000

$700,000

Dividends declared:

4 months ended 4/30/X.

8 months ended 12/31/Xa.

$ 900,000 $100,000

2,000,000

$2,900,000

300,000

$400,000

Parent's recorded amortization of

$70,000

cost in excess of book value for 101.

What is the parent's net income for 101 under the equity method?

a. $8,230,000

b. $8,350,000

C. $8,410,000

d. $8,480,000

e. None of the above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College