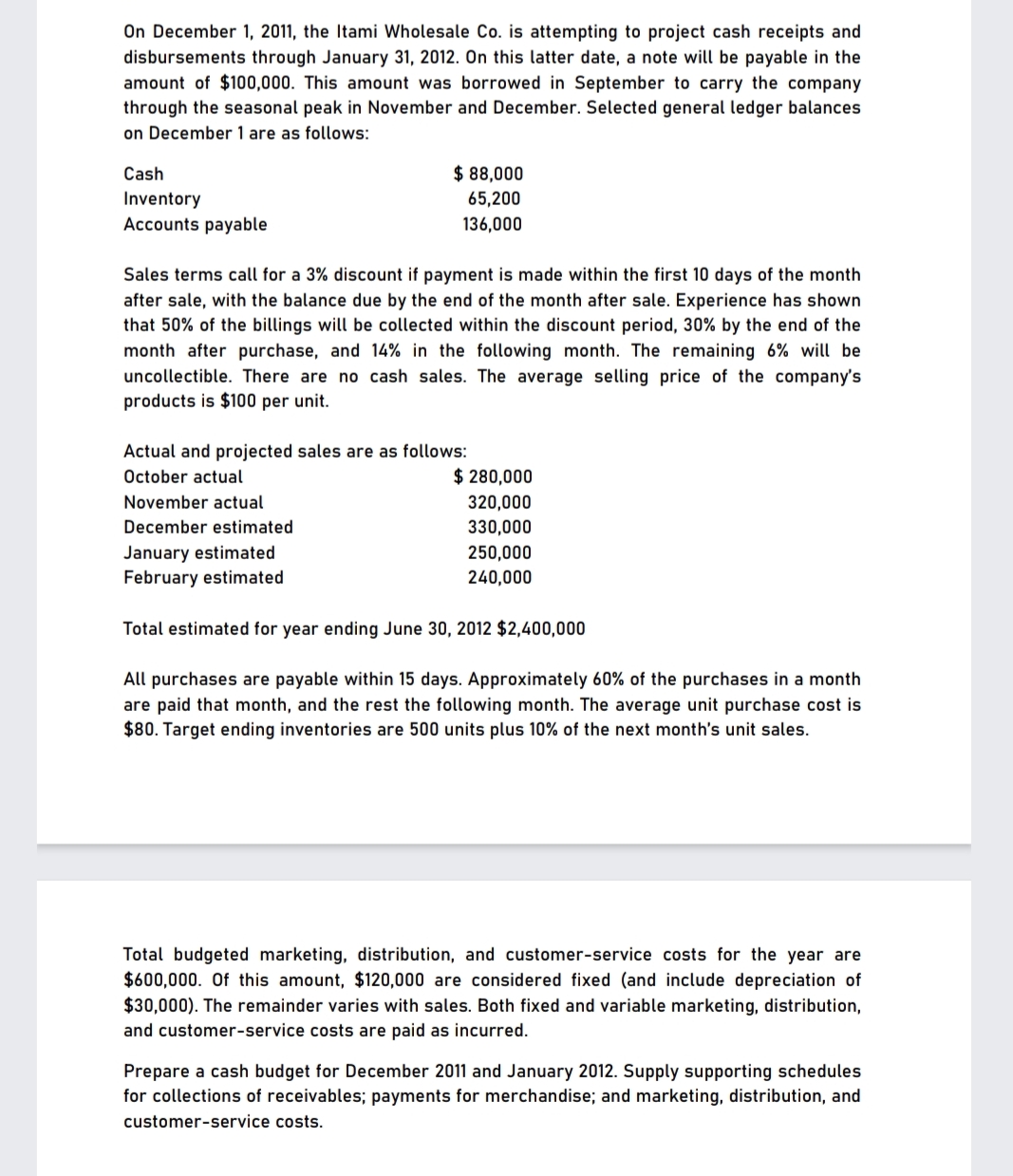

On December 1, 2011, the Itami Wholesale Co. is attempting to project cash receipts and disbursements through January 31, 2012. On this latter date, a note will be payable in the amount of $100,000. This amount was borrowed in September to carry the company through the seasonal peak in November and December. Selected general ledger balances on December 1 are as follows: Cash $ 88,000 Inventory Accounts payable 65,200 136,000 Sales terms call for a 3% discount if payment is made within the first 10 days of the month after sale, with the balance due by the end of the month after sale. Experience has shown that 50% of the billings will be collected within the discount period, 30% by the end of the month after purchase, and 14% in the following month. The remaining 6% will be uncollectible. There are no cash sales. The average selling price of the company's products is $100 per unit. Actual and projected sales are as follows: October actual $ 280,000 November actual 320,000 December estimated 330,000 January estimated February estimated 250,000 240,000 Total estimated for year ending June 30, 2012 $2,400,000 All purchases are payable within 15 days. Approximately 60% of the purchases in a month are paid that month, and the rest the following month. The average unit purchase cost is $80. Target ending inventories are 500 units plus 10% of the next month's unit sales. Total budgeted marketing, distribution, and customer-service costs for the year are $600,000. Of this amount, $120,000 are considered fixed (and include depreciation of $30,000). The remainder varies with sales. Both fixed and variable marketing, distribution, and customer-service costs are paid as incurred. Prepare a cash budget for December 2011 and January 2012. Supply supporting schedules for collections of receivables; payments for merchandise; and marketing, distribution, and customer-service costs.

On December 1, 2011, the Itami Wholesale Co. is attempting to project cash receipts and disbursements through January 31, 2012. On this latter date, a note will be payable in the amount of $100,000. This amount was borrowed in September to carry the company through the seasonal peak in November and December. Selected general ledger balances on December 1 are as follows: Cash $ 88,000 Inventory Accounts payable 65,200 136,000 Sales terms call for a 3% discount if payment is made within the first 10 days of the month after sale, with the balance due by the end of the month after sale. Experience has shown that 50% of the billings will be collected within the discount period, 30% by the end of the month after purchase, and 14% in the following month. The remaining 6% will be uncollectible. There are no cash sales. The average selling price of the company's products is $100 per unit. Actual and projected sales are as follows: October actual $ 280,000 November actual 320,000 December estimated 330,000 January estimated February estimated 250,000 240,000 Total estimated for year ending June 30, 2012 $2,400,000 All purchases are payable within 15 days. Approximately 60% of the purchases in a month are paid that month, and the rest the following month. The average unit purchase cost is $80. Target ending inventories are 500 units plus 10% of the next month's unit sales. Total budgeted marketing, distribution, and customer-service costs for the year are $600,000. Of this amount, $120,000 are considered fixed (and include depreciation of $30,000). The remainder varies with sales. Both fixed and variable marketing, distribution, and customer-service costs are paid as incurred. Prepare a cash budget for December 2011 and January 2012. Supply supporting schedules for collections of receivables; payments for merchandise; and marketing, distribution, and customer-service costs.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter8: Budgeting

Section: Chapter Questions

Problem 18E

Related questions

Question

Transcribed Image Text:On December 1, 2011, the Itami Wholesale Co. is attempting to project cash receipts and

disbursements through January 31, 2012. On this latter date, a note will be payable in the

amount of $100,000. This amount was borrowed in September to carry the company

through the seasonal peak in November and December. Selected general ledger balances

on December 1 are as follows:

Cash

$ 88,000

Inventory

Accounts payable

65,200

136,000

Sales terms call for a 3% discount if payment is made within the first 10 days of the month

after sale, with the balance due by the end of the month after sale. Experience has shown

that 50% of the billings will be collected within the discount period, 30% by the end of the

month after purchase, and 14% in the following month. The remaining 6% will be

uncollectible. There are no cash sales. The average selling price of the company's

products is $100 per unit.

Actual and projected sales are as follows:

October actual

$ 280,000

320,000

330,000

November actual

December estimated

January estimated

February estimated

250,000

240,000

Total estimated for year ending June 30, 2012 $2,400,000

All purchases are payable within 15 days. Approximately 60% of the purchases in a month

are paid that month, and the rest the following month. The average unit purchase cost is

$80. Target ending inventories are 500 units plus 10% of the next month's unit sales.

Total budgeted marketing, distribution, and customer-service costs for the year are

$600,000. Of this amount, $120,000 are considered fixed (and include depreciation of

$30,000). The remainder varies with sales. Both fixed and variable marketing, distribution,

and customer-service costs are paid as incurred.

Prepare a cash budget for December 2011 and January 2012. Supply supporting schedules

for collections of receivables; payments for merchandise; and marketing, distribution, and

customer-service costs.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning