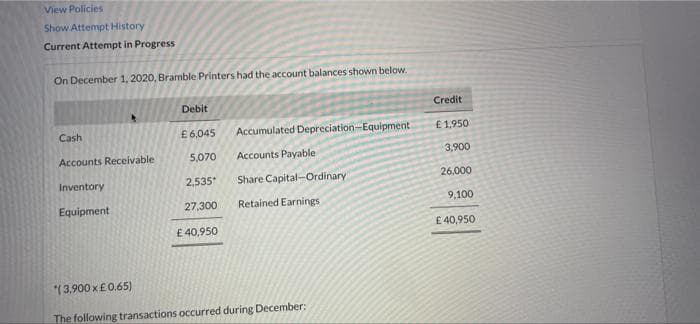

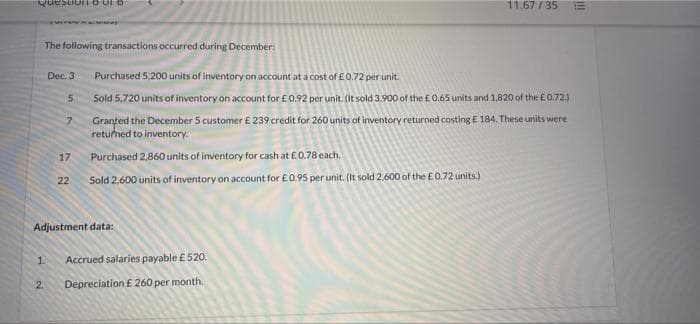

On December 1, 2020, Bramble Printers had the account balances shown below. Debit Credit Cash £6.045 Accumulated Depreciation-Equipment €1.950 Accounts Receivable 5,070 Accounts Payable 3,900 Inventory 2.535 Share Capital-Ordinary 26.000 Equipment 27,300 Retained Earnings 9,100 E 40,950 E 40,950 *(3,900 x£0.65) The following transactions occurred during December:

Q: DOOKO Corporation’s, Statement of Financial Position as of December 31, 2018 shows the following…

A: This question deals with the calculation of current asset. Lets understand the meaning of current…

Q: Pleasantville Company had the following balance sheet on January 1. Pleasantville Company Balance…

A:

Q: Based on the following Adjusted Trial Balance for Duston Inc: Duston Inc Adjusted Trial Balance…

A: Financial statement shows the current position and profit and loss of the entity so that intended…

Q: The adjusted trial balance of William Co. as of December 31, 2022, contains the following. William…

A: Net income = Revenues - Expenses

Q: ROBINA COMPANY provided the following trial balance as of June 30, 2020: Debits Credits Cash....…

A: Income statement in the business shows all incomes and all expenses of the business and at the end…

Q: BTS Corporation provided the following balances in its trial balance for the year ended December 31,…

A: Balance sheet The purpose preparing the balance sheet to know the actual position which are incurred…

Q: BTS Corporation provided the following balances in its trial balance for the year ended December 31,…

A: Statement of owner’s equity: The statement of owner’s equity shows the change (increase or decrease)…

Q: The trial balance below was extracted from the ledger of Aseda Ltd as at 31st December, 2020, CR GHE…

A: 1. Income Statement 2. Balance Sheet The first statement shows the income earned and loss incurred…

Q: The company reported a current ratio of 2.1 and 2.22 as of December 31, 2020 and December 31, 202…

A: Liability is an obligation that an entity has to pay on some future date.

Q: 358,500 Cash and cash equivalents 817,300 Notes payable (due April 1,…

A: Balance sheet The purpose preparing the balance sheet to know the actual position which are…

Q: JCV Company's records show the following information: December 31, 2018 100,000 150,000 (1) 900,000…

A: The balance sheet represents the financial position of the business on a particular date with assets…

Q: Imagine you are the financial accountant of Happiness Ltd. You have the following final balances for…

A:

Q: For items #6-10 - Financial Statement: Below is the balance sheet of ABM International for June 30,…

A: Liquidity ratios are the measures that are used to depict the capacity of the entity to meet up its…

Q: Based on these accounts, prepare the balance sheet for GS company on 31 December 2019 Debit Credit…

A: Balance sheet is also known as statement of financial position considered as one of most important…

Q: "Assume a company's November 1, 2020, financial position was: Assets: P400,000 and Liabilities…

A: Total assets on November 30, 2020 = Assets on Nov 1 - Payment of notes payable - payment of trade…

Q: How much should be reported as net cash

A: Cash from operating activities is a separate section in Cash flow Statement.

Q: The following accounts were included on Nigel’s adjusted trial balance at December 31, 2020:…

A: Current assets are those assets which are easily convertible in to cash or used with in a period of…

Q: The following Details are from the books of Terraxa Limited for the year ended May 31 2020 Trial…

A: Financial statements refers to the statement that shows the financial position of the business. It…

Q: BTS Corporation provided the following balances in its trial balance for the year ended December 31,…

A: The income statement of the business shows all incomes and expenses of the business at the end it…

Q: Below is the trial balance of Summit Ltd. at December 31, 2021 Summit Ltd. Trial Balance December…

A: "Since you have posted a question with multiple sub-parts we will solve first three sub-parts for…

Q: e following balance sheet is for X Company: Balance Sheet January 1, 2021 Assets Equities Cash…

A: Assets include the tangible and intangible rights of a business enterprise which is carried the…

Q: The following balance sheet is for X Company: Balance Sheet January 1, 2021 Assets Equities Cash…

A: Solution: Ending Total assets = Beginning Total assets + Increase in assets during the year -…

Q: The following are the changes in the accounts of BTS Co. during the period: · Accounts…

A: If any asset is donated by the shareholder then company should records such asset in the books of…

Q: Bridgeport Corp.’s balance sheet at December 31, 2019, is presented below. BRIDGEPORT CORP. Balance…

A: 1. Journal Entries - Journal Entries are way of recording a transaction into it. It is recorded in…

Q: Lewiston Company reports the following trial balance on December 31, 2020: Account title Debit…

A: Balance Sheet - This statement shows the income earned and loss incurred by the organization in the…

Q: The comparative balance sheet for the ZYX Company at December 31, 2019 and 2018 is as follows:…

A: The cash flow statement is an essential part of the financial statements of the organization. It is…

Q: The following are extracts from the financial records of ABC Ltd for the year ended 31 August 2021.…

A:

Q: BTS Corporation provided the following balances in its trial balance for the year ended December 31,…

A: The income statement of the business shows all incomes and expenses of the business at the end it…

Q: The following list of balances obtained from Agro Trading as at 31 July 2020. PARTICULARS RM Cash in…

A: Balance sheet represents the financial position of the company by showing assets owned and…

Q: The comparative balance sheet of Gus Company at December 31, 2021 and 2020 appears below: Assets:…

A: Cash flows from investing activities is an important section of cash flow statement, which shows all…

Q: Simon Company’s year-end balance sheets follow. (1) Express the balance sheets in common-size…

A: Common size financial statements: These are the financial statements in which all the items are…

Q: General Journal 2. Income Statement 3. Balance Sheet

A: General journal is the journal which in common parlance means the book or original entries or the…

Q: Company's records show the following information: December 31, 2018 December 31, 2019 Cash 100,000…

A: The accounting equation states that assets equals to sum of liabilities and shareholders equity.…

Q: The comparative balance sheet of Gus Company at December 31, 2021 and 2020 appears below: Assets:…

A: Cash flows are of 3 Tyes - Cash flows from operating activities Cash flows from investing…

Q: The following are the changes in the accounts of BT21 Co. during the period: · Accounts…

A: Income Statement The purpose of preparing the income statement is to know the actual profit / loss…

Q: Q4- Presented below is the adjusted trial balance of Risen Corporation at December 31, 2020. Debit…

A: The business entities or lenders determine financial ratios to compare different companies' outcomes…

Q: The comparative balance sheet of Gus Company at December 31, 2021 and 2020 appears below: Assets:…

A: Cash flows from financing activities is an important section of cash flows statement which shows all…

Q: The accounts below appear in the ledger of Bramble Company. Retained Earnings Dr. Cr.…

A: Journal entry: It is a set of economic events that can be measured in monetary terms. These journal…

Q: The following account balances appear in the 20XC year end POST-closing trial balance of BA…

A: Disclaimer: “Since you have posted a question with multiple sub-parts, we will solve first three…

Q: Samantha Company had the following account balances at the end of May of the current year: Cash…

A: There are three important elements of the accounting equation of business. These are assets,…

Q: Snoopy Co.'s trial balance includes the following account balances at September 30, 2021: Accounts…

A: Noncurrent assets are those which have an economic life of more than one year. It includes land,…

Q: On January 1, 2021, the general ledger of Grand Finale Fireworks includes the following account…

A: Financial ratios refers to the ratio which simply the financial statements of the company and it…

Q: Below is the trial balance of Summit Ltd. at December 31, 2021 Summit Ltd. Trial Balance December…

A: Adjusting Entry – Adjusting Entries are the entries that make the accrual principle work for the…

Q: The comparative balance sheet for the ZYX Company on December 31, 2019 and 2018 is as follows:…

A: cashflows statements prepare to show inflow and outflow of cash movement

Q: Financial information of Barnes Ltd, a furniture maker, for the year ended 31st December 202X as…

A: Income statement or statement of financial performance is the one which is prepared by the entity to…

Q: JCV Company's records show the following information: ... December 31, 2018 100,000 December 31,…

A: The balance sheet is one of the important financial statement of the business, which represents the…

Q: The company reported a current ratio of 2.1 and 2.22 as of December 31, 2020 and December 31, 2021…

A: Answer:- Liabilities definition:- A liability is anything that a person or corporation owes,…

Q: The following are extracts from the financial records of ABC Ltd for the year ended 31 August 2021.…

A: Cash flow from Operating activities is a method of converting the net income to the net cash flow…

Q: "Assume a company's November 1, 2020, financial position was: Assets: P400,000 and Liabilities…

A: Total liabilities on November 30, 2020 =Liabilities on Nov 1 + Payment of Notes payable - Payment of…

journalize the december transaction and

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- 24. Partially correct answer icon Your answer is partially correct. Condensed financial data of Sheffield Company for 2020 and 2019 are presented below. SHEFFIELD COMPANYCOMPARATIVE BALANCE SHEETAS OF DECEMBER 31, 2020 AND 2019 2020 2019 Cash $1,800 $1,130 Receivables 1,770 1,320 Inventory 1,560 1,890 Plant assets 1,900 1,700 Accumulated depreciation (1,220 ) (1,180 ) Long-term investments (held-to-maturity) 1,300 1,430 $7,110 $6,290 Accounts payable $1,220 $890 Accrued liabilities 190 250 Bonds payable 1,410 1,520 Common stock 1,870 1,730 Retained earnings 2,420 1,900 $7,110 $6,290 SHEFFIELD COMPANYINCOME STATEMENTFOR THE YEAR ENDED DECEMBER 31, 2020 Sales revenue $6,860 Cost of goods sold 4,710 Gross margin…Maple Group LtdComparative Balance SheetDecember 31, 2020 and 20192020 2019 Increase/(Decrease)Assets Cash and cash equivalent ? 31,500 (10,000)Accounts Receivable ? 87,500 ? Inventories 97,100 ? ? Fixed Assets, net 142,300 ? 32,000 Total Assets 302,900 323,000 (20,100)Liabilities Accounts payable 25,600 26,600 ? Accrued liabilities 24,000 ? 1,200 Long-term notes payable 58,200 ? (20,000)Stockholders' Equity: Common Stock ? 131,400 ? Retained earnings 54,800 64,000 (9,200)Total liabilities and stockholders' equity 302,900 323,000 (20,100)- - - Maple Group Ltd Income Statement Year Ended December 31,2020 Revenues and gains: Sales revenue 370,000 Interest revenue 11,800 Total revenues and gains 381,800 Expenses Cost of goods sold 205,500 Depreciation expense 15,500 Other operating expense 126,000 Interest expense 24,300 Total expenses 371,300 Income before income taxes 10,500 Income tax expense 16,300 Net Loss (5,800) Notes Acquisition of fixed asset during 2020 47,500 Sale proceed…Maple Group Ltd Comparative Balance Sheet December 31, 2020 and 2019 2020 2019 Increase/(Decrease) Assets Cash and cash equivalent 64,990 61,895 ? Accounts Receivable 95,100 88,500 ? Inventories 72,500 79,855 ? Fixed Assets, net ? ? ? Total Assets 442,590 395,800 46,790 Liabilities Accounts payable 45,000 58,350 ? Accrued liabilities ? ? ? Long-term notes payable 99,500 128,550 ? Stockholders' Equity: Common Stock 143,050 105,110 37,940 Retained earnings 43,540 24,290 19,250 Total liabilities and stockholders' equity 442,590 395,800 46,790…

- Maple Group Ltd Comparative Balance Sheet December 31, 2020 and 2019 2020 2019 Increase/(Decrease) Assets Cash and cash equivalent 64,990 61,895 ? Accounts Receivable 95,100 88,500 ? Inventories 72,500 79,855 ? Fixed Assets, net ? ? ? Total Assets 442,590 395,800 46,790 Liabilities Accounts payable 45,000 58,350 ? Accrued liabilities ? ? ? Long-term notes payable 99,500 128,550 ? Stockholders' Equity: Common Stock 143,050 105,110 37,940 Retained earnings 43,540 24,290 19,250 Total liabilities and stockholders' equity 442,590 395,800…Xyz tradingCondensed comparative balance sheet 2021 2020 2019Assets:Current assets 468,000. 345,600. 300,000Property and equipment 600,000. 560,400. 500,400Other assets(advances ). 72,000. 126,000. 150,000Total assets. 1,140,000. 1,032,000. 950,400Liabilities and stockholders’ equityLiabilitiesCurrent liabilities 134,400. 112,800. 100,00012 % long-term notes payable. 240,000. 300,000 350,000Total liabilities. 374,400. 412,800. 450,000Stockholders’ equity10% preferred stock 120,000. 120,000. 120,000Common stock 300,000 240,000 200,000Additional paid in capital 84,000. 48,000 40,000Retained earnings…GLITTER INC.Condensed Balance SheetsDecember 31 Increase or (Decrease) 2020 2019 Amount Percentage Assets Current assets $124,600 $100,000 $enter a dollar amount enter your answer in percentages rounded to 1 decimal place % Plant assets (net) 394,800 329,000 enter a dollar amount enter your answer in percentages rounded to 1 decimal place % Total assets $519,400 $429,000 $enter a subtotal of the two previous amounts enter your answer in percentages rounded to 1 decimal place % Liabilities Current liabilities $85,994 $73,000 $enter a dollar amount enter your answer in percentages rounded to 1 decimal place % Long-term liabilities 128,828 86,000 enter a dollar amount enter your answer in percentages rounded to 1 decimal place % Total liabilities 214,822 159,000 enter a subtotal…

- Balance sheet 2020 2021 Plots 80.000 98.000 Mechanical equipment 100.000 140.000 Accumulated depreciation machine. Equipment (25.000) (26.000) Commodities finished stock 25.000 33.000 Customers 45.000 17.000 Promissory notes receivable 30.000 20.000 Suppliers' advances 3.000 6.500 Cash resources 51.000 35.000 Total assets 309.000 323.500 Share capital 145.000 145.000 Results in re-employment 11.000 104.000 Long-term liabilities (same loan) 51.000 67.000 Suppliers 30.000 3.500 Cheques payable 70.000 1.000 Interest payable 2.000 3.000 Total own funds and liabilities 309.000 323.500 Profit and loss statement Sales 215.000 Cost of sales (67.000) Other operating expenses (16.000) Depreciation (14.000) Loss from the sale of mechanical equipment (3.000) Earnings before interest…Auga Company Ltd Comparative Balance Sheet December 31, 2021 and 2020 2021 2020 Increase/(Decrease) Assets Cash 238,000 138,000 ? Accounts Receivable 325,000 300,000 ? Inventories 280,000 350,000 ? Prepaid expenses 28,000 35,000 ? Intangible assets 328,000 328,000 ? Plant assets, net 1,200,000 980,000 ? Total Assets 2,399,000 2,131,000 Liabilities Accounts payable 180,000 240,000 ? Accrued liabilities 310,000 415,000 ? Income tax payable 105,000 100,000 ? Long-term notes payable 1,350,000 800,000 ? Stockholders' Equity Common Stock 330,000 295,000 ? Retained earnings 450,000…CONCORD INC.Comparative Balance SheetsDecember 31 Assets 2022 2021 Cash $80,500 $48,700 Accounts receivable 87,900 38,600 Inventory 111,900 102,100 Prepaid expenses 29,400 27,900 Long-term investments 139,800 113,700 Plant assets 284,200 241,900 Accumulated depreciation (47,700) (49,100) Total $686,000 $523,800 Liabilities and Stockholders’ Equity Accounts payable $106,000 $63,700 Accrued expenses payable 16,500 21,200 Bonds payable 117,100 149,500 Common stock 219,000 175,100 Retained earnings 227,400 114,300 Total $686,000 $523,800 CONCORD INC.Income StatementFor the Year Ended December 31, 2022 Sales revenue $382,500 Less: Cost of goods sold $135,600 Operating expenses, excluding…

- Condensed financial data of Cheng Inc. follow. Cheng Inc. Comparative Balance Sheets December 31 Assets 2020 2019 Cash $ 80,800 $ 48,400 Accounts receivable 92,800 33,000 Inventory 117,500 102,850 Prepaid expenses 28,400 26,000 Investments 143,000 114,000 Equipment 270,000 242,500 Accumulated depreciation--- (50,000) (52,000) equipment Total $ 682,500 $ 514,750 Liabilities and Stockholders’ Equity…Question 1The following information was extracted from the financial statement of Barryfor the year ended 31 December 2020. RMSales 437,500Opening inventories 17,500Closing inventories 26,250Cost of sales 262,500Other income 3,750Expenses 61,250Current liabilities 47,250Trade receivables 39,375Bank 8,750Cash 31,500Required:(a) Show the formulae and compute the value of the following for Barry:(i) Purchases(ii) Gross profit(iii)Net ProfitShafNita Sdn. Bhd. Statement of Financial Position as at 31 December2019 2020RM RM RM RM Non Current AssetsBuilding 100,000 100,000Fixtures less accumulated depreciation 3,600 4,000Van less accumulated depreciation 7,840 14,800111,440 118,800 Current AssetInventory 11,200 24,800Trade account receivable 12,800 16,400Bank 1,800 -Cash 440 400 26,240 41,600Total assets 137,680 160,400Finance by:Capital account:Balance at 1 January 74,080 105,080Add: Net profit for the year 70,400 42,320Cash introduced - 20,000144,480 167,400Less: Drawings (39,400) (43,200)105,080 124,200 Non Current LiabilitiesLoan (repayable in 10 years time) 20,000 30,000Current LiablitiesAccount Payable 12,600 6,012Bank overdraft - 188Retained earnings 32,600 36,200Total liabilities and equity 137,680 160,400 Additional information at 31 December 2020: Fixtures bought in 2020 cost RM800. Van bought in 2020 cost RM11,000. Required: Prepare statement of cash flow for ShafNita Sdn. Bhd. for the year ended 31 December…