On December 1, 20X0, AKE Pte Ltd paid $5,000 to a Real Estate consulting company for a market report of the property market. The market survey was favourable and AKE Pte Ltd decided to make an entry into the property market. On January 1, 20X1 the company purchased two buildings paying $800,000 for Building X and $1,200,000 for Building Y. The company paid $20,000 to the property agent and incurred an additional $80,000 legal fee to finalise the transaction. Both buildings have useful life of 40 years and zero residual value. The company uses straight- line method for depreciation of all its non-current assets. The company intends to use Building X as their office and rent out Building Y. The company adopts revaluation model for its PPE and fair value model for its investment property. Any accumulated depreciation at the date of the revaluation will be eliminated against the gross carrying amount of the asset. At the end of the year 20X1, values of the two buildings were as below: FVLCS (S) VIU (S) 850,000 900,000 Item Building X Building Y 1,300,000 To improve cash flows for 20X2, the company decided to sell the two buildings. On September 30, 20X2 Building X was sold for $920,000 and Building Y was sold for $1,450,000. The company paid the property agent a fee of $12,000 for brokering the sales. Required: Illustrate the proper accounting treatment for the two buildings under the International Financial Reporting Standards. Workings and explanation must be clearly shown.

On December 1, 20X0, AKE Pte Ltd paid $5,000 to a Real Estate consulting company for a market report of the property market. The market survey was favourable and AKE Pte Ltd decided to make an entry into the property market. On January 1, 20X1 the company purchased two buildings paying $800,000 for Building X and $1,200,000 for Building Y. The company paid $20,000 to the property agent and incurred an additional $80,000 legal fee to finalise the transaction. Both buildings have useful life of 40 years and zero residual value. The company uses straight- line method for depreciation of all its non-current assets. The company intends to use Building X as their office and rent out Building Y. The company adopts revaluation model for its PPE and fair value model for its investment property. Any accumulated depreciation at the date of the revaluation will be eliminated against the gross carrying amount of the asset. At the end of the year 20X1, values of the two buildings were as below: FVLCS (S) VIU (S) 850,000 900,000 Item Building X Building Y 1,300,000 To improve cash flows for 20X2, the company decided to sell the two buildings. On September 30, 20X2 Building X was sold for $920,000 and Building Y was sold for $1,450,000. The company paid the property agent a fee of $12,000 for brokering the sales. Required: Illustrate the proper accounting treatment for the two buildings under the International Financial Reporting Standards. Workings and explanation must be clearly shown.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter4: Balance Sheet: Presenting And Analyzing Resources And Financing

Section: Chapter Questions

Problem 7Q

Related questions

Concept explainers

Depreciation Methods

The word "depreciation" is defined as an accounting method wherein the cost of tangible assets is spread over its useful life and it usually denotes how much of the assets value has been used up. The depreciation is usually considered as an operating expense. The main reason behind depreciation includes wear and tear of the assets, obsolescence etc.

Depreciation Accounting

In terms of accounting, with the passage of time the value of a fixed asset (like machinery, plants, furniture etc.) goes down over a specific period of time is known as depreciation. Now, the question comes in your mind, why the value of the fixed asset reduces over time.

Topic Video

Question

Transcribed Image Text:On December 1, 20X0, AKE Pte Ltd paid $5,000 to a Real Estate consulting company for a

market report of the property market. The market survey was favourable and AKE Pte Ltd

decided to make an entry into the property market. On January 1, 20X1 the company purchased

two buildings paying $800,000 for Building X and $1,200,000 for Building Y. The company

paid $20,000 to the property agent and incurred an additional $80,000 legal fee to finalise the

transaction.

Both buildings have useful life of 40 years and zero residual value. The company uses straight-

line method for depreciation of all its non-current assets.

The company intends to use Building X as their office and rent out Building Y. The company

adopts revaluation model for its PPE and fair value model for its investment property. Any

accumulated depreciation at the date of the revaluation will be eliminated against the gross

carrying amount of the asset.

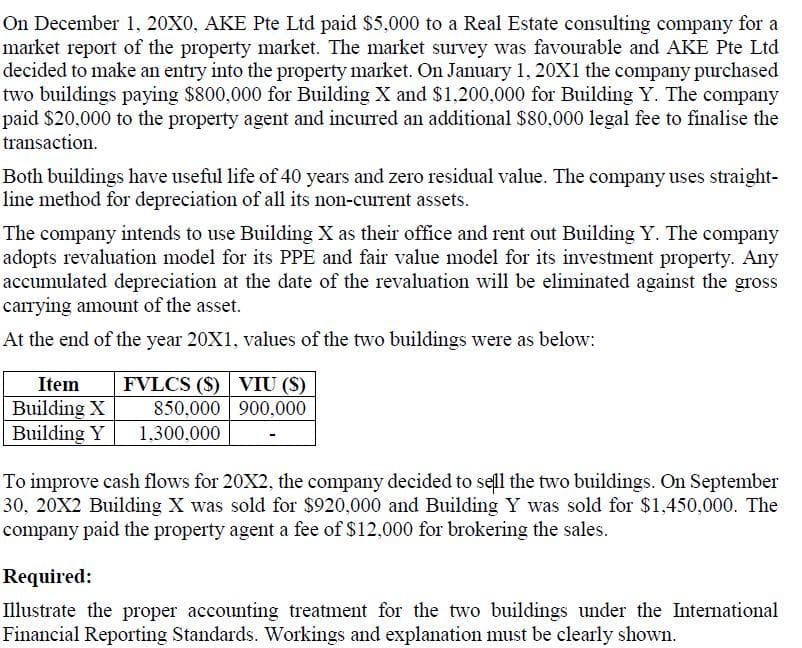

At the end of the year 20X1, values of the two buildings were as below:

FVLCS (S) VIU (S)

850,000 900,000

Item

Building X

Building Y

1,300,000

To improve cash flows for 20X2, the company decided to sell the two buildings. On September

30, 20X2 Building X was sold for $920,000 and Building Y was sold for $1,450,000. The

company paid the property agent a fee of $12,000 for brokering the sales.

Required:

Illustrate the proper accounting treatment for the two buildings under the International

Financial Reporting Standards. Workings and explanation must be clearly shown.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT