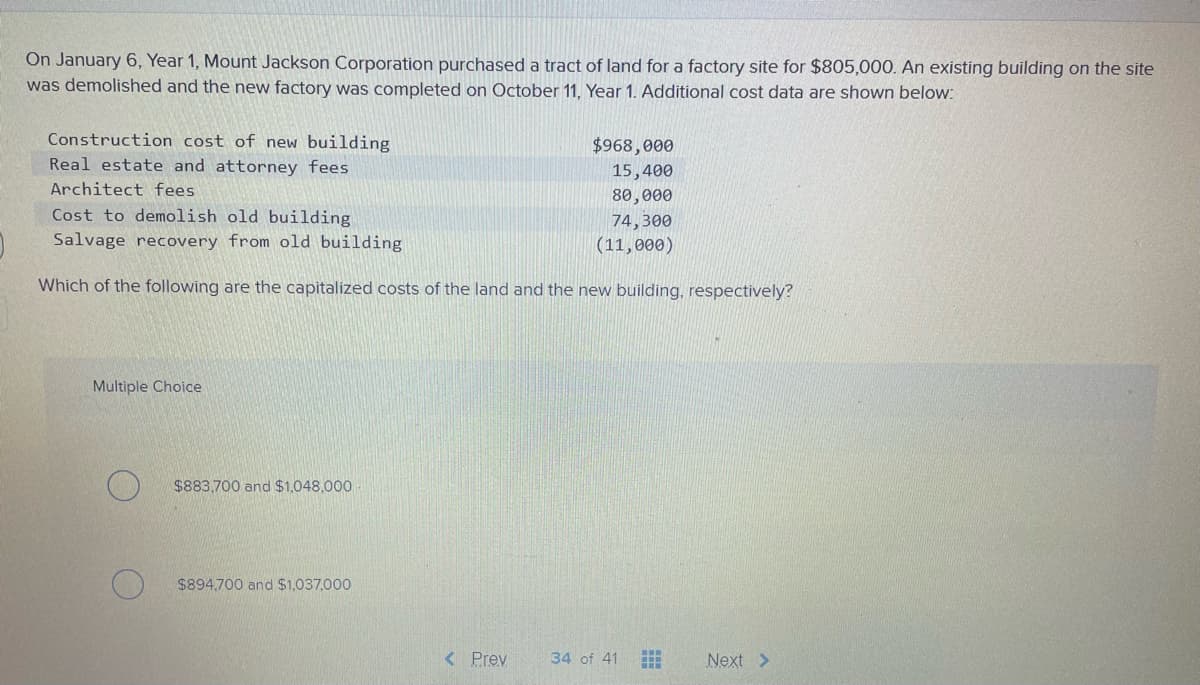

On January 6, Year 1, Mount Jackson Corporation purchased a tract of land for a factory site for $805,000. An existing building on the site was demolished and the new factory was completed on October 11, Year 1. Additional cost data are shown below: Construction cost of new building Real estate and attorney fees Architect fees Cost to demolish old building Salvage recovery from old building Which of the following are the capitalized costs of the land and the new building, respectively? $968,000 15,400 80,000 74,300 (11,000)

On January 6, Year 1, Mount Jackson Corporation purchased a tract of land for a factory site for $805,000. An existing building on the site was demolished and the new factory was completed on October 11, Year 1. Additional cost data are shown below: Construction cost of new building Real estate and attorney fees Architect fees Cost to demolish old building Salvage recovery from old building Which of the following are the capitalized costs of the land and the new building, respectively? $968,000 15,400 80,000 74,300 (11,000)

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 3PA: During the current year, Alanna Co. had the following transactions pertaining to its new office...

Related questions

Question

Which of the following are the capitalized coats of the land and the new building, respectively?

Transcribed Image Text:0

On January 6, Year 1, Mount Jackson Corporation purchased a tract of land for a factory site for $805,000. An existing building on the site

was demolished and the new factory was completed on October 11, Year 1. Additional cost data are shown below:

Construction cost of new building

Real estate and attorney fees

Architect fees

Cost to demolish old building

Salvage recovery from old building

Which of the following are the capitalized costs of the land and the new building, respectively?

Multiple Choice

$883,700 and $1,048,000

$894,700 and $1,037,000

< Prev

$968,000

15,400

80,000

74,300

(11,000)

34 of 41

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning