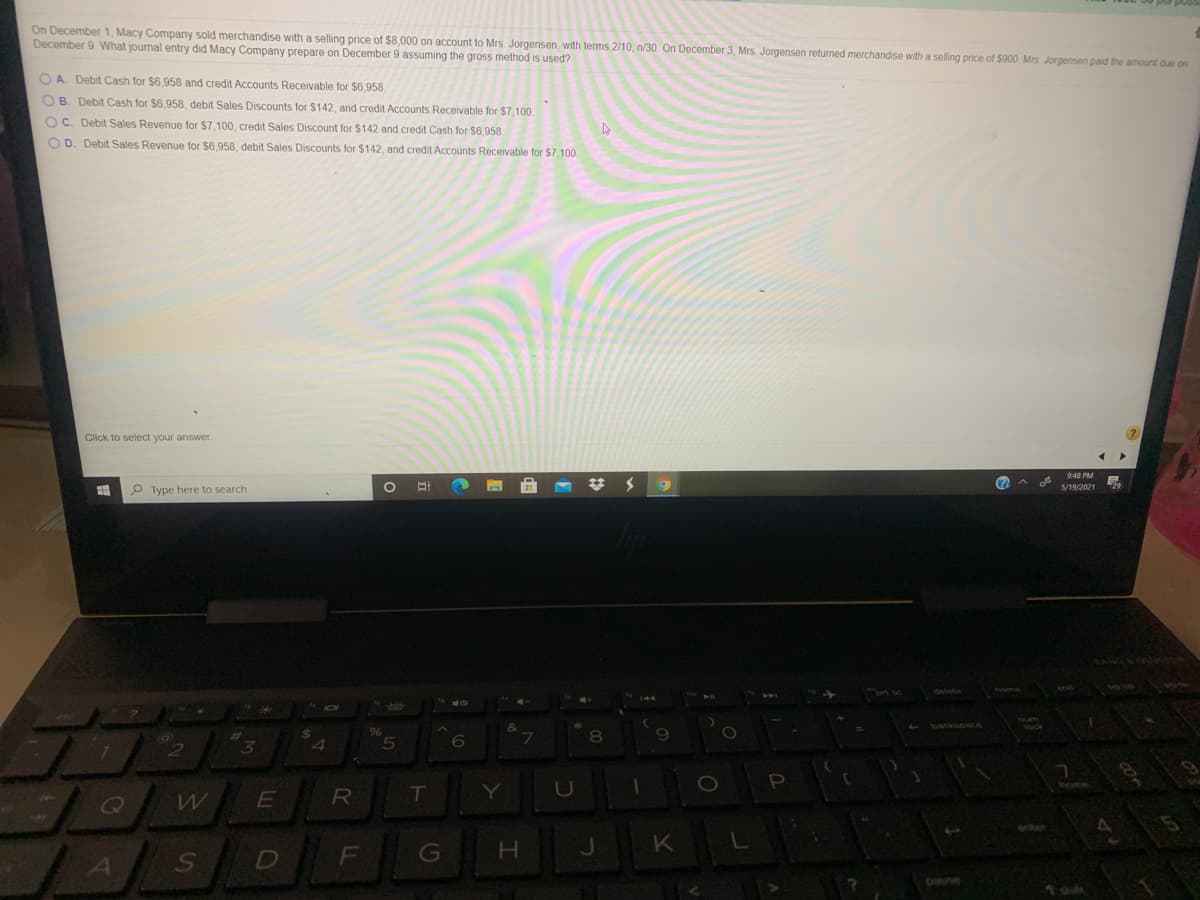

On December 1, Macy Company sold merchandise with a selling price of $8,000 on account to Mrs Jorgensen, with terms 2/10, n/30 On December 3, Mrs. Jorgensen returned merchandise with a selling price of $900 Mrs Jorgensen paid the amount due on December 9 What journal entry did Macy Company prepare on December 9 assuming the gross method is used? O A. Debit Cash for $6.958 and credit Accounts Receivable for $6.958 OB. Debit Cash for $6.958, debit Sales Discounts for $142, and credit Accounts Receivable for $7,100 OC. Debit Sales Revenue for $7,100, credit Sales Discount for $142 and credit Cash for $6,958 O D. Debit Sales Revenue for $6,958, debit Sales Discounts for $142, and credit Accounts Receivable for $7,100

On December 1, Macy Company sold merchandise with a selling price of $8,000 on account to Mrs Jorgensen, with terms 2/10, n/30 On December 3, Mrs. Jorgensen returned merchandise with a selling price of $900 Mrs Jorgensen paid the amount due on December 9 What journal entry did Macy Company prepare on December 9 assuming the gross method is used? O A. Debit Cash for $6.958 and credit Accounts Receivable for $6.958 OB. Debit Cash for $6.958, debit Sales Discounts for $142, and credit Accounts Receivable for $7,100 OC. Debit Sales Revenue for $7,100, credit Sales Discount for $142 and credit Cash for $6,958 O D. Debit Sales Revenue for $6,958, debit Sales Discounts for $142, and credit Accounts Receivable for $7,100

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter9: Sales And Purchases

Section: Chapter Questions

Problem 8E: Toby Company had the following sales transactions for March: Mar. 6Sold merchandise on account to...

Related questions

Question

On December 1, Macy company sold merchandise with a selling price of $8000 on account to Mrs Jorge son with terms 2/10, n

Transcribed Image Text:On December 1, Macy Company sold merchandise with a selling price of $8,000 on account to Mrs. Jorgensen, with terms 2/10, n/30. On December 3, Mrs. Jorgensen returned merchandise with a selling price of $900 Mrs Jorgensen paid the amount due on

December 9. What journal entry did Macy Company prepare on December 9 assuming the gross method is used?

O A. Debit Cash for $6,958 and credit Accounts Receivable for $6.958.

OB. Debit Cash for $6,958, debit Sales Discounts for $142, and credit Accounts Receivable for $7,100.

O C. Debit Sales Revenue for $7,100, credit Sales Discount for $142 and credit Cash for $6,958.

O D. Debit Sales Revenue for $6,958, debit Sales Discounts for $142, and credit Accounts Receivable for $7,100.

Click to select your answer.

9:48 PM

P Type here to search

6.

5/19/2021

8.

4

RI

K

D

F

G

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning