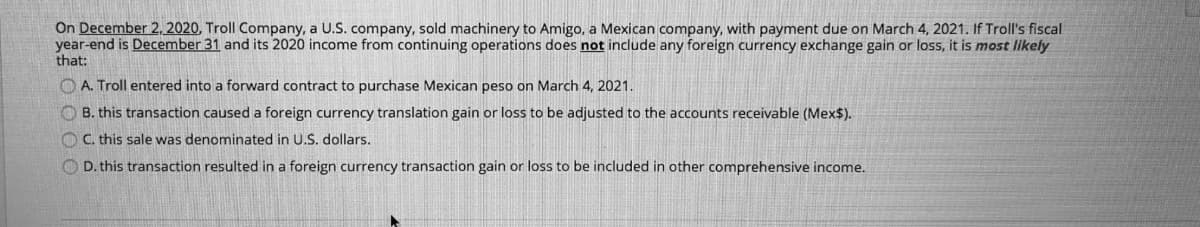

On December 2, 2020, Troll Company, a U.S. company, sold machinery to Amigo, a Mexican company, with payment due on March 4, 2021. If Troll's fiscal year-end is December 31 and its 2020 income from continuing operations does not include any foreign currency exchange gain or loss, it is most likely that: O A. Troll entered into a forward contract to purchase Mexican peso on March 4, 2021. O B. this transaction caused a foreign currency translation gain or loss to be adjusted to the accounts receivable (Mex$). O C. this sale was denominated in U.S. dollars. O D. this transaction resulted in a foreign currency transaction gain or loss to be included in other comprehensive income.

On December 2, 2020, Troll Company, a U.S. company, sold machinery to Amigo, a Mexican company, with payment due on March 4, 2021. If Troll's fiscal year-end is December 31 and its 2020 income from continuing operations does not include any foreign currency exchange gain or loss, it is most likely that: O A. Troll entered into a forward contract to purchase Mexican peso on March 4, 2021. O B. this transaction caused a foreign currency translation gain or loss to be adjusted to the accounts receivable (Mex$). O C. this sale was denominated in U.S. dollars. O D. this transaction resulted in a foreign currency transaction gain or loss to be included in other comprehensive income.

ChapterP2: Part 2: Exchange Rate Behavior

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:On December 2, 2020, Troll Company, a U.S. company, sold machinery to Amigo, a Mexican company, with payment due on March 4, 2021. If Troll's fiscal

year-end is December 31 and its 2020 income from continuing operations does not include any foreign currency exchange gain or loss, it is most likely

that:

O A. Troll entered into a forward contract to purchase Mexican peso on March 4, 2021.

O B. this transaction caused a foreign currency translation gain or loss to be adjusted to the accounts receivable (Mex$).

O C. this sale was denominated in U.S. dollars.

O D. this transaction resulted in a foreign currency transaction gain or loss to be included in other comprehensive income.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning