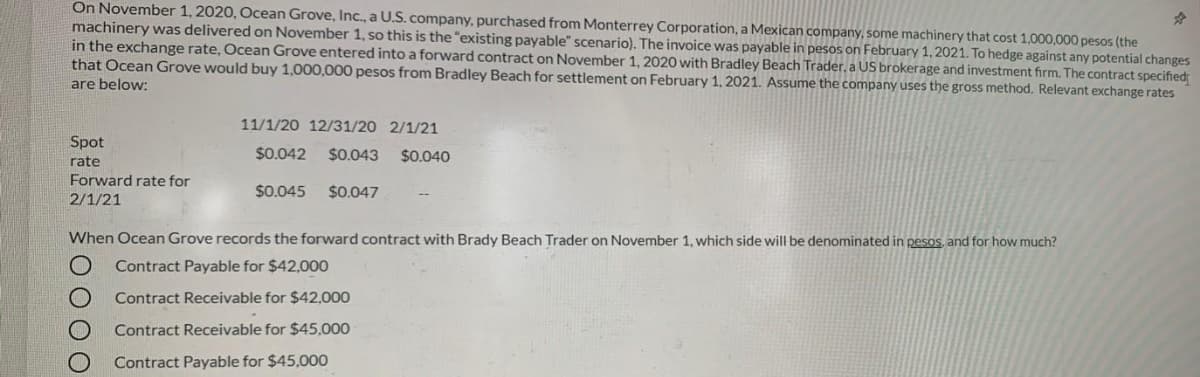

On November 1, 2020, Ocean Grove, Inc., a U.S. company, purchased from Monterrey Corporation, a Mexican company, some machinery that cost 1,000,000 pesos (the machinery was delivered on November 1, so this is the "existing payable" scenario). The invoice was payable in pesos on February 1, 2021. To hedge against any potential change in the exchange rate, Ocean Grove entered into a forward contract on November 1, 2020 with Bradley Beach Trader. a US brokerage and investment firm. The contract specified that Ocean Grove would buy 1,000,000 pesos from Bradley Beach for settlement on February 1, 2021. Assume the company uses the gross method. Relevant exchange rates are below: 11/1/20 12/31/20 2/1/21 Spot $0.042 $0.043 $0.040 rate Forward rate for 2/1/21 $0.045 $0.047 When Ocean Grove records the forward contract with Brady Beach Trader on November 1, which side will be denominated in pesos, and for how much?

On November 1, 2020, Ocean Grove, Inc., a U.S. company, purchased from Monterrey Corporation, a Mexican company, some machinery that cost 1,000,000 pesos (the machinery was delivered on November 1, so this is the "existing payable" scenario). The invoice was payable in pesos on February 1, 2021. To hedge against any potential change in the exchange rate, Ocean Grove entered into a forward contract on November 1, 2020 with Bradley Beach Trader. a US brokerage and investment firm. The contract specified that Ocean Grove would buy 1,000,000 pesos from Bradley Beach for settlement on February 1, 2021. Assume the company uses the gross method. Relevant exchange rates are below: 11/1/20 12/31/20 2/1/21 Spot $0.042 $0.043 $0.040 rate Forward rate for 2/1/21 $0.045 $0.047 When Ocean Grove records the forward contract with Brady Beach Trader on November 1, which side will be denominated in pesos, and for how much?

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter13: Marketable Securities And Derivatives

Section: Chapter Questions

Problem 21E

Related questions

Question

Transcribed Image Text:On November 1, 2020, Ocean Grove, Inc., a U.S. company, purchased from Monterrey Corporation, a Mexican company, some machinery that cost 1,000,000 pesos (the

machinery was delivered on November 1, so this is the "existing payable" scenario). The invoice was payable in pesos on February 1, 2021. To hedge against any potential changes

in the exchange rate, Ocean Grove entered into a forward contract on November 1, 2020 with Bradley Beach Trader. a US brokerage and investment firm. The contract specified

that Ocean Grove would buy 1,000,000 pesos from Bradley Beach for settlement on February 1, 2021. Assume the company uses the gross method. Relevant exchange rates

are below:

11/1/20 12/31/20 2/1/21

Spot

$0.042

$0.043

$0.040

rate

Forward rate for

2/1/21

$0.045

$0.047

When Ocean Grove records the forward contract with Brady Beach Trader on November 1, which side will be denominated in pesOs, and for how much?

Contract Payable for $42,000

Contract Receivable for $42,000

Contract Receivable for $45,000

Contract Payable for $45,000

0000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning