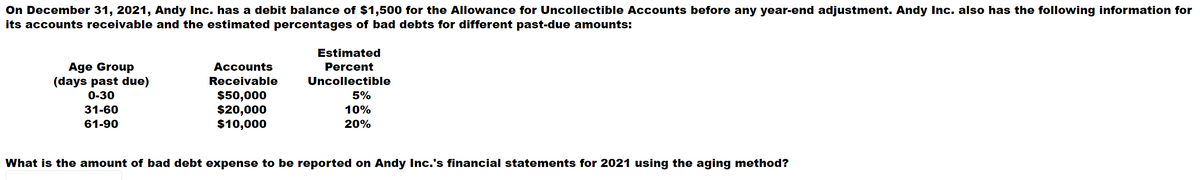

On December 31, 2021, Andy Inc. has a debit balance of $1,500 for the Allowance for Uncollectible Accounts before any year-end adjustment. Andy Inc. also has the following information for its accounts receivable and the estimated percentages of bad debts for different past-due amounts: Estimated Age Group (days past due) 0-30 Accounts Percent Receivable Uncollectible $50,000 $20,000 $10,000 5% 31-60 10% 61-90 20% What is the amount of bad debt expense to be reported on Andy Inc.'s financial statements for 2021 using the aging method?

On December 31, 2021, Andy Inc. has a debit balance of $1,500 for the Allowance for Uncollectible Accounts before any year-end adjustment. Andy Inc. also has the following information for its accounts receivable and the estimated percentages of bad debts for different past-due amounts: Estimated Age Group (days past due) 0-30 Accounts Percent Receivable Uncollectible $50,000 $20,000 $10,000 5% 31-60 10% 61-90 20% What is the amount of bad debt expense to be reported on Andy Inc.'s financial statements for 2021 using the aging method?

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 11EB: Outpost Designs uses the balance sheet aging method to account for uncollectible debt on...

Related questions

Question

no work shown required

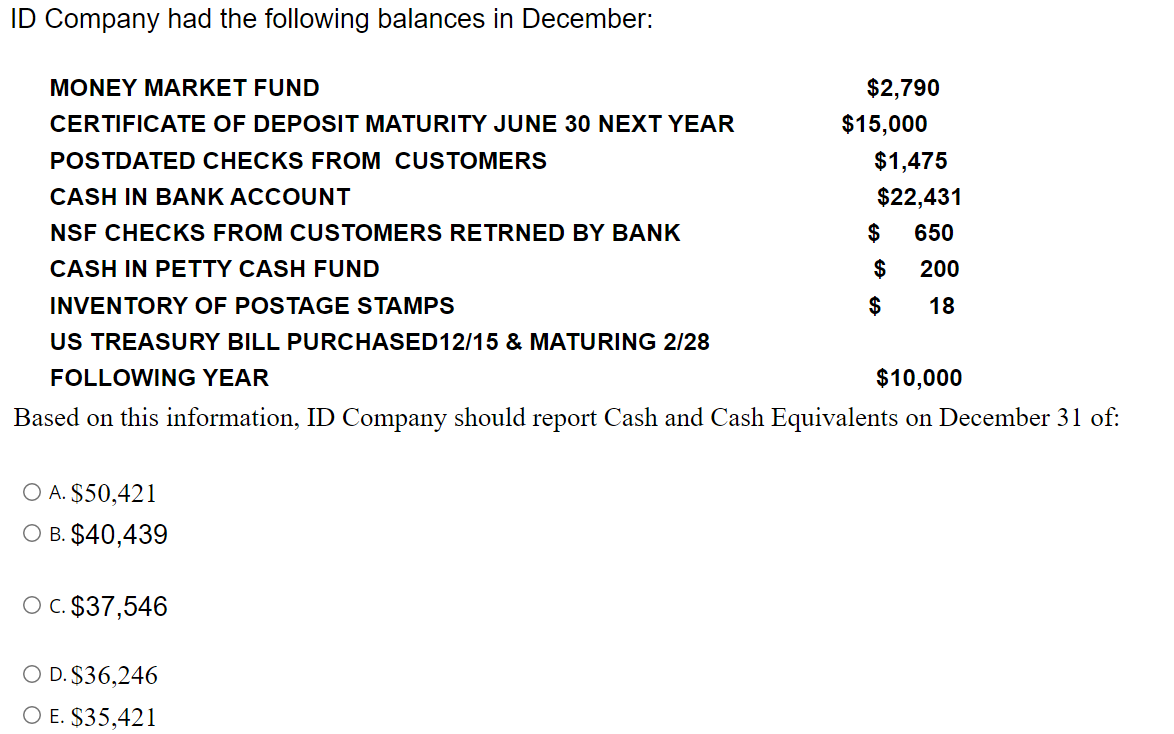

Transcribed Image Text:ID Company had the following balances in December:

MONEY MARKET FUND

$2,790

CERTIFICATE OF DEPOSIT MATURITY JUNE 30 NEXT YEAR

$15,000

POSTDATED CHECKS FROM CUSTOMERS

$1,475

CASH IN BANK ACCOUNT

$22,431

NSF CHECKS FROM CUSTOMERS RETRNED BY BANK

$

650

CASH IN PETTY CASH FUND

INVENTORY OF POSTAGE STAMPS

$

200

$

18

US TREASURY BILL PURCHASED12/15 & MATURING 2/28

FOLLOWING YEAR

$10,000

Based on this information, ID Company should report Cash and Cash Equivalents on December 31 of:

O A. $50,421

О В. $40,439

О с.$37,546

O D. $36,246

O E. $35,421

Transcribed Image Text:On December 31, 2021, Andy Inc. has a debit balance of $1,500 for the Allowance for Uncollectible Accounts before any year-end adjustment. Andy Inc. also has the following information for

its accounts receivable and the estimated percentages of bad debts for different past-due amounts:

Estimated

Age Group

(days past due)

0-30

Accounts

Percent

Receivable

Uncollectible

$50,000

$20,000

$10,000

5%

31-60

10%

61-90

20%

What is the amount of bad debt expense to be reported on Andy Inc.'s financial statements for 2021 using the aging method?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub