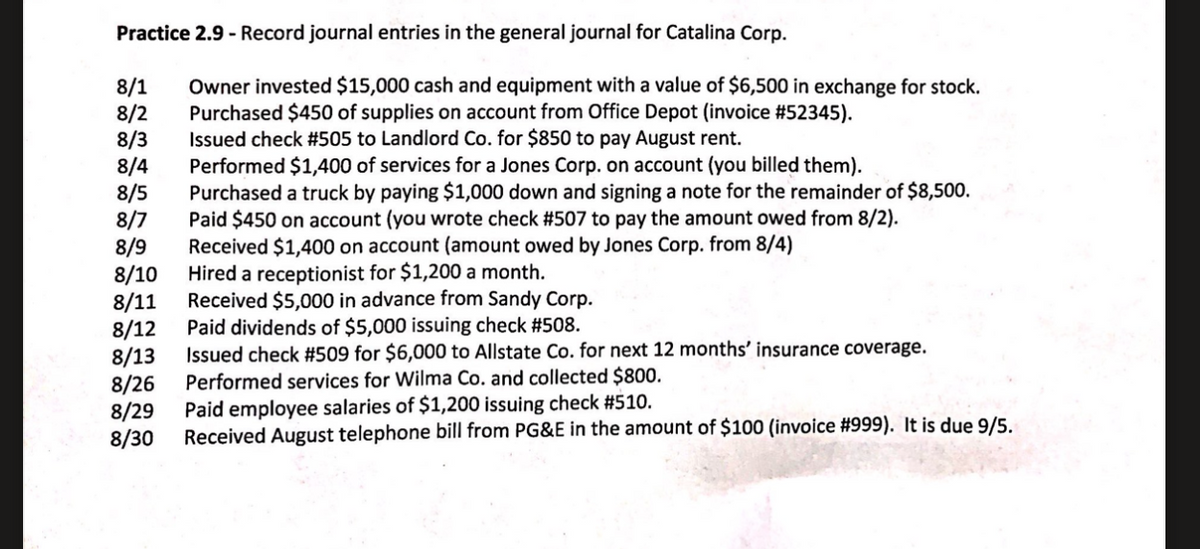

Practice 2.9 - Record journal entries in the general journal for Catalina Corp. 8/1 8/2 8/3 8/4 8/5 8/7 8/9 8/10 8/11 8/12 8/13 8/26 8/29 8/30 Owner invested $15,000 cash and equipment with a value of $6,500 in exchange for stock. Purchased $450 of supplies on account from Office Depot (invoice #52345). Issued check #505 to Landlord Co. for $850 to pay August rent. Performed $1,400 of services for a Jones Corp. on account (you billed them). Purchased a truck by paying $1,000 down and signing a note for the remainder of $8,500. Paid $450 on account (you wrote check #507 to pay the amount owed from 8/2). Received $1,400 on account (amount owed by Jones Corp. from 8/4) Hired a receptionist for $1,200 a month. Received $5,000 in advance from Sandy Corp. Paid dividends of $5,000 issuing check #508. Issued check #509 for $6,000 to Allstate Co. for next 12 months' insurance coverage. Performed services for Wilma Co. and collected $800. Paid employee salaries of $1,200 issuing check #510. Received August telephone bill from PG&E in the amount of $100 (invoice #999). It is due 9/5.

Practice 2.9 - Record journal entries in the general journal for Catalina Corp. 8/1 8/2 8/3 8/4 8/5 8/7 8/9 8/10 8/11 8/12 8/13 8/26 8/29 8/30 Owner invested $15,000 cash and equipment with a value of $6,500 in exchange for stock. Purchased $450 of supplies on account from Office Depot (invoice #52345). Issued check #505 to Landlord Co. for $850 to pay August rent. Performed $1,400 of services for a Jones Corp. on account (you billed them). Purchased a truck by paying $1,000 down and signing a note for the remainder of $8,500. Paid $450 on account (you wrote check #507 to pay the amount owed from 8/2). Received $1,400 on account (amount owed by Jones Corp. from 8/4) Hired a receptionist for $1,200 a month. Received $5,000 in advance from Sandy Corp. Paid dividends of $5,000 issuing check #508. Issued check #509 for $6,000 to Allstate Co. for next 12 months' insurance coverage. Performed services for Wilma Co. and collected $800. Paid employee salaries of $1,200 issuing check #510. Received August telephone bill from PG&E in the amount of $100 (invoice #999). It is due 9/5.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter3: The Double-entry Framework

Section: Chapter Questions

Problem 8SEA: ANALYSIS OF TRANSACTIONS Charles Chadwick opened a business called Charlies Detective Service in...

Related questions

Question

please explain the steps. thank you

Transcribed Image Text:Practice 2.9 - Record journal entries in the general journal for Catalina Corp.

8/1

8/2

8/3

8/4

8/5

8/7

8/9

8/10

8/11

8/12

8/13

8/26

8/29

8/30

Owner invested $15,000 cash and equipment with a value of $6,500 in exchange for stock.

Purchased $450 of supplies on account from Office Depot (invoice #52345).

Issued check #505 to Landlord Co. for $850 to pay August rent.

Performed $1,400 of services for a Jones Corp. on account (you billed them).

Purchased a truck by paying $1,000 down and signing a note for the remainder of $8,500.

Paid $450 on account (you wrote check #507 to pay the amount owed from 8/2).

Received $1,400 on account (amount owed by Jones Corp. from 8/4)

Hired a receptionist for $1,200 a month.

Received $5,000 in advance from Sandy Corp.

Paid dividends of $5,000 issuing check #508.

Issued check #509 for $6,000 to Allstate Co. for next 12 months' insurance coverage.

Performed services for Wilma Co. and collected $800.

Paid employee salaries of $1,200 issuing check #510.

Received August telephone bill from PG&E in the amount of $100 (invoice #999). It is due 9/5.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub