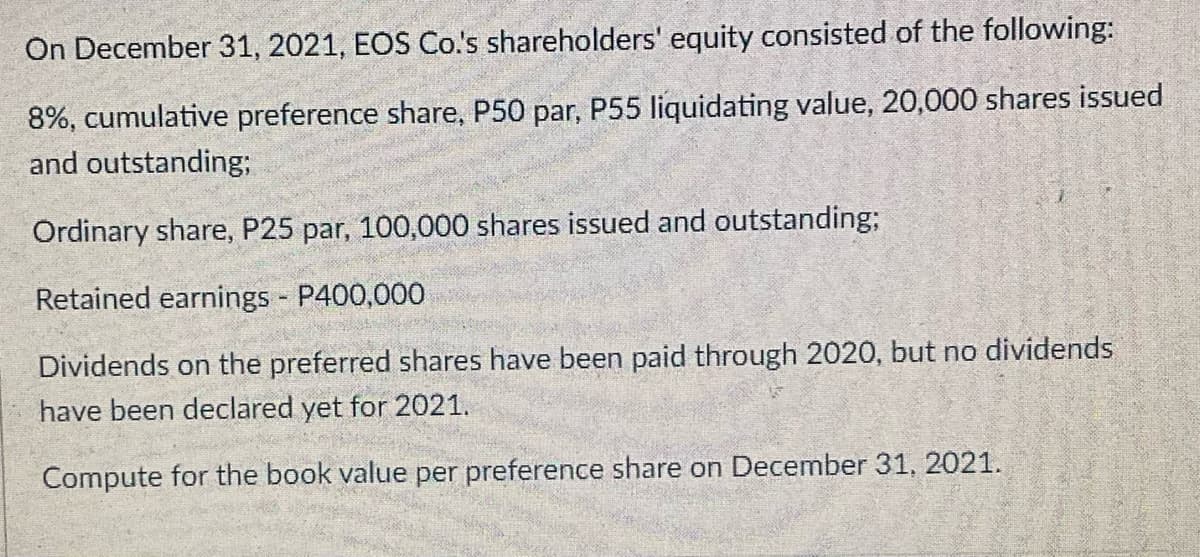

On December 31, 2021, EOS Co.'s shareholders' equity consisted of the following: 8%, cumulative preference share, P50 par, P55 liquidating value, 20,000 shares issued and outstanding; Ordinary share, P25 par, 100,000 shares issued and outstanding; Retained earnings P400,000 Dividends on the preferred shares have been paid through 2020, but no dividends have been declared yet for 2021. Compute for the book value per preference share on December 31, 2021.

Q: 21. Facts: Earnest and Old (EO), is partnership established under the laws of the Philippines.…

A: In the context of the given question, we are required to compute, whether the income of Mr. Nicanor…

Q: Required information [The following information applies to the questions displayed below.] The…

A: The question is based on the concept of Bank reconciliation statement.

Q: Variable manufacturing overhead costs are treated as period costs under both absorption and variable…

A: Variable manufacturing overhead cost is treated as product cost under both absorption and variable…

Q: Only answer part1

A: The goodwill means the favorable reputation that a company has with its customers. Goodwill arises…

Q: АВС, C. Condensed Income Statement For the Years Ended December 31 (In millions) 2014 2015 8,853.3…

A:

Q: Brockton Ltd. began applying IFRS in 20X8. One of the necessary adjustments was to adjust past…

A: Retrospective Restatement: Retrospective restatement is the act of revising the acknowledgment,…

Q: Holmes Cleaning Service began operation on January 1, Year 1. The company experienced the following…

A: T Accounts: A T-account is a graphical depiction of a general ledger, which is used to record the…

Q: QS 14-11 (Algo) Preparing an income statement LO P1 Prepare an income statement for Rex…

A: REX MANUFACTURING Income Statement For Year Ended December 31 Sales $ 93,600 Cost of…

Q: Division A makes a part with the following characteristics: **SEE IMAGE TO SEE DETAILS** a}…

A: Transfer price is a price at which inter-division transfer is made within the corporation.

Q: What would you consider to be Luca Pacioli’s major contribution to the development of double-entry…

A: Here asked about the contribution which are made by the Luca Pacioli in the Accounting and its…

Q: following unit sales projections for 2022. Quarter 1,350 kayaks 1,300 kayaks 1,100 kayaks 950 kayaks…

A: In this question, we will make 1) Production Budget 2) Sales Budget 3) Direct Material Budget…

Q: b. Applying the 2022 Social Security benefit formula, calculate the monthly social security benefit…

A: Social security benefit = 90% of first $1024 of AIME + 32% of any amount over $1024 less than $6172…

Q: On the basis of the following data, determine the value of the inventory at the…

A: Note: Under the Lower of cost or Market method, inventory is valued at the lower of the Cost of the…

Q: 1. If each partner received P30,000 (ignore income tax) on the residual profit after salaries,…

A: Answer

Q: Is all accounting income taxable? is there any accounting income that is not taxable? Please Explain…

A: Accounting income is the profit left over after all applicable expenses have been deducted from…

Q: Rocky Mountain Corporation makes two types of hiking boots—Xactive and Pathbreaker. Data concerning…

A: Solution 1: Determination of activity rate for each activity & allocation of overhead…

Q: Preferred shares, $4.55 non-cumulative, 52,000 shares authorized and issued* $ 3,328,000…

A: Dividend per share is calculated as total dividend paid divided by number of outstanding shares.

Q: Assuming no other changes to the limit order book, which of the following statements is always true?

A: In resulting from the placement of a new limit order only depth and width are changes . Remaining…

Q: The following selected transactions were completed by Betz Company during July of the current year.…

A: Introduction Purchase of merchandise inventory is recorded by debiting to merchandise inventory…

Q: Harry and Sally formed the Evergreen partnership by contributing the following assets in exchange…

A: Evergreen's Tax basis in its assets = Cash + Tax basis of assets - tax basis of liabilties

Q: On November 16, Bell borrowed $10,000 from Graham and gave a 90-day, 12% note. On December 31, the…

A: As of the end of accounting period, the company that has lent money needs to record interest on a…

Q: A sneaker outlet has made the following wholesale purchases of new running shoes: 12 pairs at…

A: As per FIFO, the ending inventory would consist of the last inward items as the first items would be…

Q: a. Applying the FICA tax rates and rules for 2022, calculate how much you would pay in FICA taxes if…

A: * As per Bartleby policy, if question are different then answer first question only. For 2022, the…

Q: A lease that has 2 years to run is recorded on a company's books as a liability of $12,603. If the…

A:

Q: O $853,623 O $896,325 O$1.128,600

A: All sorts of future cash flows in respect of adding interest on present value are known as the…

Q: Complete the check register given completely using the following information: The balance on…

A: A check register which is also known as a cash disbursement journal is used to record all the cash…

Q: Explained and described the measurement aspects of accounting in relations to assets valuation and…

A: measurement is generally related to the valuation and recording and also the process of collecting…

Q: Beginning inventory, purchases, and sales for Item Zeta9 are as follows: Oct. 1 Inventory 7 Sale 42…

A: Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: 1. Calculate the bond issue price assuming a market interest rate of 7% on the date of issue 2.…

A: Journal entries refers to the official book of a company which is used to record the day to day…

Q: You brought your work home one evening, and your nephew spilled his chocolate milk shake on the…

A: Flexible Budget- A flexible budget is one that responds to changes in volume and activity. Because…

Q: On May 1, Foress Corporation incorporated and authorized 211,000 preferred shares and an unlimited…

A: The journal entries are prepared to keep the record of day to day transactions of the business.

Q: To create the global capital structure in a MNC, the business must ________.

A: A. diversify to the oversea markets

Q: please prepare the journal entries for the following info. Morton Company had the following select…

A: Journal entries will be recorded as the first step of recording the transaction. for notes…

Q: a. What is the minimum amount of income Stephanie should recognize for tax purposes this year if she…

A: Accrual Method of Accounting means that revenue should be recognized when it is earned but not when…

Q: Cash on hand and in bank P 5,960 1,200 8,000 1,100 1,000 1,800 4,000 300 600 Utilities expense…

A: Formula: Profit / ( Loss ) = Revenues - Expenses.

Q: A firm reported the following financials for 2021: Sales revenue = $3,060 Accounts receivables =…

A: Earnings per share = (Net income - )Dividend on preferred stock / Number of common shares…

Q: Answer item 5

A: The item 5 don't have any impact on the income of that year. The impact of this transaction is only…

Q: A machine having a first cost of P60,000.00 will be retired at the end of 8 years. Depreciation cost…

A: Under the declining balance method, depreciation is charged on the reduced book value that is at the…

Q: Larson, Inc., manufactures backpacks. Last year, it sold 87,500 of its basic model for $15 per unit.…

A: Let us consider whole market = 100% Given market is expected to increase by 15% Therefore total…

Q: FIFO and LIFO Costs Under Perpetual Inventory System The following units of an item were available…

A: Under FIFO Method value of balance inventory is calculated after each transaction of purchase or…

Q: On January 2, 2016, Banno Corp. issued P1,500,000 of 10% bonds to yield 11% due December 31, 2025.…

A: The answer is stated below:

Q: What is the appropriate accounting for each of the phases, Capital projects funds and Debt services…

A: Investing in a built environment represents short-term costs that return only benefits on long-term…

Q: Answe these questions in relation to accounting packages systems

A: Here discuss about the details of the sage Pastel software for the Accounting and uses to kept…

Q: Alpha Company is considering the purchase of Beta Company. Alpha has collected the following data…

A: A 1) Compute average earning per annum Particulars Amount Cumulative Earnings 850,000…

Q: Mr. Albuera, a resident citizen, received P18,000.00 as interest from his short-term deposit.…

A: Solution Short term deposit means amount deposit generally for a period less than one year.

Q: Dynamo Corporation manufactures toasters. Each toaster comes with a 5-year assurance-type warranty.…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: Question Seven Sherman Charter signed a four-month note payable in the amount of $9,000 on September…

A: The adjustment entries are prepared to adjust the revenue and expenses of the current period.

Q: The Bottling Department of Mountain Springs Water Company had 5,000 liters in beginning work in…

A: Solution: Equivalent units for conversion cost under FIFO method = Beginning WIP Units * % completed…

Q: Halcrow Yolles purchased equipment for new highway construction in Manitoba, Canada, costing…

A: Depreciation is an accounting method for allocating the cost of a tangible or physical asset over…

Q: Complete this question by entering your answers in the tabs below. Req 1A Req 1B Req 2A Req 2B…

A: Calculation of unit cost under Absorption Costing Particular Amount Direct Material 11 ADD…

Step by step

Solved in 2 steps

- Monona Company reported net income of 29,975 for 2019. During all of 2019, Monona had 1,000 shares of 10%, 100 par, nonconvertible preferred stock outstanding, on which the years dividends had been paid. At the beginning of 2019, the company had 7,000 shares of common stock outstanding. On April 2, 2019, the company issued another 2,000 shares of common stock so that 9,000 common shares were outstanding at the end of 2019. Common dividends of 17,000 had been paid during 2019. At the end of 2019, the market price per share of common stock was 17.50. Required: 1. Compute Mononas basic earnings per share for 2019. 2. Compute the price/earnings ratio for 2019.Raun Company had the following equity items as of December 31, 2019: Preferred stock, 9% cumulative, 100 par, convertible Paid-in capital in excess of par value on preferred stock Common stock, 1 stated value Paid-in capital in excess of stated value on common stock| Retained earnings The following additional information about Raun was available for the year ended December 31, 2019: 1. There were 2 million shares of preferred stock authorized, of which 1 million were outstanding. All 1 million shares outstanding were issued on January 2, 2016, for 120 a share. The preferred stock is convertible into common stock on a 1-for-1 basis until December 31, 2025; thereafter, the preferred stock ceases to be convertible and is callable at par value by the company. No preferred stock has been converted into common stock, and there were no dividends in arrears at December 31, 2019. 2. The common stock has been issued at amounts above stated value per share since incorporation in 2002. Of the 5 million shares authorized, 3,580,000 were outstanding at January 1, 2019. The market price of the outstanding common stock has increased slowly but consistently for the last 5 years. 3. Raun has an employee share option plan where certain key employees and officers may purchase shares of common stock at 100% of the marker price at the date of the option grant. All options are exercisable in installments of one-third each year, commencing 1 year after the date of the grant, and expire if not exercised within 4 years of the grant date. On January 1, 2019, options for 70,000 shares were outstanding at prices ranging from 47 to 83 a share. Options for 20,000 shares were exercised at 47 to 79 a share during 2019. During 2019, no options expired and additional options for 15,000 shares were granted at 86 a share. The 65,000 options outstanding at December 31, 2019, were exercisable at 54 to 86 a share; of these, 30,000 were exercisable at that date at prices ranging from 54 to 79 a share. 4. Raun also has an employee share purchase plan whereby the company pays one-half and the employee pays one-half of the market price of the stock at the date of the subscription. During 2019, employees subscribed to 60,000 shares at an average price of 87 a share. All 60,000 shares were paid for and issued late in September 2019. 5. On December 31, 2019, there was a total of 355,000 shares of common stock set aside for the granting of future share options and for future purchases under the employee share purchase plan. The only changes in the shareholders equity for 2019 were those described previously, the 2019 net income, and the cash dividends paid. Required: Prepare the shareholders equity section of Rauns balance sheet at December 31, 2019. Substitute, where appropriate, Xs for unknown dollar amounts. Use good form and provide full disclosure. Write appropriate notes as they should appear in the publisher financial statements.Anoka Company reported the following selected items in the shareholders equity section of its balance sheet on December 31, 2019, and 2020: In addition, it listed the following selected pretax items as a December 31, 2019 and 2020: The preferred shares were outstanding during all of 2019 and 2020; annual dividends were declared and paid in each year. During 2019, 2,000 common shares were sold for cash on October 4. During 2020, a 20% stock dividend was declared and issued in early May. At the end of 2019 and 2020, the common stock was selling for 25.75 and 32.20, respectively. The company is subject to a 30% income tax rate. Required: 1. Prepare the comparative 2019 and 2020 income statements (multiple-step), and the related note that would appear in Anokas 2020 annual report. 2. Next Level Compute the price/earnings ratio for 2020. How does this compare to 2019? Why is it different?

- On January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a 30% corporate income tax rate. During 2019, Kittson earned net income of 67,000, and the following events occurred: 1. Cash dividends of 3 per share on 4,000 shares of common stock were declared and paid. 2. A small stock dividend was declared and issued. The dividend consisted of 600 shares of 10 par common stock. On the date of declaration, the market price of the companys common stock was 36 per share. 3. The company recalled and retired 500 shares of 100 par preferred stock. The call price was 125 per share; the stock had originally been issued for 110 per share. 4. The company discovered that it had erroneously recorded depreciation expense of 45,000 in 2018 for both financial reporting and income tax reporting. The correct depreciation for 2018 should have been 20,000. This is considered a material error. Required: 1. Prepare journal entries to record Items 1 through 4. 2. Prepare Kittsons statement of retained earnings for the year ended December 31, 2019.Lyon Company shows the following condensed income statement information for the year ended December 31, 2019: Lyon declared dividends of 6,000 on preferred stock and 17,280 on common stock. At the beginning of 2019, 10,000 shares of common stock were outstanding. On May 1, 2019, the company issued 2,000 additional common shares, and on October 31, 2019, it issued a 20% stock dividend on its common stock. The preferred stock is not convertible. Required: 1. Compute the 2019 basic earnings per share. 2. Show the 2019 income statement disclosure of basic earnings per share. 3. Draft a related note to accompany the 2019 financial statements.Hyde Corporations capital structure at December 31, 2018, was as follows: On July 2, 2019, Hyde issued a 10% stock dividend on its common stock and paid a cash dividend of 2.00 per share on its preferred stock. Net income for the year ended December 31, 2019, was 780,000. What should be Hydes 2019 basic earnings per share? a. 7.80 b. 7.09 c. 7.68 d. 6.73

- Winona Company began 2019 with 10,000 shares of 10 par common stock and 2,000 shares of 9.4%, 100 par, convertible preferred stock outstanding. On April 2 and June 1, respectively, the company issued 2,000 and 6,000 additional shares of common stock. On November 16, Winona declared a 2-for-1 stock split. The preferred stock was issued in 2018. Each share of preferred stock is currently convertible into 4 shares of common stock. To date, no preferred stock has been converted. Current dividends have been paid on both preferred and common stock. Net income after taxes for 2019 totaled 109,800. The company is subject to a 30% income tax rate. The common stock sold at an average market price of 24 per share during 2019. Required: 1. Prepare supporting calculations for Winona and compute its: a. basic earnings per share b. diluted earnings per share 2. Show how Winona would report the earnings per share on its 2019 income statement. Include an accompanying note to the financial statements. 3. Next Level Assume Winona uses IFRS. Discuss what Winona would do differently for computing earnings per share, and then repeat Requirement 1 under IFRS.Cash dividends on the 10 par value common stock of Garrett Company were as follows: The 4th-quarter cash dividend was declared on December 21, 2019, to shareholders of record on December 31, 2019. Payment of the 4th-quarter cash dividend was made on January 18, 2020. In addition, Garrett declared a 5% stock dividend on its 10 par value common stock on December 3, 2019, when there were 300,000 shares issued and outstanding and the market value of the common stock was 20 per share. The shares were issued on December 24, 2019. What was the effect on Garretts shareholders equity accounts as a result of the preceding transactions?Statement of Stockholders' Equity At the end of 2019, Stanley Utilities Inc. had the following equity accounts and balances: During 2020, Stanley Utilities engaged in the following transactions involving its equity accounts: Sold 3,300 shares of common stock for $15 per share. Sold 1,000 shares of 12%, $100 par preferred stock at $105 per share. Declared and paid cash dividends of $8,000. Repurchased 1,000 shares of treasury stock (common) for $38 per share. Sold 400 of the treasury shares for $42 per share. Required: Prepare the journal entries for Transactions a through e. Assume that 2020 net income was $87,000. Prepare a statement of stockholders equity at December 31, 2020.

- Statement of Stockholders' Equity At the end of 2019, Stanley Utilities Inc. had the following equity accounts and balances: During 2020, Haley engaged in the following transactions involving its equity accounts: Sold 5,000 shares of common stock for $19 per share. Sold 1.200 shares of 12%, $50 par preferred stock at $75 per share. Declared and paid cash dividends of $22,000. Repurchased 1,000 shares of treasury stock (common) for $24 per share. Sold 300 of the treasury shares for $26 per share. Required: Prepare the journal entries for Transactions a through e. Assume that 2020 net income was $123,700. Prepare a statement of stockholders equity at December 31, 2020.Contributed Capital Adams Companys records provide the following information on December 31, 2019: Additional information: 1. Common stock has a 5 par value, 50,000 shares are authorized, 15,000 shares have been issued and are outstanding. 2. Preferred stock has a 100 par value, 3,000 shares are authorized, 800 shares have been issued and are outstanding. Two hundred shares have been subscribed at 120 per share. The stock pays an 8% dividend, is cumulative, and is callable at 130 per share. 3. Bonds payable mature on January 1, 2023. They carry a 12% annual interest rate, payable semiannually. Required: Prepare the Contributed Capital section of the December 31, 2019, balance sheet for Adams. Include appropriate parenthetical notes.Kent Corporation was organized on January 1, 2014. On that date, it issued 200,000 shares of 10 par value common stock at 15 per share (400,000 shares were authorized). During the period January 1, 2014, through December 31, 2019, Kent reported net income of 750,000 and paid cash dividends of 380,000. On January 5, 2019, Kent purchased 12,000 shares of its common stock at 12 per share. On December 28, 2019, 8,000 treasury shares were sold at 8 per share. Kent used the cost method of accounting for treasury shares. What is Kents total shareholders equity as of December 31, 2019? a. 3,290,000 b. 3,306,000 c. 3,338,000 d. 3,370,000