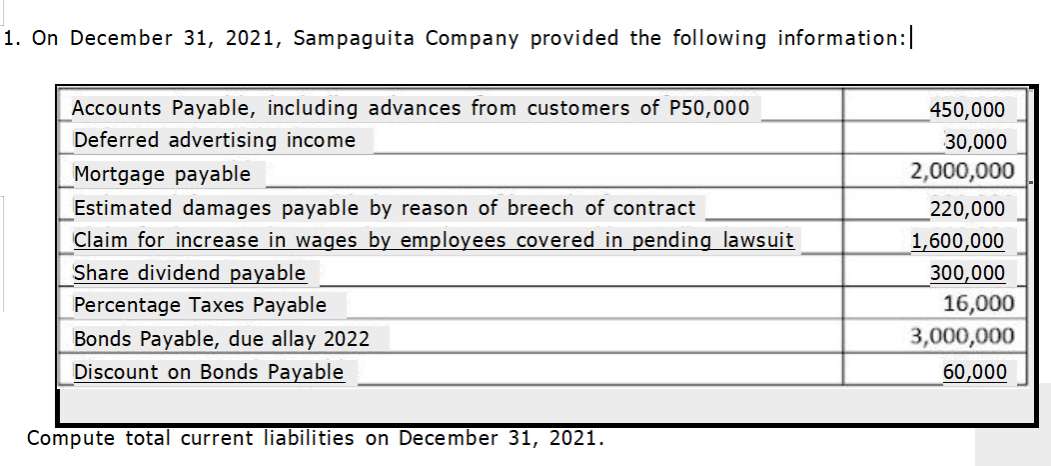

On December 31, 2021, Sampaguita Company provided the following information: Accounts Payable, including advances from customers of P50,000 450,000 Deferred advertising income 30,000 Mortgage payable 2,000,000 Estimated damages payable by reason of breech of contract Claim for increase in wages by employees covered in pending lawsuit Share dividend payable 220,000 1,600,000 300,000 Percentage Taxes Payable 16,000 Bonds Payable, due allay 2022 Discount on Bonds Payable 3,000,000 60,000 Compute total current liabilities on December 31, 2021.

On December 31, 2021, Sampaguita Company provided the following information: Accounts Payable, including advances from customers of P50,000 450,000 Deferred advertising income 30,000 Mortgage payable 2,000,000 Estimated damages payable by reason of breech of contract Claim for increase in wages by employees covered in pending lawsuit Share dividend payable 220,000 1,600,000 300,000 Percentage Taxes Payable 16,000 Bonds Payable, due allay 2022 Discount on Bonds Payable 3,000,000 60,000 Compute total current liabilities on December 31, 2021.

Chapter17: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 48P

Related questions

Question

Transcribed Image Text:1. On December 31, 2021, Sampaguita Company provided the following information:

Accounts Payable, including advances from customers of P50,000

450,000

Deferred advertising income

30,000

Mortgage payable

2,000,000

Estimated damages payable by reason of breech of contract

220,000

Claim for increase in wages by employees covered in pending lawsuit

Share dividend payable

1,600,000

300,000

16,000

Percentage Taxes Payable

Bonds Payable, due allay 2022

3,000,000

Discount on Bonds Payable

60,000

Compute total current liabilities on December 31, 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning