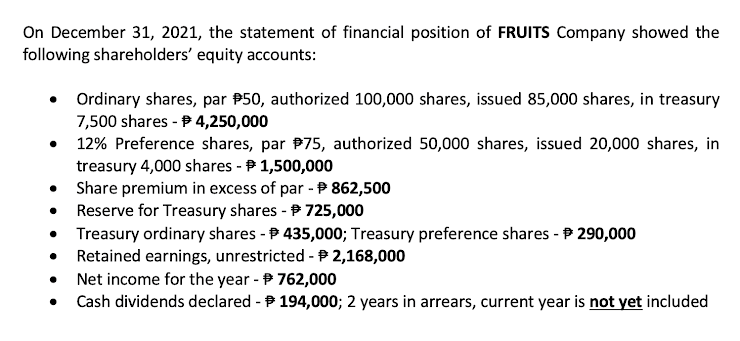

On December 31, 2021, the statement of financial position of FRUITS Company showed the following shareholders' equity accounts: • Ordinary shares, par P50, authorized 100,000 shares, issued 85,000 shares, in treasury 7,500 shares - P 4,250,000 • 12% Preference shares, par P75, authorized 50,000 shares, issued 20,000 shares, in treasury 4,000 shares - P 1,500,000 • Share premium in excess of par - P 862,500 Reserve for Treasury shares - P 725,000 Treasury ordinary shares - P 435,000; Treasury preference shares - P 290,000 Retained earnings, unrestricted - P 2,168,000 Net income for the year - P 762,000 Cash dividends declared - P 194,000; 2 years in arrears, current year is not yet included

On December 31, 2021, the statement of financial position of FRUITS Company showed the following shareholders' equity accounts: • Ordinary shares, par P50, authorized 100,000 shares, issued 85,000 shares, in treasury 7,500 shares - P 4,250,000 • 12% Preference shares, par P75, authorized 50,000 shares, issued 20,000 shares, in treasury 4,000 shares - P 1,500,000 • Share premium in excess of par - P 862,500 Reserve for Treasury shares - P 725,000 Treasury ordinary shares - P 435,000; Treasury preference shares - P 290,000 Retained earnings, unrestricted - P 2,168,000 Net income for the year - P 762,000 Cash dividends declared - P 194,000; 2 years in arrears, current year is not yet included

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter10: Stockholder's Equity

Section: Chapter Questions

Problem 81PSA

Related questions

Question

1. How much is the

2. . How much is the dividend allocation for ORDINARY shareholders considering -

Transcribed Image Text:On December 31, 2021, the statement of financial position of FRUITS Company showed the

following shareholders' equity accounts:

• Ordinary shares, par P50, authorized 100,000 shares, issued 85,000 shares, in treasury

7,500 shares - P 4,250,000

12% Preference shares, par P75, authorized 50,000 shares, issued 20,000 shares, in

treasury 4,000 shares - P 1,500,000

Share premium in excess of par - P 862,500

Reserve for Treasury shares - P 725,000

Treasury ordinary shares - P 435,000; Treasury preference shares - P 290,000

Retained earnings, unrestricted -P 2,168,000

Net income for the year - P 762,000

Cash dividends declared - P 194,000; 2 years in arrears, current year is not yet included

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning