On Feb06, Mr Shrinivas wanted to starts a business. So he decided to start usiness on Agro seeds. He decided to move on with agro seeds as he had an 8 yea experience in private agro seeds business firm. He resisted to mention the firm name. He decided to invest 10,00,000. He got the amount from different sources. He fi eceived 3,00,000 from his father Mr Kanisk from his savings on 27th Feb, 2013. applied for a bank loan on February 10 2013 and submitted the necessary documents. State Bank of India. He got an amount of 2,50,000 from his fixed deposit on March. 2013. le opened a bank account in State Bank of India with the name of "Golden agro seed. le deposited an amount of 5,00,000 and kept the other 50,000 as cash in hands March 2nd 2013. On March 11, 2013 the bank loan was sanctioned and an amount of 3,50,000 was transfer to his account .he borrowed 73,000 from Mr Jayaprakash on Mar 5, 2013 by promising him to pay an amount of t 7300 for 10 months and an interest. % per month for the total principal amount. He took a small loan for the remaining capi f 27,000 from Mr Ritesh on March 16, 2013, it was interest free and he had to pay within December 15, 2013 that is he had to pay t 3,000 every month. Mr K Sriniv vithdrew t50,000 from the bank account on March 17, 2013. On March 17, 2013 he has

On Feb06, Mr Shrinivas wanted to starts a business. So he decided to start usiness on Agro seeds. He decided to move on with agro seeds as he had an 8 yea experience in private agro seeds business firm. He resisted to mention the firm name. He decided to invest 10,00,000. He got the amount from different sources. He fi eceived 3,00,000 from his father Mr Kanisk from his savings on 27th Feb, 2013. applied for a bank loan on February 10 2013 and submitted the necessary documents. State Bank of India. He got an amount of 2,50,000 from his fixed deposit on March. 2013. le opened a bank account in State Bank of India with the name of "Golden agro seed. le deposited an amount of 5,00,000 and kept the other 50,000 as cash in hands March 2nd 2013. On March 11, 2013 the bank loan was sanctioned and an amount of 3,50,000 was transfer to his account .he borrowed 73,000 from Mr Jayaprakash on Mar 5, 2013 by promising him to pay an amount of t 7300 for 10 months and an interest. % per month for the total principal amount. He took a small loan for the remaining capi f 27,000 from Mr Ritesh on March 16, 2013, it was interest free and he had to pay within December 15, 2013 that is he had to pay t 3,000 every month. Mr K Sriniv vithdrew t50,000 from the bank account on March 17, 2013. On March 17, 2013 he has

Chapter9: Acquisitions Of Property

Section: Chapter Questions

Problem 51P

Related questions

Question

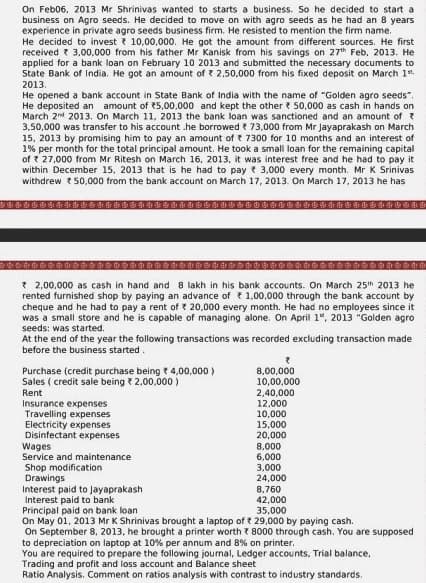

Transcribed Image Text:On Feb06, 2013 Mr Shrinivas wanted to starts a business. So he decided to start a

business on Agro seeds. He decided to move on with agro seeds as he had an 8 years

experience in private agro seeds business firm. He resisted to mention the firm name.

He decided to invest 10,00,000. He got the amount from different sources. He first

received 3,00,000 from his father Mr Kanisk from his savings on 27th Feb, 2013. He

applied for a bank loan on February 10 2013 and submitted the necessary documents to

State Bank of India. He got an amount of 2,50,000 from his fixed deposit on March 1st.

2013.

He opened a bank account in State Bank of India with the name of "Golden agro seeds".

He deposited an amount of 5,00,000 and kept the other 50,000 as cash in hands on

March 2nd 2013. On March 11, 2013 the bank loan was sanctioned and an amount of ?

3,50,000 was transfer to his account he borrowed * 73,000 from Mr Jayaprakash on March

15, 2013 by promising him to pay an amount of 7300 for 10 months and an interest of

1% per month for the total principal amount. He took a small loan for the remaining capital

of 27,000 from Mr Ritesh on March 16, 2013, it was interest free and he had to pay it

within December 15, 2013 that is he had to pay 3,000 every month. Mr K Srinivas

withdrew 50,000 from the bank account on March 17, 2013. On March 17, 2013 he has

ÞÜÜÜÜÜÜÜÜDDDDDDDDDDDDDDDDDÊÈRÐËÛÛÐÐÒÈÐÒË056663360000

* 2,00,000 as cash in hand and 8 lakh in his bank accounts. On March 25th 2013 he

rented furnished shop by paying an advance of 1,00,000 through the bank account by

cheque and he had to pay a rent of * 20,000 every month. He had no employees since it

was a small store and he is capable of managing alone. On April 1, 2013 "Golden agro

seeds: was started.

At the end of the year the following transactions was recorded excluding transaction made

before the business started.

z

Purchase (credit purchase being * 4,00,000)

Sales ( credit sale being * 2,00,000)

Rent

8,00,000

10,00,000

2,40,000

Insurance expenses

12,000

Travelling expenses

10,000

Electricity expenses

15,000

Disinfectant expenses

20,000

Wages

8,000

Service and maintenance

6,000

Shop modification

3,000

Drawings

24,000

Interest paid to Jayaprakash

8.760

Interest paid to bank

42,000

Principal paid on bank loan

35,000

On May 01, 2013 Mr K Shrinivas brought a laptop of * 29,000 by paying cash.

On September 8, 2013, he brought a printer worth 8000 through cash. You are supposed

to depreciation on laptop at 10% per annum and 8% on printer.

You are required to prepare the following journal, Ledger accounts, Trial balance,

Trading and profit and loss account and Balance sheet

Ratio Analysis. Comment on ratios analysis with contrast to industry standards.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you