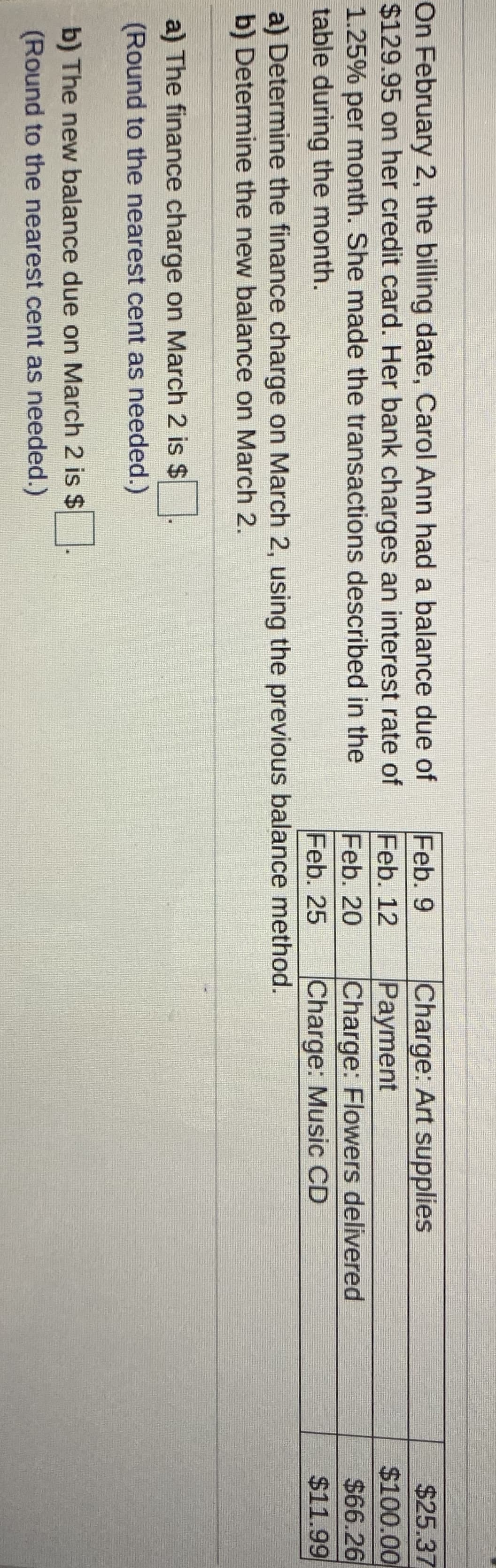

On February 2, the billing date, Carol Ann had a balance due of $129.95 on her credit card. Her bank charges an interest rate of 1.25% per month. She made the transactions described in the table during the month. Feb. 9 Feb. 12 Feb. 20 Feb. 25 a) Determine the finance charge on March 2, using the previous balance method. Charge: Art supplies Payment Charge: Flowers delivered Charge: Music CD $25.37 $100.00 $66.26 $11.99 b) Determine the new balance on March 2. a) The finance charge on March 2 is $ (Round to the nearest cent as needed.) b) The new balance due on March 2 is $ (Round to the nearest cent as needed.)

On February 2, the billing date, Carol Ann had a balance due of $129.95 on her credit card. Her bank charges an interest rate of 1.25% per month. She made the transactions described in the table during the month. Feb. 9 Feb. 12 Feb. 20 Feb. 25 a) Determine the finance charge on March 2, using the previous balance method. Charge: Art supplies Payment Charge: Flowers delivered Charge: Music CD $25.37 $100.00 $66.26 $11.99 b) Determine the new balance on March 2. a) The finance charge on March 2 is $ (Round to the nearest cent as needed.) b) The new balance due on March 2 is $ (Round to the nearest cent as needed.)

Chapter7: Credit Cards And Consumer Loans

Section: Chapter Questions

Problem 3DTM

Related questions

Question

Transcribed Image Text:On February 2, the billing date, Carol Ann had a balance due of

$129.95 on her credit card. Her bank charges an interest rate of

1.25% per month. She made the transactions described in the

table during the month.

Feb. 9

Feb. 12

Feb. 20

Feb. 25

a) Determine the finance charge on March 2, using the previous balance method.

Charge: Art supplies

Payment

Charge: Flowers delivered

Charge: Music CD

$25.37

$100.00

$66.26

$11.99

b) Determine the new balance on March 2.

a) The finance charge on March 2 is $

(Round to the nearest cent as needed.)

b) The new balance due on March 2 is $

(Round to the nearest cent as needed.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage