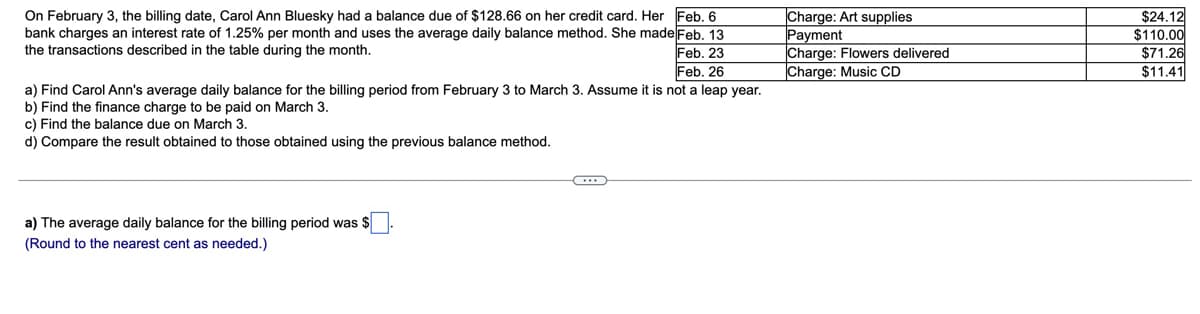

On February 3, the billing date, Carol Ann Bluesky had a balance due of $128.66 on her credit card. Her Feb. 6 bank charges an interest rate of 1.25% per month and uses the average daily balance method. She made Feb. 13 Feb. 23 Feb. 26 Charge: Art supplies Payment Charge: Flowers delivered |Charge: Music CD $24.12 $110.00 $71.26 $11.41 the transactions described in the table during the month. a) Find Carol Ann's average daily balance for the billing period from February 3 to March 3. Assume it is not a leap year. b) Find the finance charge to be paid on March 3. c) Find the balance due on March 3. d) Compare the result obtained to those obtained using the previous balance method. a) The average daily balance for the billing period was $ (Round to the nearest cent as needed.)

On February 3, the billing date, Carol Ann Bluesky had a balance due of $128.66 on her credit card. Her Feb. 6 bank charges an interest rate of 1.25% per month and uses the average daily balance method. She made Feb. 13 Feb. 23 Feb. 26 Charge: Art supplies Payment Charge: Flowers delivered |Charge: Music CD $24.12 $110.00 $71.26 $11.41 the transactions described in the table during the month. a) Find Carol Ann's average daily balance for the billing period from February 3 to March 3. Assume it is not a leap year. b) Find the finance charge to be paid on March 3. c) Find the balance due on March 3. d) Compare the result obtained to those obtained using the previous balance method. a) The average daily balance for the billing period was $ (Round to the nearest cent as needed.)

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 12EA: Scrimiger Paints wants to upgrade its machinery and on September 20 takes out a loan from the bank...

Related questions

Question

12)

Transcribed Image Text:On February 3, the billing date, Carol Ann Bluesky had a balance due of $128.66 on her credit card. Her Feb. 6

bank charges an interest rate of 1.25% per month and uses the average daily balance method. She made Feb. 13

Feb. 23

Feb. 26

a) Find Carol Ann's average daily balance for the billing period from February 3 to March 3. Assume it is not a leap year.

|Charge: Art supplies

Payment

Charge: Flowers delivered

Charge: Music CD

$24.12

$110.00

$71.26

$11.41

the transactions described in the table during the month.

b) Find the finance charge to be paid on March 3.

c) Find the balance due on March 3.

d) Compare the result obtained to those obtained using the previous balance method.

a) The average daily balance for the billing period was $

(Round to the nearest cent as needed.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub