Using the following General Journal activity sheets, record the above transaction of CCS for the month of December, 2020. December 1 transaction was done for your example on how to record

Using the following General Journal activity sheets, record the above transaction of CCS for the month of December, 2020. December 1 transaction was done for your example on how to record

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter6: Cash And Internal Control

Section: Chapter Questions

Problem 6.4MCP

Related questions

Question

Make a general journal of the following problem below

(Charts of accounts and transactions are provided)

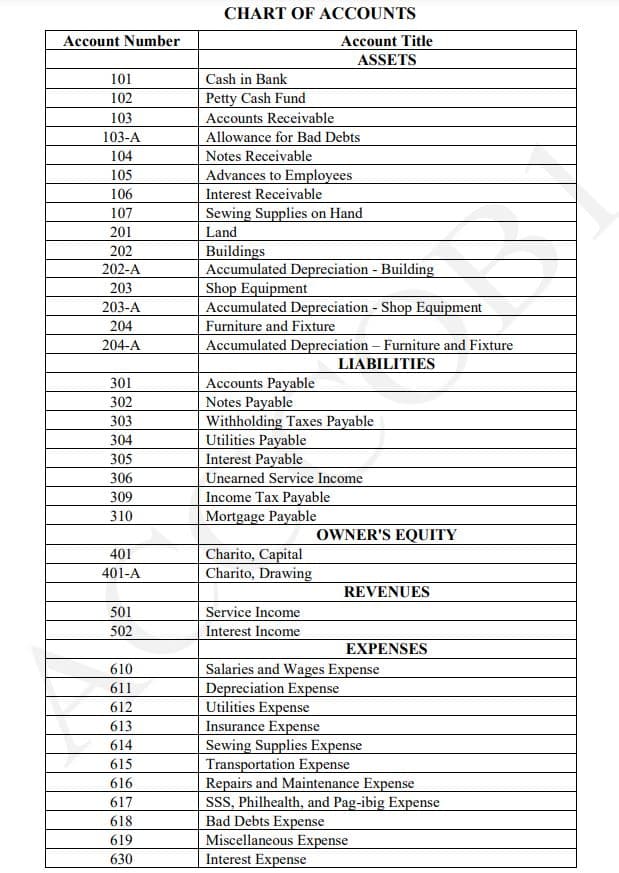

Transcribed Image Text:CHART OF ACCOUNTS

Account Number

Account Title

ASSETS

101

Cash in Bank

Petty Cash Fund

Accounts Receivable

102

103

103-A

Allowance for Bad Debts

Notes Receivable

Advances to Employees

Interest Receivable

Sewing Supplies on Hand

104

105

106

107

201

Land

202

Buildings

Accumulated Depreciation - Building

Shop Equipment

Accumulated Depreciation - Shop Equipment

Furniture and Fixture

Accumulated Depreciation- Furniture and Fixture

202-A

203

203-A

204

204-A

LIABILITIES

Accounts Payable

Notes Payable

Withholding Taxes Payable

Utilities Payable

Interest Payable

Unearned Service Income

Income Tax Payable

Mortgage Payable

301

302

303

304

305

306

309

310

OWNER'S EQUITY

Charito, Capital

Charito, Drawing

401

401-A

REVENUES

Service Income

Interest Income

501

502

EXPENSES

Salaries and Wages Expense

Depreciation Expense

Utilities Expense

Insurance Expense

Sewing Supplies Expense

Transportation Expense

Repairs and Maintenance Expense

SSS, Philhealth, and Pag-ibig Expense

Bad Debts Expense

Miscellaneous Expense

Interest Expense

610

611

612

613

614

615

616

617

618

619

630

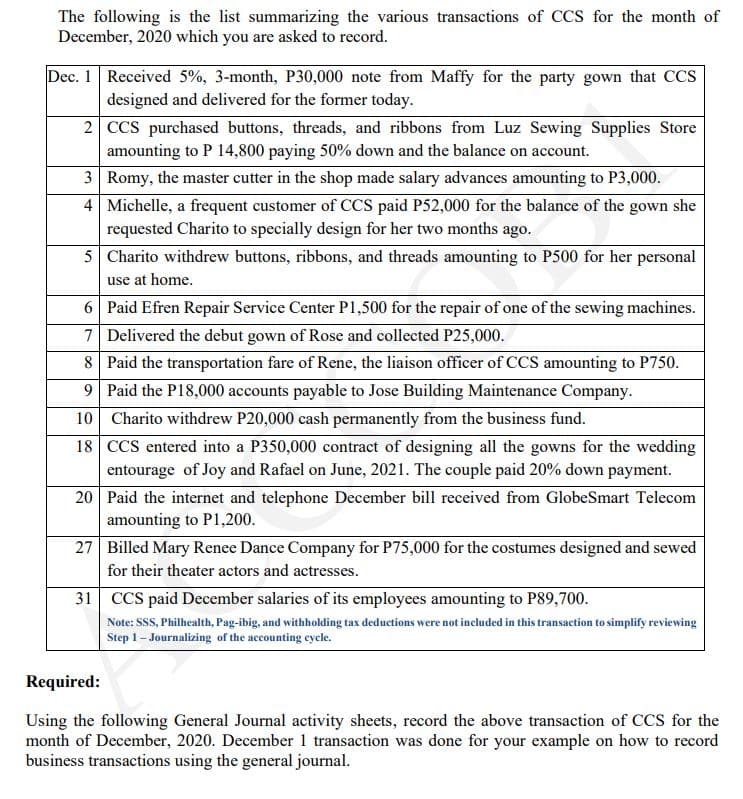

Transcribed Image Text:The following is the list summarizing the various transactions of CCS for the month of

December, 2020 which you are asked to record.

Dec. 1 Received 5%, 3-month, P30,000 note from Maffy for the party gown that CCs

designed and delivered for the former today.

2 CCS purchased buttons, threads, and ribbons from Luz Sewing Supplies Store

amounting to P 14,800 paying 50% down and the balance on account.

3 Romy, the master cutter in the shop made salary advances amounting to P3,000.

4 Michelle, a frequent customer of CCS paid P52,000 for the balance of the gown she

requested Charito to specially design for her two months ago.

5 Charito withdrew buttons, ribbons, and threads amounting to P500 for her personal

use at home.

6 Paid Efren Repair Service Center P1,500 for the repair of one of the sewing machines.

7 Delivered the debut gown of Rose and collected P25,000.

8 Paid the transportation fare of Rene, the liaison officer of CCS amounting to P750.

9 Paid the P18,000 accounts payable to Jose Building Maintenance Company.

10 Charito withdrew P20,000 cash permanently from the business fund.

18 CCS entered into a P350,000 contract of designing all the gowns for the wedding

entourage of Joy and Rafael on June, 2021. The couple paid 20% down payment.

20 Paid the internet and telephone December bill received from GlobeSmart Telecom

amounting to P1,200.

27 Billed Mary Renee Dance Company for P75,000 for the costumes designed and sewed

for their theater actors and actresses.

31 CCS paid December salaries of its employees amounting to P89,700.

Note: SSS, Philhealth, Pag-ibig, and withholding tax deductions were not included in this transaction to simplify reviewing

Step 1– Journalizing of the accounting cycle.

Required:

Using the following General Journal activity sheets, record the above transaction of CCS for the

month of December, 2020. December 1 transaction was done for your example on how to record

business transactions using the general journal.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning