2020 2021 Total P 3,000,000 P4,000,000 P 7,000,000 Net Income Gross Profit from Upstream Sales (2020 – 30% remain unsold, 2021 - 40% remain unsold as of their respective years but sold in the subsequent) 200,000 100,000 P300,000 Dividends Declared P 2,000,000 P 2,500,000 P 6,500,000 P 20,000,000 P 20,000,000 Share Capital, Ordinary Shares Share Capital, 8% Cumulative, Nonparticipating Preference Shares Total Share Capital 4,000,000 P20,000,000 P24,000,000 -0-

2020 2021 Total P 3,000,000 P4,000,000 P 7,000,000 Net Income Gross Profit from Upstream Sales (2020 – 30% remain unsold, 2021 - 40% remain unsold as of their respective years but sold in the subsequent) 200,000 100,000 P300,000 Dividends Declared P 2,000,000 P 2,500,000 P 6,500,000 P 20,000,000 P 20,000,000 Share Capital, Ordinary Shares Share Capital, 8% Cumulative, Nonparticipating Preference Shares Total Share Capital 4,000,000 P20,000,000 P24,000,000 -0-

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter2: Financial Statements, Cash Flow,and Taxes

Section: Chapter Questions

Problem 21SP: Begin with the partial model in the file Ch02 P21 Build a Model.xlsx on the textbooks Web site. a....

Related questions

Question

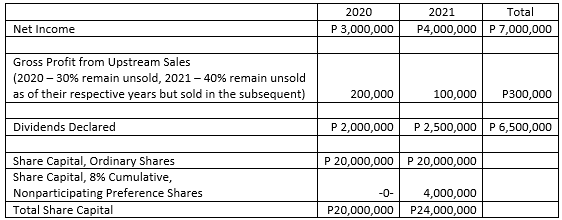

On Jan. 1, 2020, ABC bought 250,000 shares of XYZ Corporation for P8,000,000. All 1,000,000 P20-par shares of XYZ were issued and outstanding. The net assets were valued at P32,000,000 but they were carried in the accounting books at P30,000,000. The difference is attributable to an equipment that has a useful life of 4 years. Details relating to XYZ for the years 2020 and 2021 are as follows:

What is the balance of the Investment in Associate as of Dec. 31, 2021?

Transcribed Image Text:2020

2021

Total

P 3,000,000

P4,000,000 P 7,000,000

Net Income

Gross Profit from Upstream Sales

(2020 – 30% remain unsold, 2021 – 40% remain unsold

as of their respective years but sold in the subsequent)

200,000

100,000

P300,000

Dividends Declared

P 2,000,000

P 2,500,000 P 6,500,000

P 20,000,000 P 20,000,000

Share Capital, Ordinary Shares

Share Capital, 8% Cumulative,

Nonparticipating Preference Shares

Total Share Capital

-0-

4,000,000

P20,000,000

P24,000,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you