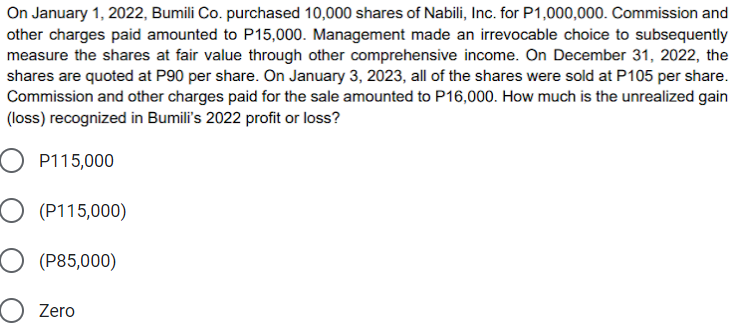

On January 1, 2022, Bumili Co. purchased 10,000 shares of Nabili, Inc. for P1,000,000. Commission and other charges paid amounted to P15,000. Management made an irrevocable choice to subsequently measure the shares at fair value through other comprehensive income. On December 31, 2022, the shares are quoted at P90 per share. On January 3, 2023, all of the shares were sold at P105 per share. Commission and other charges paid for the sale amounted to P16,000. How much is the unrealized gain (loss) recognized in Bumili's 2022 profit or loss? O P115,000 Ɔ (P115,000) (P85,000) Zero

On January 1, 2022, Bumili Co. purchased 10,000 shares of Nabili, Inc. for P1,000,000. Commission and other charges paid amounted to P15,000. Management made an irrevocable choice to subsequently measure the shares at fair value through other comprehensive income. On December 31, 2022, the shares are quoted at P90 per share. On January 3, 2023, all of the shares were sold at P105 per share. Commission and other charges paid for the sale amounted to P16,000. How much is the unrealized gain (loss) recognized in Bumili's 2022 profit or loss? O P115,000 Ɔ (P115,000) (P85,000) Zero

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter15: Investments And Fair Value Accounting

Section: Chapter Questions

Problem 28E

Related questions

Question

Transcribed Image Text:On January 1, 2022, Bumili Co. purchased 10,000 shares of Nabili, Inc. for P1,000,000. Commission and

other charges paid amounted to P15,000. Management made an irrevocable choice to subsequently

measure the shares at fair value through other comprehensive income. On December 31, 2022, the

shares are quoted at P90 per share. On January 3, 2023, all of the shares were sold at P105 per share.

Commission and other charges paid for the sale amounted to P16,000. How much is the unrealized gain

(loss) recognized in Bumili's 2022 profit or loss?

P115,000

O (P115,000)

O (P85,000)

Zero

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT