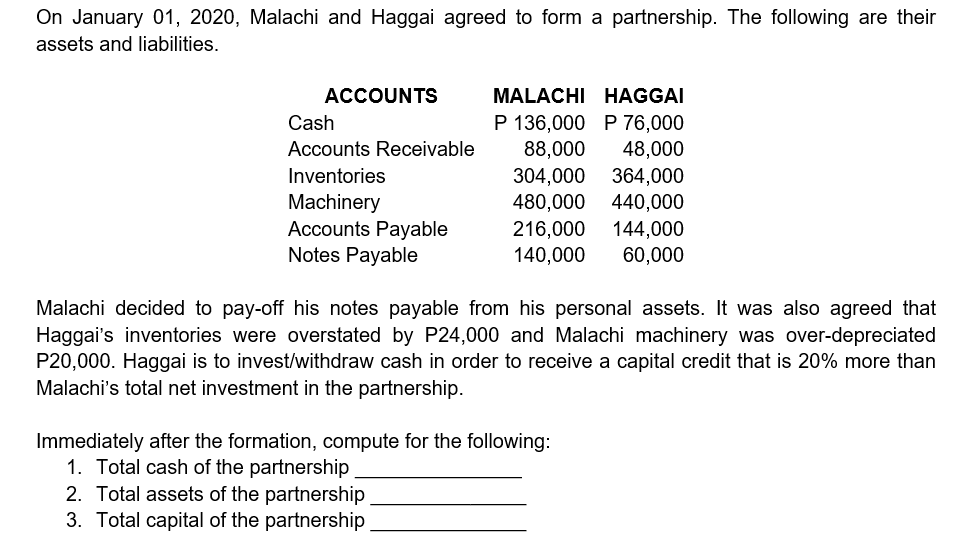

On January 01, 2020, Malachi and Haggai agreed to form a partnership. The following are their assets and liabilities. ACCOUNTS MALACHI HAGGAI P 136,000 P 76,000 48,000 Cash Accounts Receivable 88,000 304,000 364,000 480,000 Inventories Machinery Accounts Payable Notes Payable 440,000 144,000 216,000 140,000 60,000 Malachi decided to pay-off his notes payable from his personal assets. It was also agreed that Haggai's inventories were overstated by P24,000 and Malachi machinery was over-depreciated P20,000. Haggai is to invest/withdraw cash in order to receive a capital credit that is 20% more than Malachi's total net investment in the partnership. Immediately after the formation, compute for the following: 1. Total cash of the partnership 2. Total assets of the partnership 3. Total capital of the partnership

On January 01, 2020, Malachi and Haggai agreed to form a partnership. The following are their assets and liabilities. ACCOUNTS MALACHI HAGGAI P 136,000 P 76,000 48,000 Cash Accounts Receivable 88,000 304,000 364,000 480,000 Inventories Machinery Accounts Payable Notes Payable 440,000 144,000 216,000 140,000 60,000 Malachi decided to pay-off his notes payable from his personal assets. It was also agreed that Haggai's inventories were overstated by P24,000 and Malachi machinery was over-depreciated P20,000. Haggai is to invest/withdraw cash in order to receive a capital credit that is 20% more than Malachi's total net investment in the partnership. Immediately after the formation, compute for the following: 1. Total cash of the partnership 2. Total assets of the partnership 3. Total capital of the partnership

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter23: Accounting For Partnerships

Section: Chapter Questions

Problem 3AP

Related questions

Question

Transcribed Image Text:On January 01, 2020, Malachi and Haggai agreed to form a partnership. The following are their

assets and liabilities.

ACCOUNTS

MALACHI HAGGAI

P 136,000 P 76,000

48,000

Cash

Accounts Receivable

88,000

304,000 364,000

480,000

Inventories

Machinery

Accounts Payable

Notes Payable

440,000

144,000

216,000

140,000

60,000

Malachi decided to pay-off his notes payable from his personal assets. It was also agreed that

Haggai's inventories were overstated by P24,000 and Malachi machinery was over-depreciated

P20,000. Haggai is to invest/withdraw cash in order to receive a capital credit that is 20% more than

Malachi's total net investment in the partnership.

Immediately after the formation, compute for the following:

1. Total cash of the partnership

2. Total assets of the partnership

3. Total capital of the partnership

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT