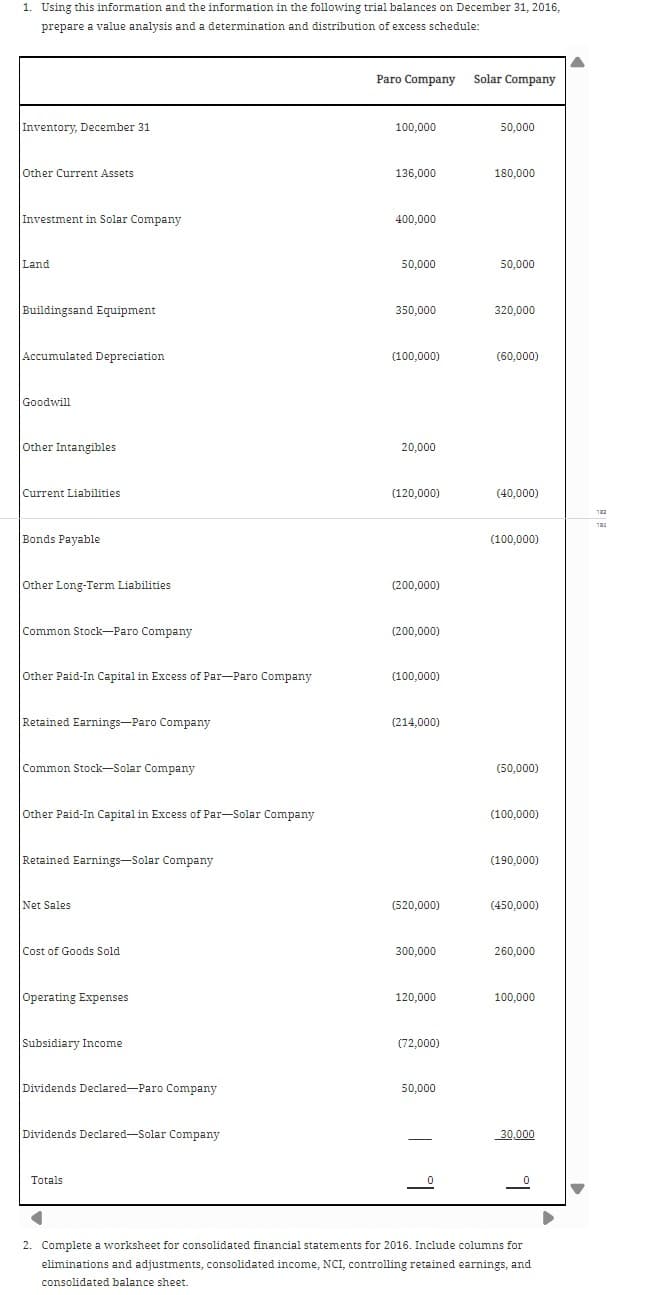

1. Using this information and the information in the following trial balances on December 31, 2016, prepare a value analysis and a determination and distribution of excess schedule: Inventory, December 31 Other Current Assets Paro Company Solar Company 100,000 50,000 136,000 180,000 Investment in Solar Company 400,000 Land 50,000 50,000 Buildingsand Equipment 350,000 320,000 Accumulated Depreciation (100,000) (60,000) Goodwill Other Intangibles Current Liabilities Bonds Payable Other Long-Term Liabilities 20,000 (120,000) (40,000) (200,000) Common Stock-Paro Company (200,000) Other Paid-In Capital in Excess of Par-Paro Company (100,000) Retained Earnings-Paro Company (214,000) Common Stock-Solar Company Other Paid-In Capital in Excess of Par-Solar Company Retained Earnings-Solar Company Net Sales Cost of Goods Sold Operating Expenses (100,000) (50,000) (100,000) (190,000) (520,000) (450,000) 300,000 260,000 120,000 100,000 Subsidiary Income (72,000) Dividends Declared-Paro Company 50,000 Dividends Declared-Solar Company Totals 30,000 2. Complete a worksheet for consolidated financial statements for 2016. Include columns for eliminations and adjustments, consolidated income, NCI, controlling retained earnings, and consolidated balance sheet. On January 1, 2015, Paro Company purchases 80% of the common stock of Solar Company for $320,000. Solar has common stock, other paid-in capital in excess of par, and retained earnings of $50,000, $100,000, and $150,000, respectively. Net income and dividends for two years for Solar are as follows: Net income Dividends 2015 2016 $60,000 $90,000 20,000 30,000 On January 1, 2015, the only undervalued tangible assets of Solar are inventory and the building. Inventory, for which FIFO is used, is worth $10,000 more than cost. The inventory is sold in 2015. The building, which is worth $30,000 more than book value, has a remaining life of 10 years, and straight-line depreciation is used. The remaining excess of cost over book value is attributed to goodwill.

1. Using this information and the information in the following trial balances on December 31, 2016, prepare a value analysis and a determination and distribution of excess schedule: Inventory, December 31 Other Current Assets Paro Company Solar Company 100,000 50,000 136,000 180,000 Investment in Solar Company 400,000 Land 50,000 50,000 Buildingsand Equipment 350,000 320,000 Accumulated Depreciation (100,000) (60,000) Goodwill Other Intangibles Current Liabilities Bonds Payable Other Long-Term Liabilities 20,000 (120,000) (40,000) (200,000) Common Stock-Paro Company (200,000) Other Paid-In Capital in Excess of Par-Paro Company (100,000) Retained Earnings-Paro Company (214,000) Common Stock-Solar Company Other Paid-In Capital in Excess of Par-Solar Company Retained Earnings-Solar Company Net Sales Cost of Goods Sold Operating Expenses (100,000) (50,000) (100,000) (190,000) (520,000) (450,000) 300,000 260,000 120,000 100,000 Subsidiary Income (72,000) Dividends Declared-Paro Company 50,000 Dividends Declared-Solar Company Totals 30,000 2. Complete a worksheet for consolidated financial statements for 2016. Include columns for eliminations and adjustments, consolidated income, NCI, controlling retained earnings, and consolidated balance sheet. On January 1, 2015, Paro Company purchases 80% of the common stock of Solar Company for $320,000. Solar has common stock, other paid-in capital in excess of par, and retained earnings of $50,000, $100,000, and $150,000, respectively. Net income and dividends for two years for Solar are as follows: Net income Dividends 2015 2016 $60,000 $90,000 20,000 30,000 On January 1, 2015, the only undervalued tangible assets of Solar are inventory and the building. Inventory, for which FIFO is used, is worth $10,000 more than cost. The inventory is sold in 2015. The building, which is worth $30,000 more than book value, has a remaining life of 10 years, and straight-line depreciation is used. The remaining excess of cost over book value is attributed to goodwill.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 14RE

Related questions

Question

Complete the following

Acquired Company's Balance Sheet Before Purchase

Amortization Schedule

Income Distribution Schedules

Consolidated worksheet

eliminations

Transcribed Image Text:1. Using this information and the information in the following trial balances on December 31, 2016,

prepare a value analysis and a determination and distribution of excess schedule:

Inventory, December 31

Other Current Assets

Paro Company Solar Company

100,000

50,000

136,000

180,000

Investment in Solar Company

400,000

Land

50,000

50,000

Buildingsand Equipment

350,000

320,000

Accumulated Depreciation

(100,000)

(60,000)

Goodwill

Other Intangibles

Current Liabilities

Bonds Payable

Other Long-Term Liabilities

20,000

(120,000)

(40,000)

(200,000)

Common Stock-Paro Company

(200,000)

Other Paid-In Capital in Excess of Par-Paro Company

(100,000)

Retained Earnings-Paro Company

(214,000)

Common Stock-Solar Company

Other Paid-In Capital in Excess of Par-Solar Company

Retained Earnings-Solar Company

Net Sales

Cost of Goods Sold

Operating Expenses

(100,000)

(50,000)

(100,000)

(190,000)

(520,000)

(450,000)

300,000

260,000

120,000

100,000

Subsidiary Income

(72,000)

Dividends Declared-Paro Company

50,000

Dividends Declared-Solar Company

Totals

30,000

2. Complete a worksheet for consolidated financial statements for 2016. Include columns for

eliminations and adjustments, consolidated income, NCI, controlling retained earnings, and

consolidated balance sheet.

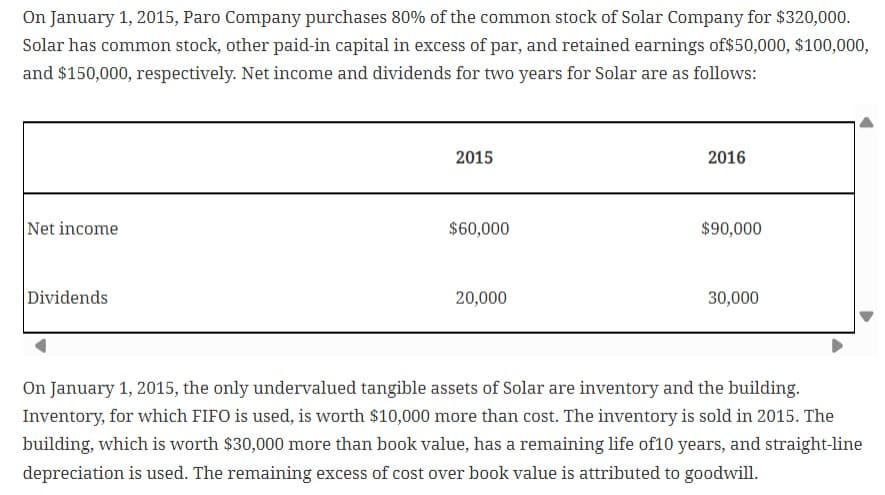

Transcribed Image Text:On January 1, 2015, Paro Company purchases 80% of the common stock of Solar Company for $320,000.

Solar has common stock, other paid-in capital in excess of par, and retained earnings of $50,000, $100,000,

and $150,000, respectively. Net income and dividends for two years for Solar are as follows:

Net income

Dividends

2015

2016

$60,000

$90,000

20,000

30,000

On January 1, 2015, the only undervalued tangible assets of Solar are inventory and the building.

Inventory, for which FIFO is used, is worth $10,000 more than cost. The inventory is sold in 2015. The

building, which is worth $30,000 more than book value, has a remaining life of 10 years, and straight-line

depreciation is used. The remaining excess of cost over book value is attributed to goodwill.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning