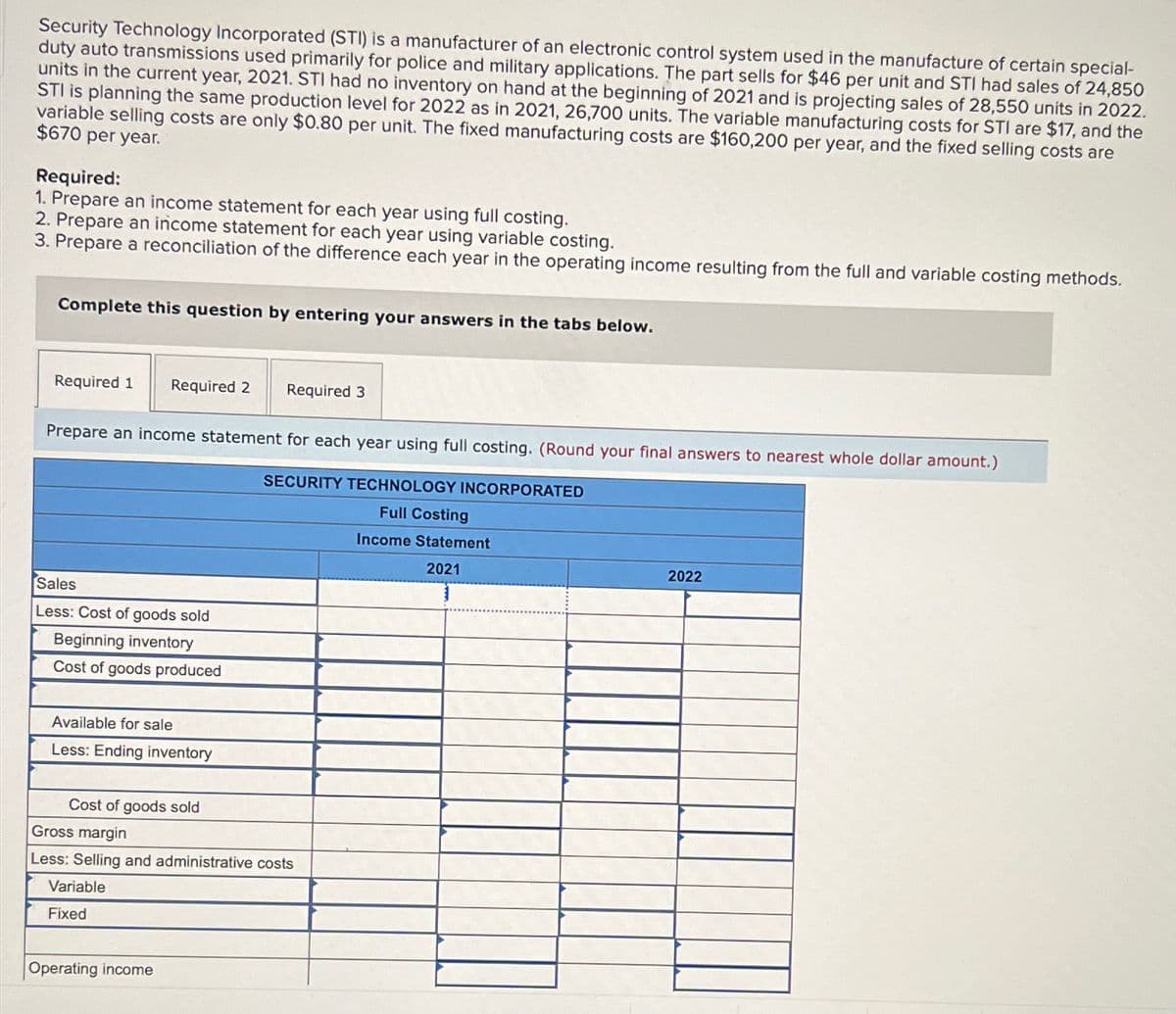

Security Technology Incorporated (STI) is a manufacturer of an electronic control system used in the manufacture of certain special- duty auto transmissions used primarily for police and military applications. The part sells for $46 per unit and STI had sales of 24,850 units in the current year, 2021. STI had no inventory on hand at the beginning of 2021 and is projecting sales of 28,550 units in 2022. STI is planning the same production level for 2022 as in 2021, 26,700 units. The variable manufacturing costs for STI are $17, and the variable selling costs are only $0.80 per unit. The fixed manufacturing costs are $160,200 per year, and the fixed selling costs are $670 per year. Required: 1. Prepare an income statement for each year using full costing. 2. Prepare an income statement for each year using variable costing. 3. Prepare a reconciliation of the difference each year in the operating income resulting from the full and variable costing methods. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare an income statement for each year using full costing. (Round your final answers to nearest whole dollar amount.) SECURITY TECHNOLOGY INCORPORATED Full Costing Sales Less: Cost of goods sold Beginning inventory Cost of goods produced Available for sale Less: Ending inventory Cost of goods sold Gross margin Less: Selling and administrative costs Variable Fixed Operating income Income Statement 2021 2022

Security Technology Incorporated (STI) is a manufacturer of an electronic control system used in the manufacture of certain special- duty auto transmissions used primarily for police and military applications. The part sells for $46 per unit and STI had sales of 24,850 units in the current year, 2021. STI had no inventory on hand at the beginning of 2021 and is projecting sales of 28,550 units in 2022. STI is planning the same production level for 2022 as in 2021, 26,700 units. The variable manufacturing costs for STI are $17, and the variable selling costs are only $0.80 per unit. The fixed manufacturing costs are $160,200 per year, and the fixed selling costs are $670 per year. Required: 1. Prepare an income statement for each year using full costing. 2. Prepare an income statement for each year using variable costing. 3. Prepare a reconciliation of the difference each year in the operating income resulting from the full and variable costing methods. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare an income statement for each year using full costing. (Round your final answers to nearest whole dollar amount.) SECURITY TECHNOLOGY INCORPORATED Full Costing Sales Less: Cost of goods sold Beginning inventory Cost of goods produced Available for sale Less: Ending inventory Cost of goods sold Gross margin Less: Selling and administrative costs Variable Fixed Operating income Income Statement 2021 2022

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter20: Inventory Management: Economic Order Quantity, Jit, And The Theory Of Constraints

Section: Chapter Questions

Problem 7E: Ottis, Inc., uses 640,000 plastic housing units each year in its production of paper shredders. The...

Related questions

Question

Transcribed Image Text:Security Technology Incorporated (STI) is a manufacturer of an electronic control system used in the manufacture of certain special-

duty auto transmissions used primarily for police and military applications. The part sells for $46 per unit and STI had sales of 24,850

units in the current year, 2021. STI had no inventory on hand at the beginning of 2021 and is projecting sales of 28,550 units in 2022.

STI is planning the same production level for 2022 as in 2021, 26,700 units. The variable manufacturing costs for STI are $17, and the

variable selling costs are only $0.80 per unit. The fixed manufacturing costs are $160,200 per year, and the fixed selling costs are

$670 per year.

Required:

1. Prepare an income statement for each year using full costing.

2. Prepare an income statement for each year using variable costing.

3. Prepare a reconciliation of the difference each year in the operating income resulting from the full and variable costing methods.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Required 3

Prepare an income statement for each year using full costing. (Round your final answers to nearest whole dollar amount.)

SECURITY TECHNOLOGY INCORPORATED

Full Costing

Sales

Less: Cost of goods sold

Beginning inventory

Cost of goods produced

Available for sale

Less: Ending inventory

Cost of goods sold

Gross margin

Less: Selling and administrative costs

Variable

Fixed

Operating income

Income Statement

2021

2022

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning