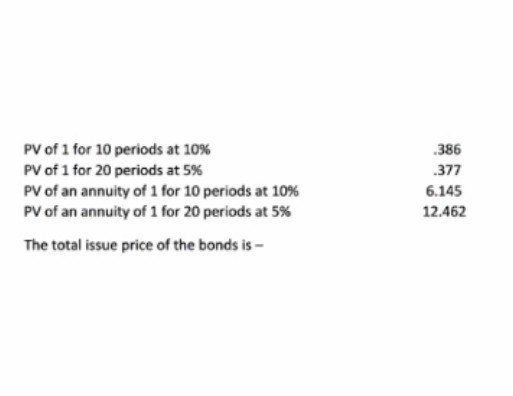

On January 1, 2016, Blue Company issued ten-year bonds with a face value of P 1,000,000 and a stated interest rate of 8% per year payable semi-annually every July 1 and January 1. The bonds were sold to yield 10%. Present value factors are as follows: Answer this with solution pls

Q: ba

A: Annual depreciation = (Cost of the assets - residual value)life of the assets = (P22,000,000 - 2,00...

Q: Given that the closing work-in-progress of a process is 400 units, which is 100% complete with regar...

A: For calculating equivalent units, we will need to use below formula. Equivalent unit for material = ...

Q: 26 The process of measuring, monitoring, and minimizing prevention, appraisal, internal failure, and...

A: Prevention cost is amount of expense incurred to reduce defects in products and services.

Q: The best time to tell guests that alcohol service will be stopped is when they order another drink. ...

A: The best time to tell guests that alcohol service will be stopped: Answer Option b:when their last d...

Q: transfer some land that I own into the company's name, and that will beef up our balance sheet. Garr...

A: Here discuss about the fundamental accounting principles which was used for the preparation of the f...

Q: Blossom Leasing Company agrees to lease equipment to Blue Corporation on January 1, 2020. The follow...

A: A journal entry is a form of accounting entry that is used to report a business transaction in a com...

Q: Dow Deep Mining Co acquired mineral rights for $56,000,000. The mineral deposit is estimated at 70,0...

A: Depletion rate per ton = 0.8 Depletion expense = 14,560,000

Q: Allen Inc. took out a 1-year, 8%, $100,000 loan on March 31, 2018. Interest is due upon maturity of ...

A: Formula: Interest expense = Loan Amount x Interest rate x Time period

Q: x, Inc. uses the following information when preparing their flexible budget: direct materials of $2 ...

A: Solution: flexible budget is the budget which represents budgeted costs at difference sales volume l...

Q: The mid-month convention applies to...

A: The mid-month convention states that all fixed asset acquisitions are assumed to have been purchased...

Q: Blossom Leasing Company agrees to lease equipment to Blue Corporation on January 1, 2020. The follow...

A: calculation of lease liability are as follows

Q: ales $910,000 oss on sale of equipment $8,000 Cost of goods sold $495,000 Operating expense $175,000...

A: Solution: Net sales is the sales reduced by sales returns and allowances. Operating income is arrive...

Q: Blaze Corporation allocates overhead on the basis of DLH and the standard amount per allocation base...

A: Solution 1: Standard overhead rate = (Budgeted variable overhead + Budgeted fixed overhead) / DLH = ...

Q: The company purchased a computer system at a cost of $100,000. The estimated useful life is 4 years,...

A: Since you have asked multiple question, we will solve the first question for you. If you want any sp...

Q: A draw bench for precision forming and strengthening of carbon steel tubing has a cost of $950,000. ...

A: Solution Depreciation represents how much assets value has been reduced. It is applicable on tangibl...

Q: 1 Adoption of a just-in-time inventory system: O Is based on a demand push theory O Provides an accu...

A: In case of multiple questions, we are allowed to solve only the first question. If you want other qu...

Q: do family firms need audit ? explain what do we mean by auditors considering various risks related...

A: According to the size of company, volume of transactions and style of functioning the management can...

Q: See below. I just need help with the red box with the 20,000 answer in it. It came back as incorrect...

A: As you have asked for help on the red box only so I'm explaining on that only. Please see Step 2 for...

Q: On January 1, 2021, Family Company purchased 10% of San Company's 100,000 outstanding ordinary share...

A: Total income includes any increase in value of investment and share of dividend received.

Q: Sheffield Steel Company, as lessee, signed a lease agreement for equipment for 5 years, beginning De...

A: Right-of-Use Asset: The right-of-use asset is a renter's on the whole correct to utilize a resource ...

Q: cash and the other 50% will be on credit when 80% of receivables are expected to pay in the month af...

A: A sales receipt is a record of a transaction delivered by a seller at the time of sale to verify the...

Q: GameGirl, Incorporated, has the following transactions during August. August 6 Sold 60 handheld g...

A: In this question, we prepare Prepare the transactions for Game Girl, Incorporated, assuming the comp...

Q: 22. SecuriPrint Ltd produces pre-printed cheques for customers to use in automated account payable d...

A: Selling Price=Cost+Profit

Q: Given the building layout for Store A, Store B, Store C, and Store D, what portion of the shared $60...

A: Cost that would be apportioned to a particular store can be calculated as: = Total cost * area of th...

Q: Mega Corporation, a domestic corporation, deposited P1,000,000 in a 7-year time deposit with BPI whi...

A: Amount deposited = 1000000 7 years Time Deposit Rate of interest 7% ( annual Interest)

Q: Required: 1-a. Compute cost of goods sold under the FIFO, LIFO, and average cost inventory costing m...

A: Under FIFO Method, units which comes in first will be sold first and the inventory will be out of th...

Q: Required: 1. Prepare a schedule of expected cash collections from sales, by month and in total, for ...

A: Sales will be realized as follows: 25% in the month of sale; 60% in the following month and 15% in t...

Q: Carla Vista Company has the following information available for September 2020. Unit selling pric...

A: Cost Volume Profit Analysis - Cost Volume Profit is the method of computing operating profit by bifu...

Q: SecuriPrint Ltd produces pre-printed cheques for customers to use in automated account payable depar...

A:

Q: Why is there a need for a change in the structure of the International Accounting Standards Committe...

A: IAS Committee (IASC) was set up in 1973 for bringing harmonization to the accounting process around ...

Q: Kirk Company purchased equipment by making a down payment of P400,000 and issuing a note payable for...

A: Capitalized cost of the equipment = Down payment + Present value of Note + Shipping charges + Instal...

Q: SBD Phone Company sells its waterproof phone case for $90 per unit. Fixed costs total $151,200, and ...

A: Contribution margin per unit = sales per unit - Variable cost per unit = $90-$36.=$54 Break even poi...

Q: A company authorize 400,000, $100 par value, 5% cumulative preferred stock. Calculate the issued 500...

A: The value of the preferred stock can be calculated by multiplying the number of preferred shares by ...

Q: Focus company accounts for its 10% interest in Bee Company using the cost method. This investment wa...

A: The carrying amount of investment on the last date of the period is the sum total of the investment ...

Q: A) A Parent Company acquired 60% equity interest in a subsidiary company for £440 million. The Marke...

A: Lets understand the basics. For calculating goodwill through proportionate share in net assets then ...

Q: What is the amount of total Assets to report on the Balance Sheet for Pack Compa

A: Introduction:- Assets includes the following as follows under:- Current assets Non-current assets I...

Q: Evaluate three accounting system controls.

A: A set of interconnected accounting operations and controls is referred to as an accounting system. A...

Q: A draw bench for precision forming and strengthening of carbon steel tubing has a cost of S950,000. ...

A: Formula: Straight line method depreciation = ( Asset cost - Salvage value ) / Useful life years

Q: 1. Compute the overall effect of these transactions on the store's reported income for 20X5. 2. Why ...

A: Adjustment entries are those entries which are made by the accountant or the accounts officer at the...

Q: If the value of the clothing allowance voucher during the year amounted to 1,500,00O

A: Value of clothing allowance is not taxable. Exempt from tax . Then whole amount is nontaxable.

Q: pany purchased a computer that cost $10,000, It had an estimated useful life of 5 years and no resid...

A: Under straight line depreciation method, annual depreciation is based on useful life in years. Book ...

Q: At the beginning of Year 1, Copeland Drugstore purchased a new computer system for $170,000. It is e...

A: Formula: Straight line method depreciation = ( Asset cost - Salvage value ) / Useful life

Q: The management of Russel Ltd. is trying to decide whether it can increase its c During the current y...

A:

Q: Citricacid plc budgets during its first year of operations to produce and sell 38,160 litres of prod...

A: The profit is calculated as difference between sales revenue and total costs.

Q: On July 1, 2014, Acting Company established an imprest (petty Cash) fund in the amount of $800.00 in...

A: Imprest (Petty Cash) System is an accounting system that is created for tracking and documenting how...

Q: DEFINE AND INDICATE TYPES OF DUMPING.

A: Dumping: Dumping refers to the reduced price of the products at which price the exporters exports go...

Q: Zen Company prepares a monthly master budget. Data for the July master budget are given below. The J...

A: Working:

Q: *see attached What amount of interest income should be recognized by Ripple for the year ended Dece...

A: Lease means giving out the assets by lessor to lessee to use that assets in return of rent. Financia...

Q: Candlemania, Inc. is a maker of scented candles in decorative containers. During 2020, the company s...

A: Answer:- Candlemani...

Q: 1. If the sum of P12,000.00 is deposited in an account earning interest rate of 9% compounded quarte...

A: This pertains to compound interest. Compound interest accrues on both the initial principal as well ...

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- A three year bond has 8.1% compound rate and face value of P1000. If the yield to maturity on the bond is 10%, calculate the price of the bond assuming that the bond makes semi-annual compound interest payments. Use 5 decimal places for the PV factor. Answer Format: 111.11A $300,000, ten year, 8% bond issue was sold to yield 9% interest payable annually. Actuarial information for 10 periods as follows: These bonds sold at A $300,000, ten year, 8% bond issue was sold to yield 9% interest payable annually. Actuarial information for 10 periods as follows: These bonds sold at A:at par B:a discount C:a premium a marginIssue Price The following terms relate to independent bond issues: 500 bonds; $1,000 face value; 8% stated rate; 5 years; annual interest payments 500 bonds; $1,000 face value; 8% stated rate; 5 years; semiannual interest payments 820 bonds; $1,000 face value; 8% stated rate; 10 years; semiannual interest payments 1,900 bonds; $500 face value; 12% stated rate; 15 years; semiannual interest payments Use the appropriate present value table: PV of $1 and PV of Annuity of $1 Required: Assuming the market rate of interest is 10%, calculate the selling price for each bond issue. If required, round your intermediate calculations and final answers to the nearest dollar. Need C. & D. help. Situation Selling Price of the Bond Issue a. $462090 b. $461390 c. $fill in the blank 3 d. $fill in the blank 4

- Bond A is a 15-year, 10.50% semiannual-pay bond priced with a yield to maturity of 8.00%, while Bond B is a 15-year, 7.35% semiannual-pay bond priced with the same yield to maturity. Given that both bonds have par values of $1,000, the prices of these two bonds would be: Bond A Bond B A. $1,216.15 $944.67 B. $1,216.15 $913.54 C. $746.61 $913.54Issue Price The following terms relate to independent bond issues: 420 bonds; $1,000 face value; 8% stated rate; 5 years; annual interest payments 420 bonds; $1,000 face value; 8% stated rate; 5 years; semiannual interest payments 780 bonds; $1,000 face value; 8% stated rate; 10 years; semiannual interest payments 1,900 bonds; $500 face value; 12% stated rate; 15 years; semiannual interest payments Use the appropriate present value table: PV of $1 and PV of Annuity of $1 Required: Assuming the market rate of interest is 10%, calculate the selling price for each bond issue. If required, round your intermediate calculations and final answers to the nearest dollar. Situation Selling Price of the Bond Issue a. $ b. $ c. $ d. $A P1000.00, 6-year, 12% bond is offered with a premium of P80.00. If interest is payable semi-annually, determine a) the current yield; (Ans. 11.11%) b) the yield to maturity. (Ans. 10.44%)

- Issue Price The following terms relate to independent bond issues: 420 bonds; $1,000 face value; 8% stated rate; 5 years; annual interest payments 420 bonds; $1,000 face value; 8% stated rate; 5 years; semiannual interest payments 780 bonds; $1,000 face value; 8% stated rate; 10 years; semiannual interest payments 1,900 bonds; $500 face value; 12% stated rate; 15 years; semiannual interest payments Use the appropriate present value table: PV of $1 and PV of Annuity of $1A P10, 000.00, 8-year, 7% bond that pays interest semi-annually is offered at 5% discount. Determine its redemption price if an investor is to realize a yield of 10% semi-annually. (Ans. P12 457.19)Issue Price The following terms relate to independent bond issues: 530 bonds; $1,000 face value; 8% stated rate; 5 years; annual interest payments 530 bonds; $1,000 face value; 8% stated rate; 5 years; semiannual interest payments 780 bonds; $1,000 face value; 8% stated rate; 10 years; semiannual interest payments 2,070 bonds; $500 face value; 12% stated rate; 15 years; semiannual interest payments Use the appropriate present value table: PV of $1 and PV of Annuity of $1 Required: Assuming the market rate of interest is 10%, calculate the selling price for each bond issue. If required, round your intermediate calculations and final answers to the nearest dollar. Situation Selling Price of the Bond Issue a. $fill in the blank 1 b. $fill in the blank 2 c. $fill in the blank 3 d. $fill in the blank 4

- A P 1,000,000 issue of 3%, 15-year bond was sold at 95%. What is the rate ofinterest of this investment?· A. 3.0%· B. 3.4%· C. 3.7%· D. 4.0%The following terms relate to independent bond issues: 460 bonds; $1,000 face value; 8% stated rate; 5 years; annual interest payments 460 bonds; $1,000 face value; 8% stated rate; 5 years; semiannual interest payments 830 bonds; $1,000 face value; 8% stated rate; 10 years; semiannual interest payments 1,890 bonds; $500 face value; 12% stated rate; 15 years; semiannual interest payments Use the appropriate present value table: PV of $1 and PV of Annuity of $1 Required: Assuming the market rate of interest is 10%, calculate the selling price for each bond issue. If required, round your intermediate calculations and final answers to the nearest dollar.A P10 000.00, 5-year, 10% bond is offered with a discount of P250.00. If the bond pays interest quarterly, find a) the current yield; (Ans. 10.26%) b) the yield to maturity. (Ans. 11.07%)