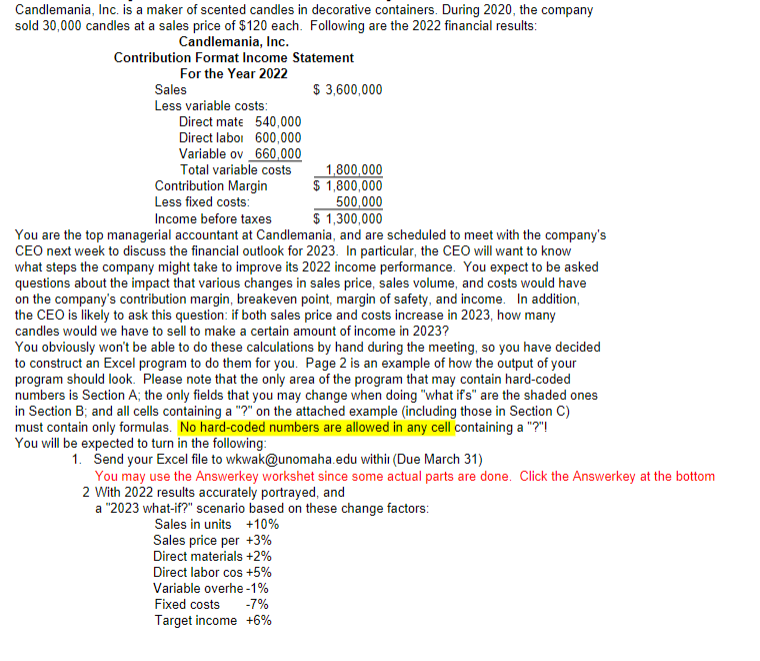

Candlemania, Inc. is a maker of scented candles in decorative containers. During 2020, the company sold 30,000 candles at a sales price of $120 each. Following are the 2022 financial results: Candlemania, Inc. Contribution Format Income Statement For the Year 2022 Sales Less variable costs: $ 3,600,000 Direct mate 540,000 Direct laboi 600,000 Variable ov 660,000 Total variable costs Contribution Margin Less fixed costs: 1,800,000 $ 1,800,000 500,000 $ 1,300,000 Income before taxes You are the top managerial accountant at Candlemania, and are scheduled to meet with the company's CEO next week to discuss the financial outlook for 2023. In particular, the CEO will want to know what steps the company might take to improve its 2022 income performance. You expect to be asked questions about the impact that various changes in sales price, sales volume, and costs would have on the company's contribution margin, breakeven point, margin of safety, and income. In addition, the CEO is likely to ask this question: if both sales price and costs increase in 2023, how many candles would we have to sell to make a certain amount of income in 2023? You obviously won't be able to do these calculations by hand during the meeting, so you have decided to construct an Excel program to do them for you. Page 2 is an example of how the output of your program should look. Please note that the only area of the program that may contain hard-coded numbers is Section A; the only fields that you may change when doing "what ifs" are the shaded ones in Section B; and all cells containing a "?" on the attached example (including those in Section C) must contain only formulas. No hard-coded numbers are allowed in any cell containing a "?"! You will be expected to turn in the following: 1. Šend your Excel file to wkwak@unomaha.edu withi (Due March 31) You may use the Answerkey workshet since some actual parts are done. Click the Answerkey at the bottom 2 With 2022 results accurately portrayed, and a "2023 what-if?" scenario based on these change factors: Sales in units +10% Sales price per +3% Direct materials +2% Direct labor cos +5% Variable overhe -1% Fixed costs -7% Target income +6%

Candlemania, Inc. is a maker of scented candles in decorative containers. During 2020, the company sold 30,000 candles at a sales price of $120 each. Following are the 2022 financial results: Candlemania, Inc. Contribution Format Income Statement For the Year 2022 Sales Less variable costs: $ 3,600,000 Direct mate 540,000 Direct laboi 600,000 Variable ov 660,000 Total variable costs Contribution Margin Less fixed costs: 1,800,000 $ 1,800,000 500,000 $ 1,300,000 Income before taxes You are the top managerial accountant at Candlemania, and are scheduled to meet with the company's CEO next week to discuss the financial outlook for 2023. In particular, the CEO will want to know what steps the company might take to improve its 2022 income performance. You expect to be asked questions about the impact that various changes in sales price, sales volume, and costs would have on the company's contribution margin, breakeven point, margin of safety, and income. In addition, the CEO is likely to ask this question: if both sales price and costs increase in 2023, how many candles would we have to sell to make a certain amount of income in 2023? You obviously won't be able to do these calculations by hand during the meeting, so you have decided to construct an Excel program to do them for you. Page 2 is an example of how the output of your program should look. Please note that the only area of the program that may contain hard-coded numbers is Section A; the only fields that you may change when doing "what ifs" are the shaded ones in Section B; and all cells containing a "?" on the attached example (including those in Section C) must contain only formulas. No hard-coded numbers are allowed in any cell containing a "?"! You will be expected to turn in the following: 1. Šend your Excel file to wkwak@unomaha.edu withi (Due March 31) You may use the Answerkey workshet since some actual parts are done. Click the Answerkey at the bottom 2 With 2022 results accurately portrayed, and a "2023 what-if?" scenario based on these change factors: Sales in units +10% Sales price per +3% Direct materials +2% Direct labor cos +5% Variable overhe -1% Fixed costs -7% Target income +6%

Chapter2: Building Blocks Of Managerial Accounting

Section: Chapter Questions

Problem 9EA: The cost data for Evencoat Paint for the year 2019 is as follows: Using the high-low method, express...

Related questions

Question

Transcribed Image Text:Candlemania, Inc. is a maker of scented candles in decorative containers. During 2020, the company

sold 30,000 candles at a sales price of $120 each. Following are the 2022 financial results:

Candlemania, Inc.

Contribution Format Income Statement

For the Year 2022

$ 3,600,000

Sales

Less variable costs:

Direct mate 540,000

Direct laboi 600,000

Variable ov 660,000

Total variable costs

Contribution Margin

Less fixed costs:

1,800,000

$ 1,800,000

500,000

$ 1,300,000

Income before taxes

You are the top managerial accountant at Candlemania, and are scheduled to meet with the company's

CEO next week to discuss the financial outlook for 2023. In particular, the CEO will want to know

what steps the company might take to improve its 2022 income performance. You expect to be asked

questions about the impact that various changes in sales price, sales volume, and costs would have

on the company's contribution margin, breakeven point, margin of safety, and income. In addition,

the CEO is likely to ask this question: if both sales price and costs increase in 2023, how many

candles would we have to sell to make a certain amount of income in 2023?

You obviously won't be able to do these calculations by hand during the meeting, so you have decided

to construct an Excel program to do them for you. Page 2 is an example of how the output of your

program should look. Please note that the only area of the program that may contain hard-coded

numbers is Section A; the only fields that you may change when doing "what if's" are the shaded ones

in Section B; and all cells containing a "?" on the attached example (including those in Section C)

must contain only formulas. No hard-coded numbers are allowed in any cell containing a "?"!

You will be expected to turn in the following:

1. Send your Excel file to wkwak@unomaha.edu withi (Due March 31)

You may use the Answerkey workshet since some actual parts are done. Click the Answerkey at the bottom

2 With 2022 results accurately portrayed, and

a "2023 what-if?" scenario based on these change factors:

Sales in units +10%

Sales price per +3%

Direct materials +2%

Direct labor cos +5%

Variable overhe -1%

Fixed costs

-7%

Target income +6%

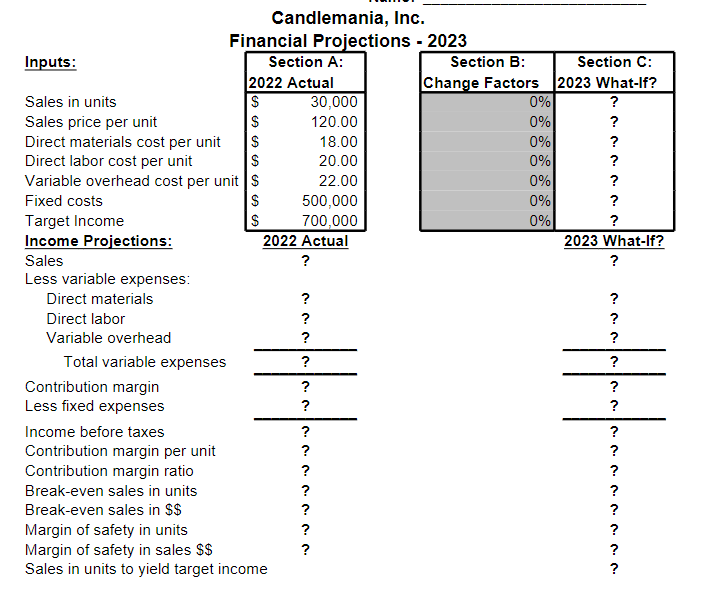

Transcribed Image Text:Candlemania, Inc.

Financial Projections - 2023

Section C:

Change Factors 2023 What-If?

?

Inputs:

Section A:

Section B:

2022 Actual

30,000

0%

0%

0%

0%

0%

0%

0%

2023 What-If?

Sales in units

$

Sales price per unit

Direct materials cost per unit

Direct labor cost per unit

Variable overhead cost per unit s

120.00

?

|s

18.00

?

20.00

?

22.00

?

Fixed costs

500,000

?

Target Income

Income Projections:

S

700,000

?

2022 Actual

Sales

?

?

Less variable expenses:

Direct materials

?

?

Direct labor

?

?

Variable overhead

?

?

Total variable expenses

?

?

Contribution margin

Less fixed expenses

?

?

?

Income before taxes

?

?

Contribution margin per unit

Contribution margin ratio

?

?

?

Break-even sales in units

?

?

Break-even sales in $$

Margin of safety in units

Margin of safety in sales $$

Sales in units to yield target income

?

?

?

?

?

?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning