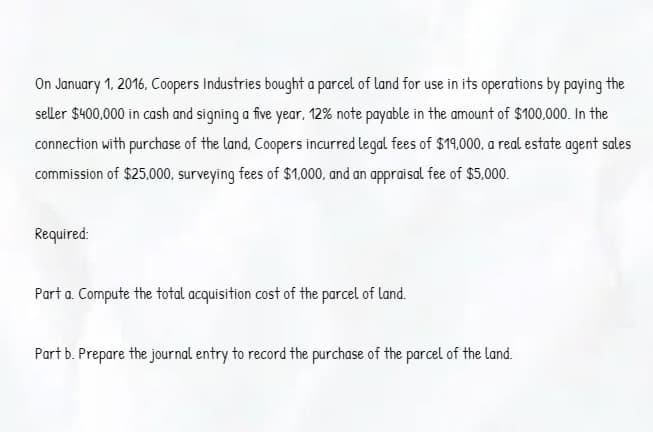

On January 1, 2016, Coopers Industries bought a parcel of land for use in its operations by paying the seller $400,000 in cash and signing a five year, 12% note payable in the amount of $100,000. In the connection with purchase of the land, Coopers incurred legal fees of $19,000, a real estate agent sales commission of $25,000, surveying fees of $1,000, and an appraisal fee of $5,000. Required: Part a. Compute the total acquisition cost of the parcel of land. Part b. Prepare the journal entry to record the purchase of the parcel of the land.

On January 1, 2016, Coopers Industries bought a parcel of land for use in its operations by paying the seller $400,000 in cash and signing a five year, 12% note payable in the amount of $100,000. In the connection with purchase of the land, Coopers incurred legal fees of $19,000, a real estate agent sales commission of $25,000, surveying fees of $1,000, and an appraisal fee of $5,000. Required: Part a. Compute the total acquisition cost of the parcel of land. Part b. Prepare the journal entry to record the purchase of the parcel of the land.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 11E: On January 1, 2014, Klinefelter Company purchased a building for 520,000. The building had an...

Related questions

Question

100%

Solve in 45 min

Transcribed Image Text:On January 1, 2016, Coopers Industries bought a parcel of land for use in its operations by paying the

seller $400,000 in cash and signing a five year, 12% note payable in the amount of $100,000. In the

connection with purchase of the land, Coopers incurred legal fees of $19,000, a real estate agent sales

commission of $25,000, surveying fees of $1,000, and an appraisal fee of $5,000.

Required:

Part a. Compute the total acquisition cost of the parcel of land.

Part b. Prepare the journal entry to record the purchase of the parcel of the land.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning