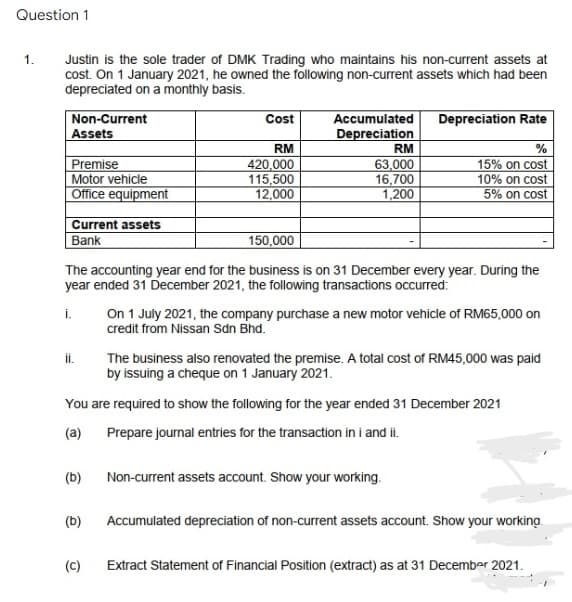

Question 1 1. Justin is the sole trader of DMK Trading who maintains his non-current assets at cost. On 1 January 2021, he owned the following non-current assets which had been depreciated on a monthly basis. Non-Current Cost Accumulated Depreciation Rate Assets Depreciation RM RM % Premise 420,000 63,000 15% on cost 115,500 16,700 10% on cost Motor vehicle Office equipment 12,000 1,200 5% on cost Current assets Bank 150,000 The accounting year end for the business is on 31 December every year. During the year ended 31 December 2021, the following transactions occurred: i. On 1 July 2021, the company purchase a new motor vehicle of RM65,000 on credit from Nissan Sdn Bhd. II. The business also renovated the premise. A total cost of RM45,000 was paid by issuing a cheque on 1 January 2021. You are required to show the following for the year ended 31 December 2021 Prepare journal entries for the transaction in i and ii. (a) (b) Non-current assets account. Show your working. (b) Accumulated depreciation of non-current assets account. Show your working (C) Extract Statement of Financial Position (extract) as at 31 December 2021.

Question 1 1. Justin is the sole trader of DMK Trading who maintains his non-current assets at cost. On 1 January 2021, he owned the following non-current assets which had been depreciated on a monthly basis. Non-Current Cost Accumulated Depreciation Rate Assets Depreciation RM RM % Premise 420,000 63,000 15% on cost 115,500 16,700 10% on cost Motor vehicle Office equipment 12,000 1,200 5% on cost Current assets Bank 150,000 The accounting year end for the business is on 31 December every year. During the year ended 31 December 2021, the following transactions occurred: i. On 1 July 2021, the company purchase a new motor vehicle of RM65,000 on credit from Nissan Sdn Bhd. II. The business also renovated the premise. A total cost of RM45,000 was paid by issuing a cheque on 1 January 2021. You are required to show the following for the year ended 31 December 2021 Prepare journal entries for the transaction in i and ii. (a) (b) Non-current assets account. Show your working. (b) Accumulated depreciation of non-current assets account. Show your working (C) Extract Statement of Financial Position (extract) as at 31 December 2021.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 23E

Related questions

Question

Transcribed Image Text:Question 1

1.

Justin is the sole trader of DMK Trading who maintains his non-current assets at

cost. On 1 January 2021, he owned the following non-current assets which had been

depreciated on a monthly basis.

Non-Current

Cost

Accumulated

Depreciation Rate

Assets

Depreciation

RM

RM

%

Premise

420,000

63,000

15% on cost

Motor vehicle

115,500

16,700

10% on cost

Office equipment

12,000

1,200

5% on cost

Current assets

Bank

150,000

The accounting year end for the business is on 31 December every year. During the

year ended 31 December 2021, the following transactions occurred:

i.

On 1 July 2021, the company purchase a new motor vehicle of RM65,000 on

credit from Nissan Sdn Bhd.

ii.

The business also renovated the premise. A total cost of RM45,000 was paid

by issuing a cheque on 1 January 2021.

You are required to show the following for the year ended 31 December 2021

Prepare journal entries for the transaction in i and ii.

(a)

(b)

Non-current assets account. Show your working.

(b)

Accumulated depreciation of non-current assets account. Show your working

(C)

Extract Statement of Financial Position (extract) as at 31 December 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning