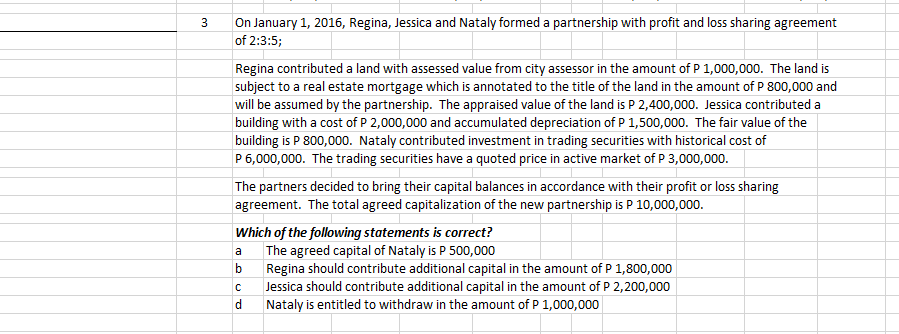

On January 1, 2016, Regina, Jessica and Nataly formed a partnership with profit and loss sharing agreement | of 2:3:5; Regina contributed a land with assessed value from city assessor in the amount of P 1,000,000. The land is subject to a real estate mortgage which is annotated to the title of the land in the amount of P 800,000 and will be assumed by the partnership. The appraised value of the land is P 2,400,000. Jessica contributed a |building with a cost of P 2,000,000 and accumulated depreciation of P 1,500,000. The fair value of the |building is P 800,000. Nataly contributed investment in trading securities with historical cost of P 6,000,000. The trading securities have a quoted price in active market of P 3,000,000. The partners decided to bring their capital balances in accordance with their profit or loss sharing | agreement. The total agreed capitalization of the new partnership is P 10,000,000. Which of the following statements is correct? The agreed capital of Nataly is P 500,000 b Regina should contribute additional capital in the amount of P 1,800,000 Jessica should contribute additional capital in the amount of P 2,200,000 d a Nataly is entitled to withdraw in the amount of P 1,000,000

On January 1, 2016, Regina, Jessica and Nataly formed a partnership with profit and loss sharing agreement | of 2:3:5; Regina contributed a land with assessed value from city assessor in the amount of P 1,000,000. The land is subject to a real estate mortgage which is annotated to the title of the land in the amount of P 800,000 and will be assumed by the partnership. The appraised value of the land is P 2,400,000. Jessica contributed a |building with a cost of P 2,000,000 and accumulated depreciation of P 1,500,000. The fair value of the |building is P 800,000. Nataly contributed investment in trading securities with historical cost of P 6,000,000. The trading securities have a quoted price in active market of P 3,000,000. The partners decided to bring their capital balances in accordance with their profit or loss sharing | agreement. The total agreed capitalization of the new partnership is P 10,000,000. Which of the following statements is correct? The agreed capital of Nataly is P 500,000 b Regina should contribute additional capital in the amount of P 1,800,000 Jessica should contribute additional capital in the amount of P 2,200,000 d a Nataly is entitled to withdraw in the amount of P 1,000,000

Chapter20: Corporations And Parterships

Section: Chapter Questions

Problem 55P

Related questions

Question

100%

kindly answer the no. 3 thnk you

Transcribed Image Text:On January 1, 2016, Regina, Jessica and Nataly formed a partnership with profit and loss sharing agreement

of 2:3:5;

Regina contributed a land with assessed value from city assessor in the amount of P 1,000,000. The land is

subject to a real estate mortgage which is annotated to the title of the land in the amount of P 800,000 and

will be assumed by the partnership. The appraised value of the land is P 2,400,000. Jessica contributed a

|building with a cost of P 2,000,000 and accumulated depreciation of P 1,500,000. The fair value of the

|building is P 800,000. Nataly contributed investment in trading securities with historical cost of

P 6,000,000. The trading securities have a quoted price in active market of P 3,000,000.

The partners decided to bring their capital balances in accordance with their profit or loss sharing

agreement. The total agreed capitalization of the new partnership is P 10,000,000.

Which of the following statements is correct?

The agreed capital of Nataly is P 500,000

Regina should contribute additional capital in the amount of P 1,800,000

Jessica should contribute additional capital in the amount of P 2,200,000

Nataly is entitled to withdraw in the amount of P 1,000,000

a

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT