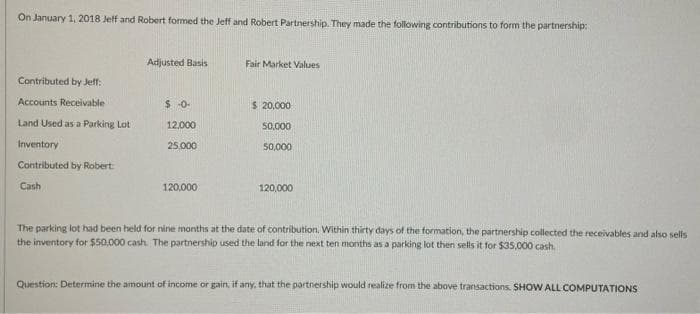

On January 1, 2018 Jeff and Robert formed the Jeff and Robert Partnership. They made the following contributions to form the partnership: Adjusted Basis Fair Market Values Contributed by Jeff: Accounts Receivable $-0 $ 20,000 Land Used as a Parking Lot 12,000 50,000 Inventory 25.000 50,000 Contributed by Robert Cash 120,000 120,000 The parking lot had been held for nine months at the date of contribution. Within thirty days of the formation, the partnership collected the receivables and also sells the inventory for $50,000 cash. The partnership used the land for the next ten months as a parking lot then sells it for $35,000 cash. Question: Determine the amount of income or gain, if any, that the partnership would realize from the above transactions. SHOW ALL COMPUTATIONS

On January 1, 2018 Jeff and Robert formed the Jeff and Robert Partnership. They made the following contributions to form the partnership: Adjusted Basis Fair Market Values Contributed by Jeff: Accounts Receivable $-0 $ 20,000 Land Used as a Parking Lot 12,000 50,000 Inventory 25.000 50,000 Contributed by Robert Cash 120,000 120,000 The parking lot had been held for nine months at the date of contribution. Within thirty days of the formation, the partnership collected the receivables and also sells the inventory for $50,000 cash. The partnership used the land for the next ten months as a parking lot then sells it for $35,000 cash. Question: Determine the amount of income or gain, if any, that the partnership would realize from the above transactions. SHOW ALL COMPUTATIONS

Chapter21: Partnerships

Section: Chapter Questions

Problem 2BCRQ

Related questions

Question

Transcribed Image Text:On January 1, 2018 Jeff and Robert formed the Jeff and Robert Partnership. They made the following contributions to form the partnership:

Adjusted Basis

Fair Market Values

Contributed by Jeff:

Accounts Receivable

$ 0-

$ 20,000

Land Used as a Parking Lot

12,000

50,000

Inventory

25,000

50,000

Contributed by Robert

Cash

120,000

120,000

The parking lot had been held for nine months at the date of contribution. Within thirty days of the formation,

the inventory for $50,000 cash. The partnership used the land for the next ten months as a parking lot then sells it for $35,000 cash.

partnership collected the receivables and also sells

Question: Determine the amount of income or gain, if any, that the partnership would realize from the above transactions. SHOW ALL COMPUTATIONS

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning