On January 1, 2017, Concord SA had Accounts Receivable €107,920 and Allowance for Doubtful Accounts €6,500. Concord prepares financial statements annually at December 31. During the year, the following selected transactions occurred. Sold €7,500 of merchandise to Patrick Co., terms n/30. Accepted Jan. 5 Feb. 2 €7,500, 4-month, 5% promissory note from Patrick for the balance due. an Sold €10,200 of merchandise to Marguerite SA and accepted Marguerite's €10,200, 2-month, 7% note for the balance due. Sold €5,600 of merchandise to Felton Co., terms n/10. 12 26 Apr. 5 Accepted a €5,600, 3-month, 9% note from Felton Co. for the balance due. 12 Collected Marguerite note in full. June 2 Collected Patrick note in full. July 5 Felton Co. dishonors its note of April 5. It is expected that Felton will eventually pay the amount owed. Sold €8,000 of merchandise to Planke Co. and accepted Planke's €8,000, 3-month, 7% note for the amount due. Planke Co.'s note was dishonored. Planke Co. is bankrupt, and there is no hope of future settlement. 15 Oct. 15 Journalize the transactions. (Record entries in the order displayed in the problem statement. Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to the nearest whole dollar, e.g. 5,275. Do not round intermediate calculations.)

On January 1, 2017, Concord SA had Accounts Receivable €107,920 and Allowance for Doubtful Accounts €6,500. Concord prepares financial statements annually at December 31. During the year, the following selected transactions occurred. Sold €7,500 of merchandise to Patrick Co., terms n/30. Accepted Jan. 5 Feb. 2 €7,500, 4-month, 5% promissory note from Patrick for the balance due. an Sold €10,200 of merchandise to Marguerite SA and accepted Marguerite's €10,200, 2-month, 7% note for the balance due. Sold €5,600 of merchandise to Felton Co., terms n/10. 12 26 Apr. 5 Accepted a €5,600, 3-month, 9% note from Felton Co. for the balance due. 12 Collected Marguerite note in full. June 2 Collected Patrick note in full. July 5 Felton Co. dishonors its note of April 5. It is expected that Felton will eventually pay the amount owed. Sold €8,000 of merchandise to Planke Co. and accepted Planke's €8,000, 3-month, 7% note for the amount due. Planke Co.'s note was dishonored. Planke Co. is bankrupt, and there is no hope of future settlement. 15 Oct. 15 Journalize the transactions. (Record entries in the order displayed in the problem statement. Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to the nearest whole dollar, e.g. 5,275. Do not round intermediate calculations.)

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter7: Receivables And Investments

Section: Chapter Questions

Problem 7.1DC: Reading 3M Companys Balance Sheet: Accounts Receivable The following current asset appears on the...

Related questions

Question

100%

If answered within 40mins,it would be appreciable!!

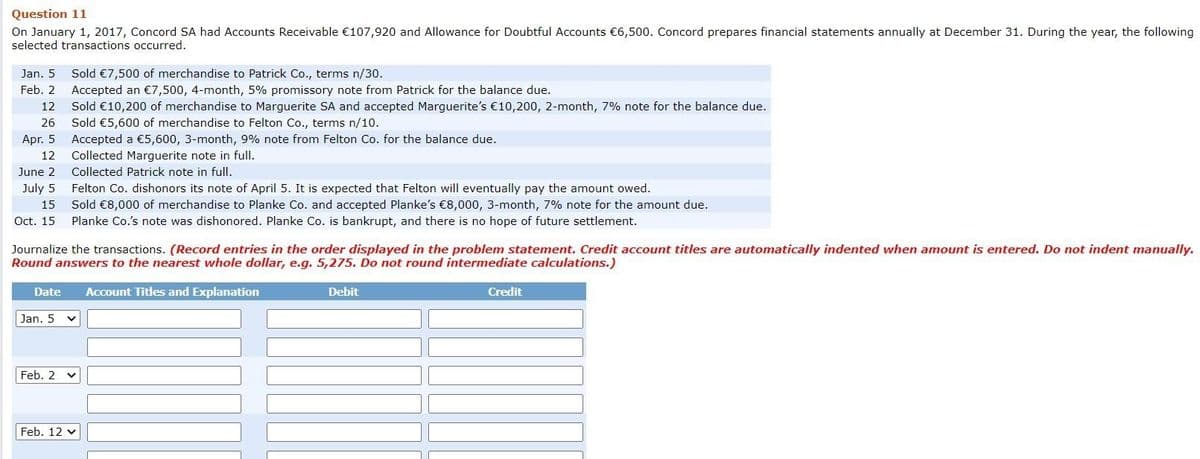

Transcribed Image Text:Question 11

On January 1, 2017, Concord SA had Accounts Receivable €107,920 and Allowance for Doubtful Accounts €6,500. Concord prepares financial statements annually at December 31. During the year, the following

selected transactions occurred.

Sold €7,500 of merchandise to Patrick Co., terms n/30.

Accepted an €7,500, 4-month, 5% promissory note from Patrick for the balance due.

Sold €10,200 of merchandise to Marguerite SA and accepted Marguerite's €10,200, 2-month, 7% note for the balance due.

Jan. 5

Feb. 2

12

26

Sold €5,600 of merchandise to Felton Co., terms n/10.

Accepted a €5,600, 3-month, 9% note from Felton Co. for the balance due.

Collected Marguerite note in full.

Apr. 5

12

June 2

Collected Patrick note in full.

July 5

Felton Co. dishonors its note of April 5. It is expected that Felton will eventually pay the amount owed.

Sold €8,000 of merchandise to Planke Co. and accepted Planke's €8,000, 3-month, 7% note for the amount due.

Planke Co.'s note was dishonored. Planke Co. is bankrupt, and there is no hope of future settlement.

15

Oct. 15

Journalize the transactions. (Record entries in the order displayed in the problem statement. Credit account titles are automatically indented when amount is entered. Do not indent manually.

Round answers to the nearest whole dollar, e.g. 5,275. Do not round intermediate calculations.)

Date

Account Titles and Explanation

Debit

Credit

Jan. 5

Feb. 2

Feb. 12 v

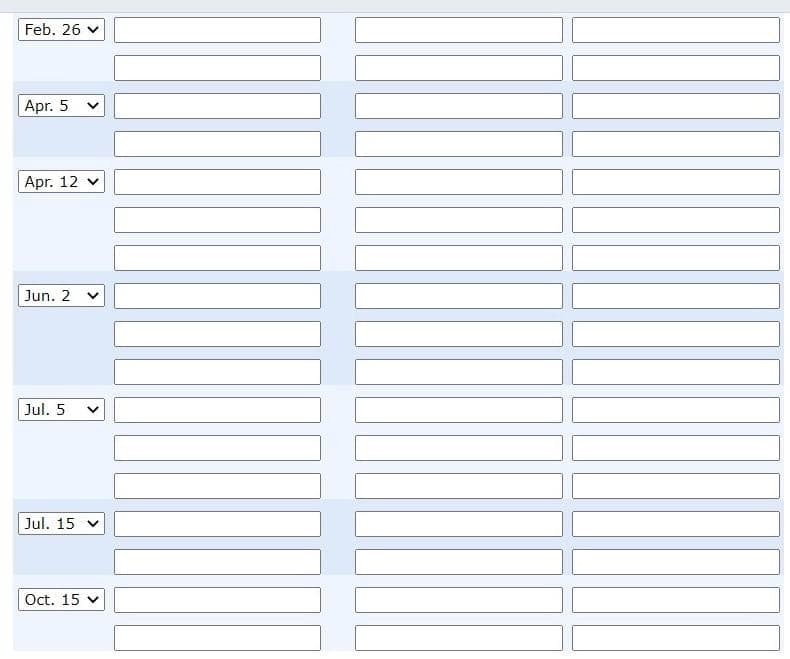

Transcribed Image Text:Feb. 26 v

Apr. 5

Apr. 12

Jun. 2

Jul. 5

Jul. 15 v

Oct. 15 v

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning