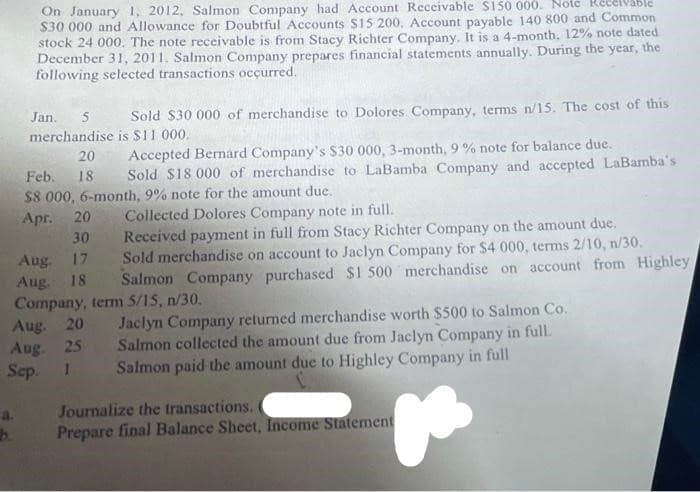

On January i, 2012, Salmon Company had $30 000 and Allowance for Doubtful Accounts $15 200. Account payable 140 800 and Common stock 24 000. The note receivable is from Stacy Richter Company. It is a 4-month, 12% note dated December 31, 2011. Salmon Company prepares financial statements annually. During the year, the following selected transactions ocçurred. Jan. Sold $30 000 of merchandise to Dolores Company, terms n/15. The cost of this 5 merchandise is $11 000. Accepted Bernard Company's $30 000, 3-month, 9 % note for balance due. Sold $18 000 of merchandise to LaBamba Company and accepted LaBamba's 20 Feb. 18 $8 000, 6-month, 9% note for the amount due. Apr. Collected Dolores Company note in full. Received payment in full from Stacy Richter Company on the amount due. Sold merchandise on account to Jaclyn Company for $4 000, terms 2/10, n/30. Salmon Company purchased S1 500 merchandise on account from Highley 20 30 Aug. Aug. Company, term 5/15, n/30. Aug. 20 Aug 25 ep. 1 17 18 Jaclyn Company returned merchandise worth $500 to Salmon Co. Salmon collected the amount due from Jaclyn Company in full. Salmon paid the amount due to Highley Company in full Journalize the transactions. Prepare final Balance Sheet, Income Statement

On January i, 2012, Salmon Company had $30 000 and Allowance for Doubtful Accounts $15 200. Account payable 140 800 and Common stock 24 000. The note receivable is from Stacy Richter Company. It is a 4-month, 12% note dated December 31, 2011. Salmon Company prepares financial statements annually. During the year, the following selected transactions ocçurred. Jan. Sold $30 000 of merchandise to Dolores Company, terms n/15. The cost of this 5 merchandise is $11 000. Accepted Bernard Company's $30 000, 3-month, 9 % note for balance due. Sold $18 000 of merchandise to LaBamba Company and accepted LaBamba's 20 Feb. 18 $8 000, 6-month, 9% note for the amount due. Apr. Collected Dolores Company note in full. Received payment in full from Stacy Richter Company on the amount due. Sold merchandise on account to Jaclyn Company for $4 000, terms 2/10, n/30. Salmon Company purchased S1 500 merchandise on account from Highley 20 30 Aug. Aug. Company, term 5/15, n/30. Aug. 20 Aug 25 ep. 1 17 18 Jaclyn Company returned merchandise worth $500 to Salmon Co. Salmon collected the amount due from Jaclyn Company in full. Salmon paid the amount due to Highley Company in full Journalize the transactions. Prepare final Balance Sheet, Income Statement

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 11RE: On December 1 of the current year, Jordan Inc. assigns 125,000 of its accounts receivable to...

Related questions

Question

only

Transcribed Image Text:On January 1, 2012, Salmon Company had Account Receivable S150 000. Note

$30 000 and Allowance for Doubtful Accounts SI5 200, Account payable 140 800 and Common

stock 24 000. The note receivable is from Stacy Richter Company. It is a 4-month, 12% note dated

December 31, 2011. Salmon Company prepares financial statements annually. During the year, the

following selected transactions ocçurred.

ble

Jan.

Sold S30 000 of merchandise to Dolores Company, terms n/15. The cost of this

5

merchandise is $11 000.

Accepted Bernard Company's S30 000, 3-month, 9 % note for balance due.

20

Feb.

Sold $18 000 of merchandise to LaBamba Company and accepted LaBamba's

18

$8 000, 6-month, 9% note for the amount due.

Collected Dolores Company note in full.

Received payment in full from Stacy Richter Company on the amount due.

Sold merchandise on account to Jaclyn Company for $4 000, terms 2/10, n/30.

Salmon Company purchased $1 500 merchandise on account from Highley

20

Apr.

30

Aug.

17

Aug 18

Company, term 5/15, n/30.

Aug. 20

Aug. 25

Sep. 1

Jaclyn Company returned merchandise worth $500 to Salmon Co.

Salmon collected the amount due from Jaclyn Company in full.

Salmon paid the amount due to Highley Company in full

Journalize the transactions.

Prepare final Balance Sheet, Income Statement

a.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning