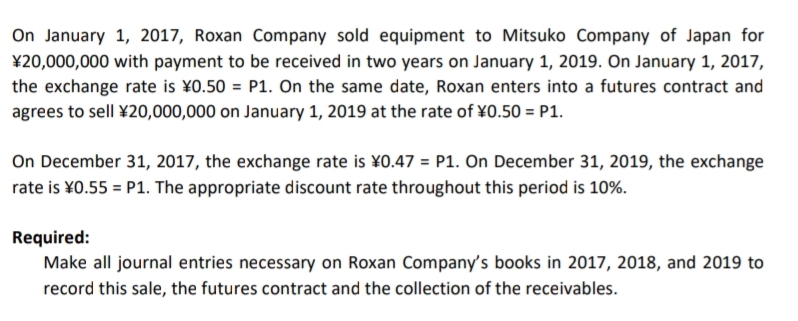

On January 1, 2017, Roxan Company sold equipment to Mitsuko Company of Japan for ¥20,000,000 with payment to be received in two years on January 1, 2019. On January 1, 2017, the exchange rate is ¥0.50 = P1. On the same date, Roxan enters into a futures contract and agrees to sell ¥20,000,000 on January 1, 2019 at the rate of ¥0.50 = P1. On December 31, 2017, the exchange rate is ¥0.47 = P1. On December 31, 2019, the exchange rate is ¥0.55 = P1. The appropriate discount rate throughout this period is 10%. Required: Make all journal entries necessary on Roxan Company's books in 2017, 2018, and 2019 to record this sale, the futures contract and the collection of the receivables.

On January 1, 2017, Roxan Company sold equipment to Mitsuko Company of Japan for ¥20,000,000 with payment to be received in two years on January 1, 2019. On January 1, 2017, the exchange rate is ¥0.50 = P1. On the same date, Roxan enters into a futures contract and agrees to sell ¥20,000,000 on January 1, 2019 at the rate of ¥0.50 = P1. On December 31, 2017, the exchange rate is ¥0.47 = P1. On December 31, 2019, the exchange rate is ¥0.55 = P1. The appropriate discount rate throughout this period is 10%. Required: Make all journal entries necessary on Roxan Company's books in 2017, 2018, and 2019 to record this sale, the futures contract and the collection of the receivables.

Chapter5: Currency Derivatives

Section: Chapter Questions

Problem 18QA

Related questions

Question

Transcribed Image Text:On January 1, 2017, Roxan Company sold equipment to Mitsuko Company of Japan for

¥20,000,000 with payment to be received in two years on January 1, 2019. On January 1, 2017,

the exchange rate is ¥0.50 = P1. On the same date, Roxan enters into a futures contract and

agrees to sell ¥20,000,000 on January 1, 2019 at the rate of ¥0.50 = P1.

On December 31, 2017, the exchange rate is ¥0.47 = P1. On December 31, 2019, the exchange

rate is ¥0.55 = P1. The appropriate discount rate throughout this period is 10%.

Required:

Make all journal entries necessary on Roxan Company's books in 2017, 2018, and 2019 to

record this sale, the futures contract and the collection of the receivables.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning