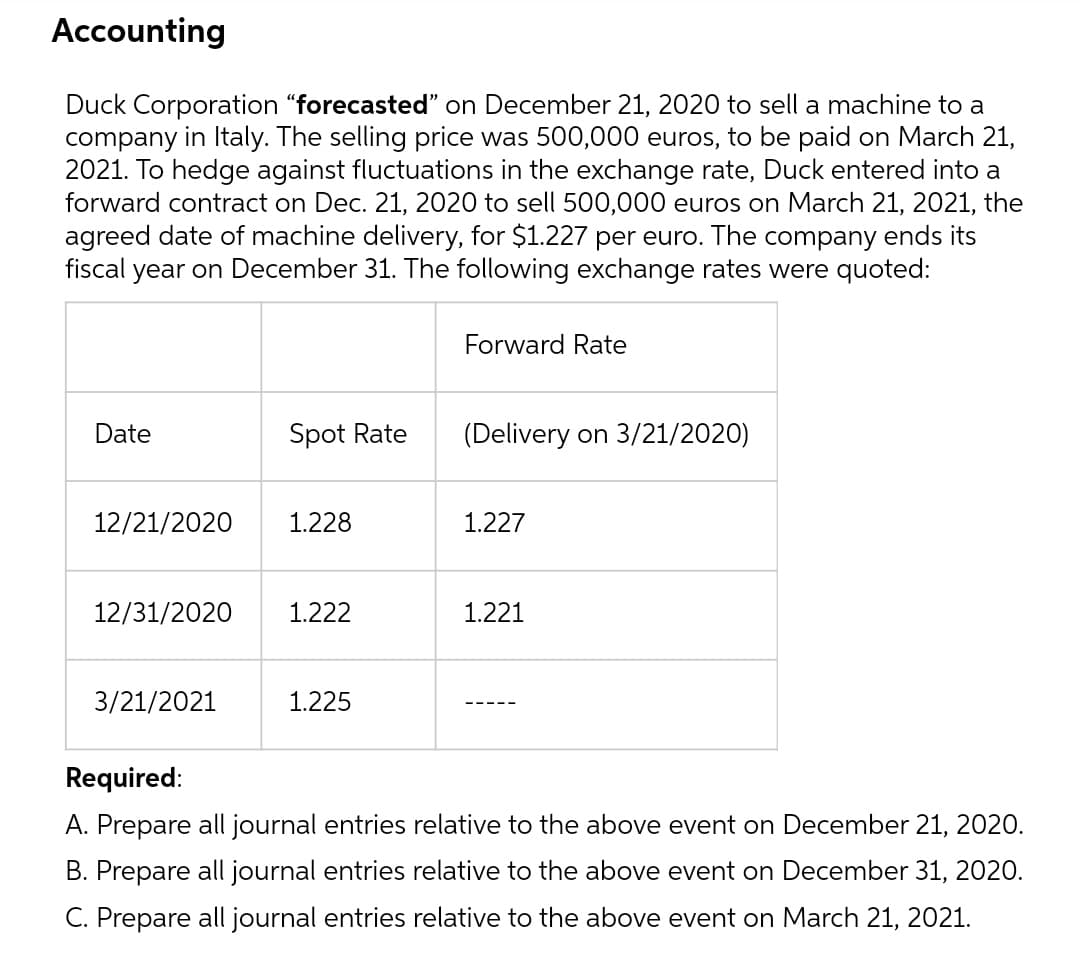

Duck Corporation "forecasted" on December 21, 2020 to sell a machine to a company in Italy. The selling price was 500,000 euros, to be paid on March 21, 2021. To hedge against fluctuations in the exchange rate, Duck entered into a forward contract on Dec. 21, 2020 to sell 500,000 euros on March 21, 2021, the agreed date of machine delivery, for $1.227 per euro. The company ends its fiscal year on December 31. The following exchange rates were quoted: Forward Rate Date Spot Rate (Delivery on 3/21/2020) 12/21/2020 1.228 1.227 12/31/2020 1.222 1.221 3/21/2021 1.225 Required: A. Prepare all journal entries relative to the above event on December 21, 2020. B. Prepare all journal entries relative to the above event on December 31, 2020. C. Prepare all journal entries relative to the above event on March 21, 2021.

Duck Corporation "forecasted" on December 21, 2020 to sell a machine to a company in Italy. The selling price was 500,000 euros, to be paid on March 21, 2021. To hedge against fluctuations in the exchange rate, Duck entered into a forward contract on Dec. 21, 2020 to sell 500,000 euros on March 21, 2021, the agreed date of machine delivery, for $1.227 per euro. The company ends its fiscal year on December 31. The following exchange rates were quoted: Forward Rate Date Spot Rate (Delivery on 3/21/2020) 12/21/2020 1.228 1.227 12/31/2020 1.222 1.221 3/21/2021 1.225 Required: A. Prepare all journal entries relative to the above event on December 21, 2020. B. Prepare all journal entries relative to the above event on December 31, 2020. C. Prepare all journal entries relative to the above event on March 21, 2021.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter13: Marketable Securities And Derivatives

Section: Chapter Questions

Problem 22E

Related questions

Question

Transcribed Image Text:Accounting

Duck Corporation "forecasted" on December 21, 2020 to sell a machine to a

company in Italy. The selling price was 500,000 euros, to be paid on March 21,

2021. To hedge against fluctuations in the exchange rate, Duck entered into a

forward contract on Dec. 21, 2020 to sell 500,000 euros on March 21, 2021, the

agreed date of machine delivery, for $1.227 per euro. The company ends its

fiscal year on December 31. The following exchange rates were quoted:

Forward Rate

Date

Spot Rate

(Delivery on 3/21/2020)

12/21/2020

1.228

1.227

12/31/2020

1.222

1.221

3/21/2021

1.225

Required:

A. Prepare all journal entries relative to the above event on December 21, 2020.

B. Prepare all journal entries relative to the above event on December 31, 2020.

C. Prepare all journal entries relative to the above event on March 21, 2021.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning