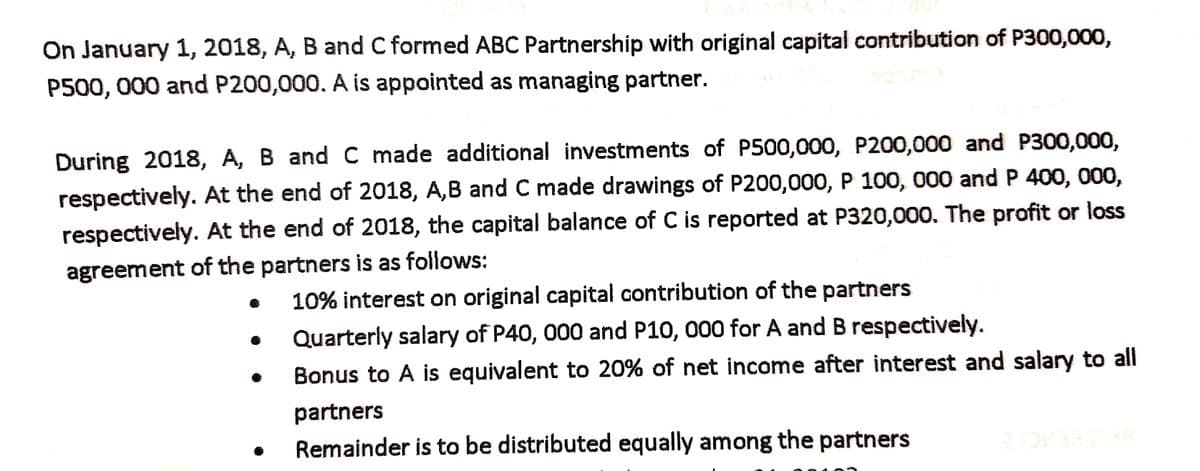

On January 1, 2018, A, B and C formed ABC Partnership with original capital contribution of P300,000, P500, 000 and P200,000. A is appointed as managing partner. During 2018, A, B and C made additional investments of P500,000, P200,000 and P300,000, respectively. At the end of 2018, A,B and C made drawings of P200,000, P 100, 000 and P 400, 000, respectively. At the end of 2018, the capital balance of C is reported at P320,000. The profit or loss agreement of the partners is as follows: 10% interest on original capital contribution of the partners Quarterly salary of P40, 000 and P10, 000 for A and B respectively. Bonus to A is equivalent to 20% of net income after interest and salary to all partners Remainder is to be distributed equally among the partners

On January 1, 2018, A, B and C formed ABC Partnership with original capital contribution of P300,000, P500, 000 and P200,000. A is appointed as managing partner. During 2018, A, B and C made additional investments of P500,000, P200,000 and P300,000, respectively. At the end of 2018, A,B and C made drawings of P200,000, P 100, 000 and P 400, 000, respectively. At the end of 2018, the capital balance of C is reported at P320,000. The profit or loss agreement of the partners is as follows: 10% interest on original capital contribution of the partners Quarterly salary of P40, 000 and P10, 000 for A and B respectively. Bonus to A is equivalent to 20% of net income after interest and salary to all partners Remainder is to be distributed equally among the partners

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter12: Accounting For Partnerships And Limited Liability Companies

Section: Chapter Questions

Problem 3PB

Related questions

Question

PLS SHOW SOLUTION

Transcribed Image Text:On January 1, 2018, A, B and C formed ABC Partnership with original capital contribution of P300,000,

P500, 000 and P200,000. A is appointed as managing partner.

During 2018, A, B and C made additional investments of P500,000, P200,000 and P300,000,

respectively. At the end of 2018, A,B and C made drawings of P200,000, P 100, 000 and P 400, 000,

respectively. At the end of 2018, the capital balance of C is reported at P320,000. The profit or loss

agreement of the partners is as follows:

10% interest on original capital contribution of the partners

Quarterly salary of P40, 000 and P10, 000 for A and B respectively.

Bonus to A is equivalent to 20% of net income after interest and salary to all

partners

Remainder is to be distributed equally among the partners

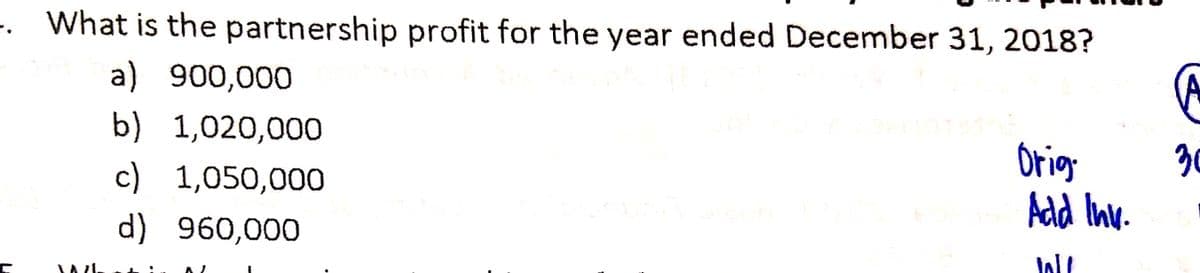

Transcribed Image Text:. What is the partnership profit for the year ended December 31, 2018?

a) 900,000

b) 1,020,000

c) 1,050,000

Orig

30

Add Inv.

d) 960,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning