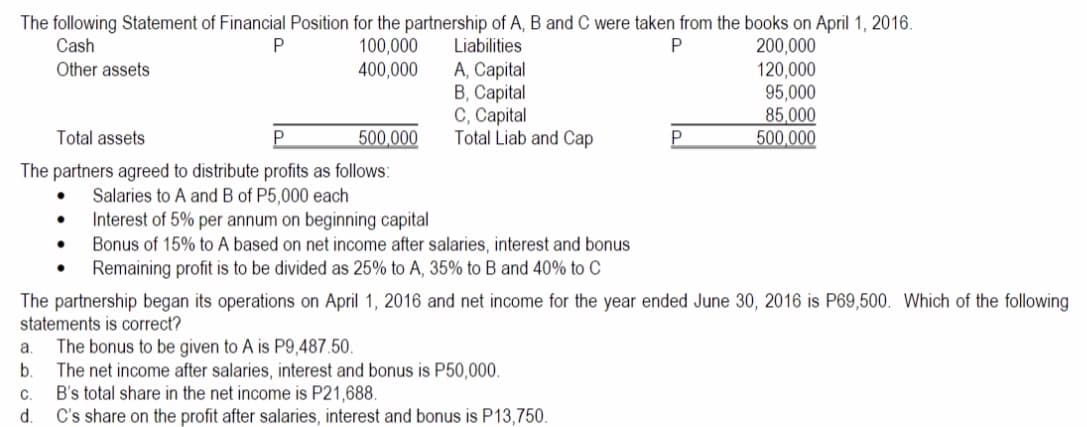

The following Statement of Financial Position for the partnership of A, B and C were taken from the books on April 1, 2016. Liabilities A, Capital B, Capital С, Сapital Total Liab and Cap Cash 100,000 400,000 P 200,000 120,000 95,000 85,000 500,000 Other assets Total assets 500,000 The partners agreed to distribute profits as follows: Salaries to A and B of P5,000 each Interest of 5% per annum on beginning capital Bonus of 15% to A based on net income after salaries, interest and bonus Remaining profit is to be divided as 25% to A, 35% to B and 40% to C The partnership began its operations on April 1, 2016 and net income for the year ended June 30, 2016 is P69,500. Which of the following statements is correct? a. The bonus to be given to A is P9,487.50. b. The net income after salaries, interest and bonus is P50,000. C. B's total share in the net income is P21,688. d. C's share on the profit after salaries, interest and bonus is P13,750.

The following Statement of Financial Position for the partnership of A, B and C were taken from the books on April 1, 2016. Liabilities A, Capital B, Capital С, Сapital Total Liab and Cap Cash 100,000 400,000 P 200,000 120,000 95,000 85,000 500,000 Other assets Total assets 500,000 The partners agreed to distribute profits as follows: Salaries to A and B of P5,000 each Interest of 5% per annum on beginning capital Bonus of 15% to A based on net income after salaries, interest and bonus Remaining profit is to be divided as 25% to A, 35% to B and 40% to C The partnership began its operations on April 1, 2016 and net income for the year ended June 30, 2016 is P69,500. Which of the following statements is correct? a. The bonus to be given to A is P9,487.50. b. The net income after salaries, interest and bonus is P50,000. C. B's total share in the net income is P21,688. d. C's share on the profit after salaries, interest and bonus is P13,750.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter19: Accounting For Partnerships

Section: Chapter Questions

Problem 3SEB

Related questions

Question

Show your solution and answer.

Transcribed Image Text:The following Statement of Financial Position for the partnership of A, B and C were taken from the books on April 1, 2016.

Cash

100,000

400,000

Liabilities

200,000

120,000

95,000

85,000

500,000

Other assets

A, Capital

В, Сарital

Capital

Total Liab and Cap

Total assets

500,000

The partners agreed to distribute profits as follows:

Salaries to A and B of P5,000 each

Interest of 5% per annum on beginning capital

Bonus of 15% to A based on net income after salaries, interest and bonus

Remaining profit is to be divided as 25% to A, 35% to B and 40% to C

The partnership began its operations on April 1, 2016 and net income for the year ended June 30, 2016 is P69,500. Which of the following

statements is correct?

The bonus to be given to A is P9,487.50.

The net income after salaries, interest and bonus is P50,000.

B's total share in the net income is P21,688.

d.

a.

b.

C.

C's share on the profit after salaries, interest and bonus is P13,750.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning