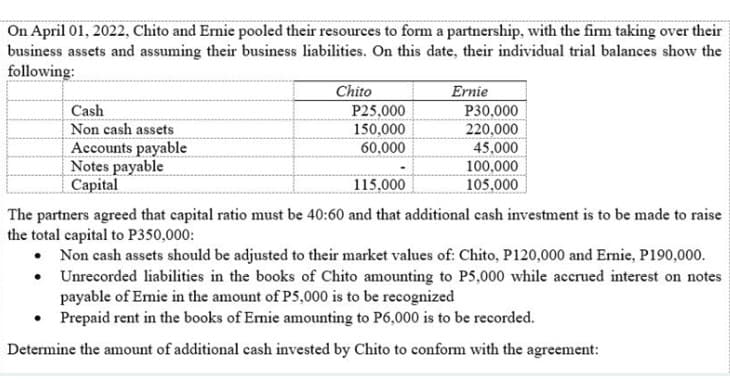

On April 01, 2022, Chito and Ernie pooled their resources to form a partnership, with the firm taking over their business assets and assuming their business liabilities. On this date, their individual trial balances show the following: Chito Ernie P30,000 Cash Non cash assets P25,000 150,000 220,000 45,000 Accounts payable Notes payable Capital 60,000 100,000 105,000 115.000 The partners agreed that capital ratio must be 40:60 and that additional cash investment is to be made to raise the total capital to P350,000: • Non cash assets should be adjusted to their market values of: Chito, P120,000 and Ernie, P190,000. • Unrecorded liabilities in the books of Chito amounting to P5,000 while accrued interest on notes payable of Emie in the amount of P5,000 is to be recognized • Prepaid rent in the books of Ernie amounting to P6,000 is to be recorded. Determine the amount of additional cash invested by Chito to conform with the agreement:

On April 01, 2022, Chito and Ernie pooled their resources to form a partnership, with the firm taking over their business assets and assuming their business liabilities. On this date, their individual trial balances show the following: Chito Ernie P30,000 Cash Non cash assets P25,000 150,000 220,000 45,000 Accounts payable Notes payable Capital 60,000 100,000 105,000 115.000 The partners agreed that capital ratio must be 40:60 and that additional cash investment is to be made to raise the total capital to P350,000: • Non cash assets should be adjusted to their market values of: Chito, P120,000 and Ernie, P190,000. • Unrecorded liabilities in the books of Chito amounting to P5,000 while accrued interest on notes payable of Emie in the amount of P5,000 is to be recognized • Prepaid rent in the books of Ernie amounting to P6,000 is to be recorded. Determine the amount of additional cash invested by Chito to conform with the agreement:

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter18: Comparative Forms Of Doing Business

Section: Chapter Questions

Problem 38P

Related questions

Question

Transcribed Image Text:On April 01, 2022, Chito and Ernie pooled their resources to form a partnership, with the firm taking over their

business assets and assuming their business liabilities. On this date, their individual trial balances show the

following:

Chito

Ernie

P25,000

150,000

Cash

P30,000

220,000

Non cash assets

Accounts payable

Notes payable

Capital

60,000

45,000

100,000

105.000

115.000

The partners agreed that capital ratio must be 40:60 and that additional cash investment is to be made to raise

the total capital to P350,000:

• Non cash assets should be adjusted to their market values of: Chito, P120,000 and Ernie, P190,000.

• Unrecorded liabilities in the books of Chito amounting to P5,000 while acerued interest on notes

payable of Emie in the amount of P5,000 is to be recognized

Prepaid rent in the books of Ernie amounting to P6,000 is to be recorded.

Determine the amount of additional cash invested by Chito to conform with the agreement:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,