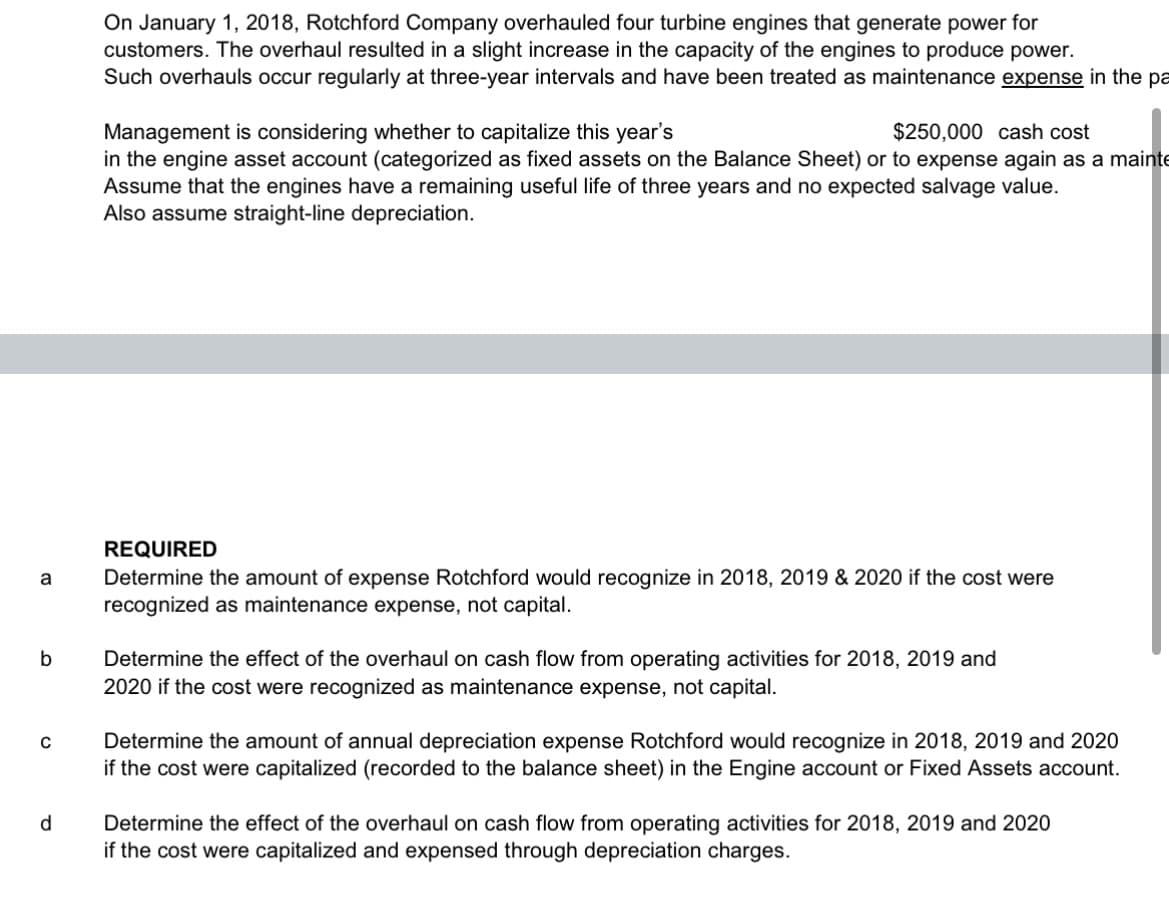

On January 1, 2018, Rotchford Company overhauled four turbine engines that generate power for customers. The overhaul resulted in a slight increase in the capacity of the engines to produce power. Such overhauls occur regularly at three-year intervals and have been treated as maintenance expense in the p Management is considering whether to capitalize this year's in the engine asset account (categorized as fixed assets on the Balance Sheet) or to expense again as a maint Assume that the engines have a remaining useful life of three years and no expected salvage value. Also assume straight-line depreciation. $250,000 cash cost REQUIRED Determine the amount of expense Rotchford would recognize in 2018, 2019 & 2020 if the cost were recognized as maintenance expense, not capital. a b Determine the effect of the overhaul on cash flow from operating activities for 2018, 2019 and 2020 if the cost were recognized as maintenance expense, not capital. Determine the amount of annual depreciation expense Rotchford would recognize in 2018, 2019 and 2020 if the cost were capitalized (recorded to the balance sheet) in the Engine account or Fixed Assets account. d Determine the effect of the overhaul on cash flow from operating activities for 2018, 2019 and 2020 if the cost were capitalized and expensed through depreciation charges.

On January 1, 2018, Rotchford Company overhauled four turbine engines that generate power for customers. The overhaul resulted in a slight increase in the capacity of the engines to produce power. Such overhauls occur regularly at three-year intervals and have been treated as maintenance expense in the p Management is considering whether to capitalize this year's in the engine asset account (categorized as fixed assets on the Balance Sheet) or to expense again as a maint Assume that the engines have a remaining useful life of three years and no expected salvage value. Also assume straight-line depreciation. $250,000 cash cost REQUIRED Determine the amount of expense Rotchford would recognize in 2018, 2019 & 2020 if the cost were recognized as maintenance expense, not capital. a b Determine the effect of the overhaul on cash flow from operating activities for 2018, 2019 and 2020 if the cost were recognized as maintenance expense, not capital. Determine the amount of annual depreciation expense Rotchford would recognize in 2018, 2019 and 2020 if the cost were capitalized (recorded to the balance sheet) in the Engine account or Fixed Assets account. d Determine the effect of the overhaul on cash flow from operating activities for 2018, 2019 and 2020 if the cost were capitalized and expensed through depreciation charges.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 10E: Hathaway Company purchased a copying machine for 8,700 on October 1, 2019. The machines residual...

Related questions

Question

just answer it

Transcribed Image Text:On January 1, 2018, Rotchford Company overhauled four turbine engines that generate power for

customers. The overhaul resulted in a slight increase in the capacity of the engines to produce power.

Such overhauls occur regularly at three-year intervals and have been treated as maintenance expense in the pa

Management is considering whether to capitalize this year's

in the engine asset account (categorized as fixed assets on the Balance Sheet) or to expense again as a mainte

Assume that the engines have a remaining useful life of three years and no expected salvage value.

Also assume straight-line depreciation.

$250,000 cash cost

REQUIRED

Determine the amount of expense Rotchford would recognize in 2018, 2019 & 2020 if the cost were

recognized as maintenance expense, not capital.

a

b

Determine the effect of the overhaul on cash flow from operating activities for 2018, 2019 and

2020 if the cost were recognized as maintenance expense, not capital.

Determine the amount of annual depreciation expense Rotchford would recognize in 2018, 2019 and 2020

if the cost were capitalized (recorded to the balance sheet) in the Engine account or Fixed Assets account.

Determine the effect of the overhaul on cash flow from operating activities for 2018, 2019 and 2020

if the cost were capitalized and expensed through depreciation charges.

d.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College