On January 1, 2019, Gates Corporation issued $100,000 of 5-year bonds due December 31, 2023, for $103,604.79 minus debt issuance costs of $3,000. The bonds carry a stated rate of interest of 13% payable annually on December 31 and were issued to yield 12%. The company uses the effective interest method of amortization to amortize any discounts or premiums and the straight-line method to amortize the debt issuance costs. Required: Prepare the journal entries to record the issuance of the bonds, all the interest payments, premium amortizations, debt issuance cost amortizations, and the repayment of the bonds. In addition, prepare a bond interest expense and premium amortization schedule for the bonds. CHART OF ACCOUNTS Gates Corporation General Ledger ASSETS 111 Cash 121 Accounts Receivable 141 Inventory 152 Prepaid Insurance 181 Equipment 195 Deferred Debt Issuance Costs 198 Accumulated Depreciation LIABILITIES 211 Accounts Payable 231 Salaries Payable 250 Unearned Revenue 255 Bonds Payable 256 Premium on Bonds Payable 257 Discount on Bonds Payable 261 Income Taxes Payable EQUITY 311 Common Stock 331 Retained Earnings PAGE 2019PAGE 2020PAGE 2021PAGE 2022PAGE 2023 GENERAL JOURNAL DATE ACCOUNT TITLE POST. REF. DEBIT CREDIT 1 2 3 4 5 6 7 8 9 10

On January 1, 2019, Gates Corporation issued $100,000 of 5-year bonds due December 31, 2023, for $103,604.79 minus debt issuance costs of $3,000. The bonds carry a stated rate of interest of 13% payable annually on December 31 and were issued to yield 12%. The company uses the effective interest method of amortization to amortize any discounts or premiums and the straight-line method to amortize the debt issuance costs. Required: Prepare the journal entries to record the issuance of the bonds, all the interest payments, premium amortizations, debt issuance cost amortizations, and the repayment of the bonds. In addition, prepare a bond interest expense and premium amortization schedule for the bonds. CHART OF ACCOUNTS Gates Corporation General Ledger ASSETS 111 Cash 121 Accounts Receivable 141 Inventory 152 Prepaid Insurance 181 Equipment 195 Deferred Debt Issuance Costs 198 Accumulated Depreciation LIABILITIES 211 Accounts Payable 231 Salaries Payable 250 Unearned Revenue 255 Bonds Payable 256 Premium on Bonds Payable 257 Discount on Bonds Payable 261 Income Taxes Payable EQUITY 311 Common Stock 331 Retained Earnings PAGE 2019PAGE 2020PAGE 2021PAGE 2022PAGE 2023 GENERAL JOURNAL DATE ACCOUNT TITLE POST. REF. DEBIT CREDIT 1 2 3 4 5 6 7 8 9 10

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter13: Investments And Long-term Receivables

Section: Chapter Questions

Problem 7RE: Refer to the information in RE13-5. Assume that on December 31, 2019, the investment in Smith...

Related questions

Question

On January 1, 2019, Gates Corporation issued $100,000 of 5-year bonds due December 31, 2023, for $103,604.79 minus debt issuance costs of $3,000. The bonds carry a stated rate of interest of 13% payable annually on December 31 and were issued to yield 12%. The company uses the effective interest method of amortization to amortize any discounts or premiums and the straight-line method to amortize the debt issuance costs.

Required:

| Prepare the |

| CHART OF ACCOUNTS | ||||||||||||||||||||||||||||||||||||||

| Gates Corporation | ||||||||||||||||||||||||||||||||||||||

| General Ledger | ||||||||||||||||||||||||||||||||||||||

|

PAGE 2019PAGE 2020PAGE 2021PAGE 2022PAGE 2023

GENERAL JOURNAL

| DATE | ACCOUNT TITLE | POST. REF. | DEBIT | CREDIT | |

|---|---|---|---|---|---|

|

1

|

|

|

|

|

|

|

2

|

|

|

|

|

|

|

3

|

|

|

|

|

|

|

4

|

|

|

|

|

|

|

5

|

|

|

|

|

|

|

6

|

|

|

|

|

|

|

7

|

|

|

|

|

|

|

8

|

|

|

|

|

|

|

9

|

|

|

|

|

|

|

10

|

|

|

|

|

|

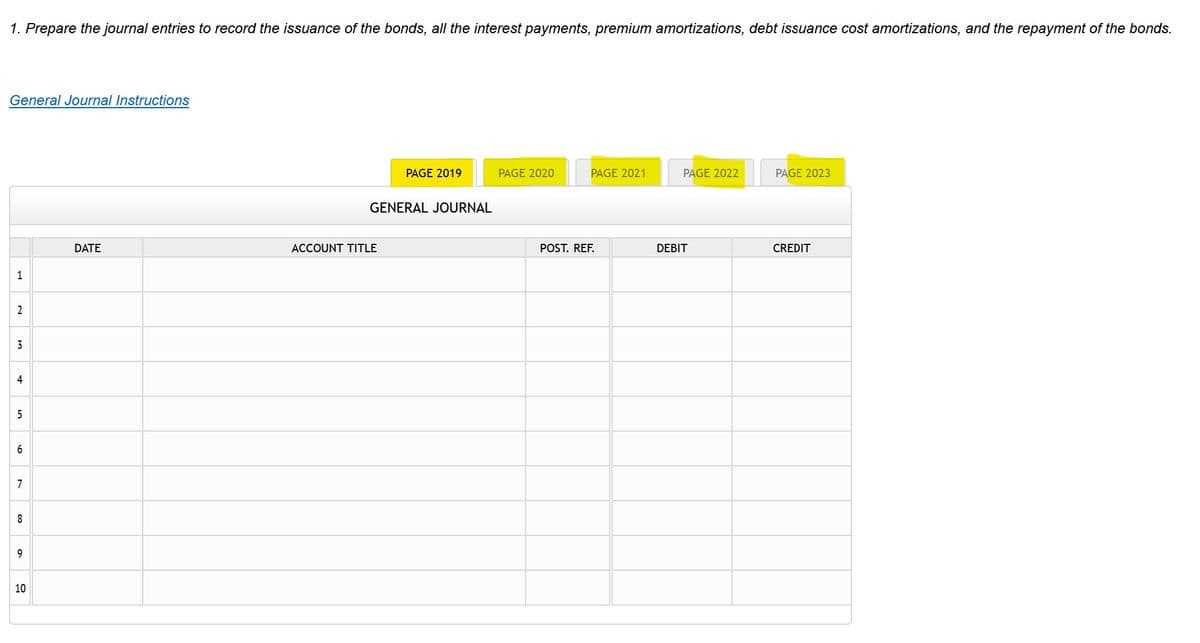

Transcribed Image Text:1. Prepare the journal entries to record the issuance of the bonds, all the interest payments, premium amortizations, debt issuance cost amortizations, and the repayment of the bonds.

General Journal Instructions

PAGE 2019

PAGE 2020

PAGE 2021

PAGE 2022

PAGE 2023

GENERAL JOURNAL

DATE

ACCOUNT TITLE

POST. REF.

DEBIT

CREDIT

1

3

4

5

6

7

8

9

10

2.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning