On September 1, 2021, Evansville Lumber Company issued $80 million in 20-year, 10 percent bonds payable. Interest is payable semiannually on March 1 and September 1. Bond discounts and premiums are amortized at each interest payment date and at year- end. The company's fiscal year ends at December 31. Required: a-1. Prepare the necessary adjusting entries at December 31, 2021, and the journal entry to record the payment of bond interest on March 1, 2022, under the assumption that the bonds were issued at 98. a-2 Prepare the necessary adjusting entries at December 31, 2021, and the journal entry to record the payment of bond interest on March 1, 2022, under the assumption that the bonds were issued at 101. b. Compute the net bond liability at December 31, 2022, under assumptions a-1 and a-2 above. c. Under which of the following assumptions would the investor's effective rate of interest be higher? 1. The bonds were issued at 98. 2 The bonds were issued at 101. Complete this question by entering your answers in the tabs below.

On September 1, 2021, Evansville Lumber Company issued $80 million in 20-year, 10 percent bonds payable. Interest is payable semiannually on March 1 and September 1. Bond discounts and premiums are amortized at each interest payment date and at year- end. The company's fiscal year ends at December 31. Required: a-1. Prepare the necessary adjusting entries at December 31, 2021, and the journal entry to record the payment of bond interest on March 1, 2022, under the assumption that the bonds were issued at 98. a-2 Prepare the necessary adjusting entries at December 31, 2021, and the journal entry to record the payment of bond interest on March 1, 2022, under the assumption that the bonds were issued at 101. b. Compute the net bond liability at December 31, 2022, under assumptions a-1 and a-2 above. c. Under which of the following assumptions would the investor's effective rate of interest be higher? 1. The bonds were issued at 98. 2 The bonds were issued at 101. Complete this question by entering your answers in the tabs below.

Chapter13: Long-term Liabilities

Section: Chapter Questions

Problem 5PA: Volunteer Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4-year term on July...

Related questions

Question

ACCT 102 - Please do Req B and C ONLY. Thank You. :)

Transcribed Image Text:On September 1, 2021, Evansville Lumber Company issued $80 million in 20-year, 10 percent bonds payable. Interest is payable

semiannually on March 1 and September 1. Bond discounts and premiums are amortized at each interest payment date and at year-

end. The company's fiscal year ends at December 31.

Required:

a-1. Prepare the necessary adjusting entries at December 31, 2021, and the journal entry to record the payment of bond interest on

March 1, 2022, under the assumption that the bonds were issued at 98.

a-2 Prepare the necessary adjusting entries at December 31, 2021, and the journal entry to record the payment of bond interest on

March 1, 2022, under the assumption that the bonds were issued at 101.

b. Compute the net bond liability at December 31, 2022, under assumptions a-1 and a-2 above.

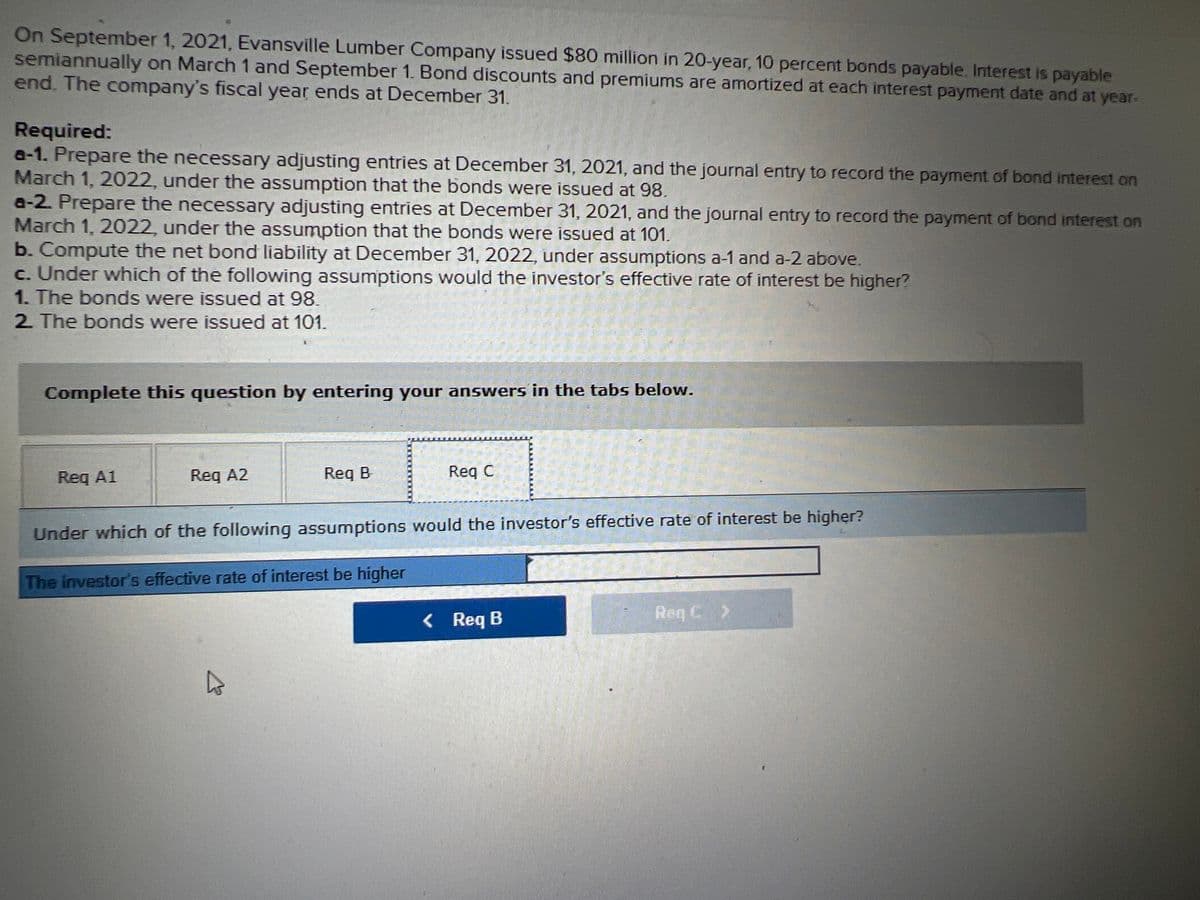

c. Under which of the following assumptions would the investor's effective rate of interest be higher?

1. The bonds were issued at 98.

2 The bonds were issued at 101.

Complete this question by entering your answers in the tabs below.

Req A1

Req A2

Req B

Req C

Under which of the following assumptions would the investor's effective rate of interest be higher?

The investor's effective rate of interest be higher

< Req B

Req C >

Transcribed Image Text:ved

On September 1, 2021, Evansville Lumber Company issued $80 million in 20-year, 10 percent bonds payable. Interest is payable

semiannually on March 1 and September 1. Bond discounts and premiums are amortized at each interest payment date and at year-

end. The company's fiscal year ends at December 31.

Required:

a-1. Prepare the necessary adjusting entries at December 31, 2021, and the journal entry to record the payment of bond interest on

March 1, 2022, under the assumption that the bonds were issued at 98.

a-2. Prepare the necessary adjusting entries at December 31, 2021, and the journal entry to record the payment of bond interest on

March 1, 2022, under the assumption that the bonds were issued at 101.

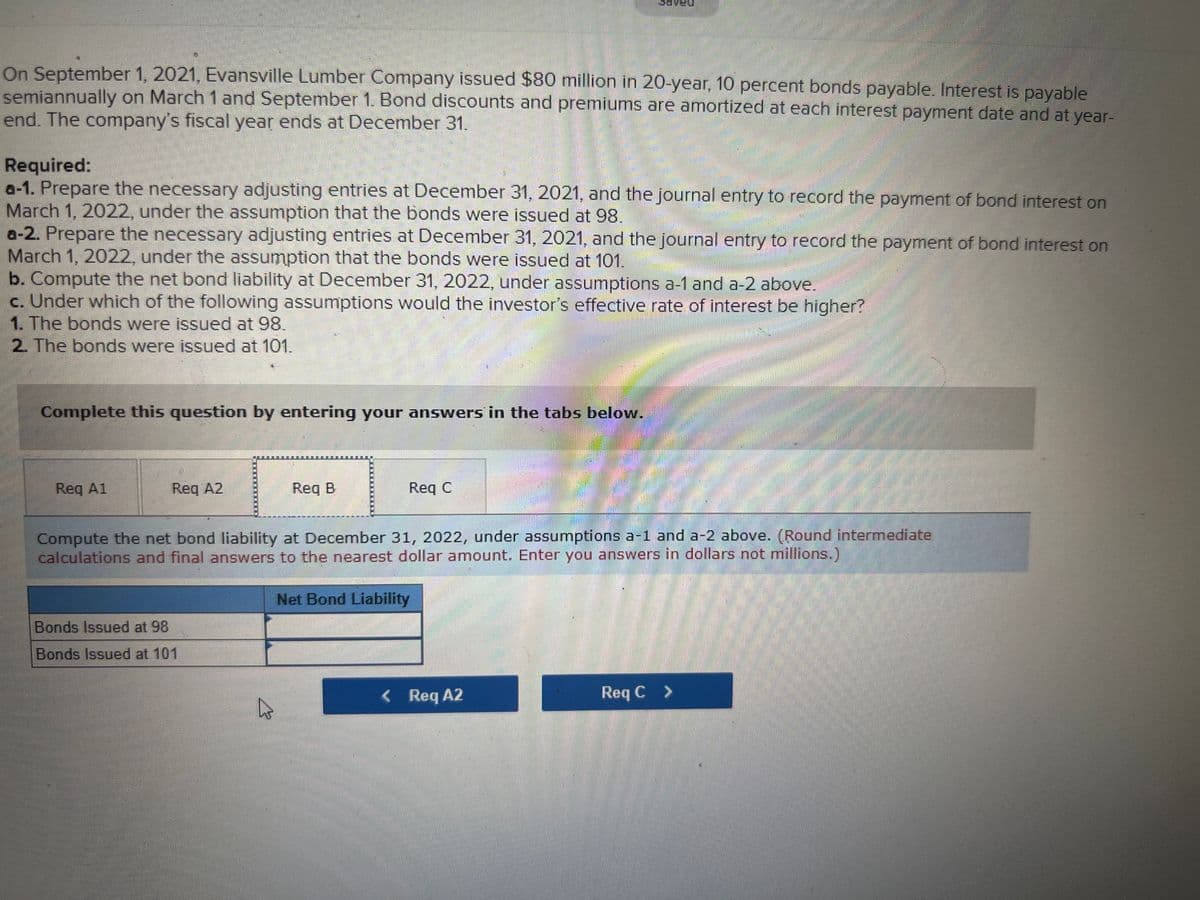

b. Compute the net bond liability at December 31, 2022, under assumptions a-1 and a-2 above.

c. Under which of the following assumptions would the investor's effective rate of interest be higher?

1. The bonds were issued at 98.

2. The bonds were issued at 101.

Complete this question by entering your answers in the tabs below.

Req A1

Req A2

Req B

Req C

Compute the net bond liability at December 31, 2022, under assumptions a-1 and a-2 above. (Round intermediate

calculations and final answers to the nearest dollar amount. Enter you answers in dollars not millions.)

Net Bond Liability

Bonds Issued at 98

Bonds Issued at 101

< Req A2

Req C>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning