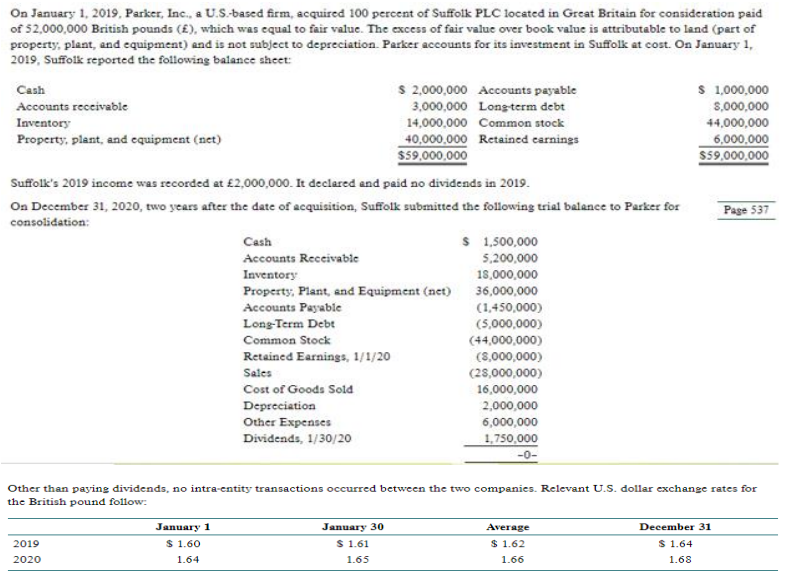

On January 1, 2019, Parker, Inc., a U.S.-based firm, acquired 100 percent of Suffolk PLC located in Great Britain for consideration paid of 52,000,000 British pounds (£), which was equal to fair value. The excess of fair value over book value is attributable to land (part of property, plant, and equipment) and is not subject to depreciation. Parker accounts for its investment in Suffolk at cost. On January 1, 2019, Suffolk reported the following balance sheet: Cash Accounts receivable $ 2,000,000 Accounts payable 3,000,000 Long-term debt 14,000,000 Common stock 40,000,000 Retained earnings $59,000,000 $ 1,000,000 $,000,000 44,000,000 6,000,000 Inventory Property, plant, and equipment (net) $59,000,000 Suffolk's 2019 income was recorded at £2,000,000. It declared and paid no dividends in 2019. On December 31, 2020, two years after the date of acquisition, Suffolk submitted the following trial balance to Parker for consolidation: Page 537 Cash $ 1,500,000 Accounts Receivable 5,200,000 Inventory 18,000,000 Property, Plant, and Equipment (net) 36,000,000 Accounts Payable (1,450,000) Long-Term Debt (5,000,000) Common Stock (44,000,000) Retained Earnings, 1/1/20 (8,000,000) Sales (28,000,000) Cost of Goods Sold 16,000,000 Depreciation 2,000,000 Other Expenses 6,000,000 Dividends, 1/30/20 1,750,000 -0- Other than paying dividends, no intra-entity transactions occurred between the two companies. Relevant U.S. dollar exchange rates for the British pound follow: January 30 Average December 31 January 1 $ 1.60 $ 1.61 $ 1.64 2019 2020 $ 1.62 1.66 1.64 1.65 1.68

On January 1, 2019, Parker, Inc., a U.S.-based firm, acquired 100 percent of Suffolk PLC located in Great Britain for consideration paid of 52,000,000 British pounds (£), which was equal to fair value. The excess of fair value over book value is attributable to land (part of property, plant, and equipment) and is not subject to depreciation. Parker accounts for its investment in Suffolk at cost. On January 1, 2019, Suffolk reported the following balance sheet: Cash Accounts receivable $ 2,000,000 Accounts payable 3,000,000 Long-term debt 14,000,000 Common stock 40,000,000 Retained earnings $59,000,000 $ 1,000,000 $,000,000 44,000,000 6,000,000 Inventory Property, plant, and equipment (net) $59,000,000 Suffolk's 2019 income was recorded at £2,000,000. It declared and paid no dividends in 2019. On December 31, 2020, two years after the date of acquisition, Suffolk submitted the following trial balance to Parker for consolidation: Page 537 Cash $ 1,500,000 Accounts Receivable 5,200,000 Inventory 18,000,000 Property, Plant, and Equipment (net) 36,000,000 Accounts Payable (1,450,000) Long-Term Debt (5,000,000) Common Stock (44,000,000) Retained Earnings, 1/1/20 (8,000,000) Sales (28,000,000) Cost of Goods Sold 16,000,000 Depreciation 2,000,000 Other Expenses 6,000,000 Dividends, 1/30/20 1,750,000 -0- Other than paying dividends, no intra-entity transactions occurred between the two companies. Relevant U.S. dollar exchange rates for the British pound follow: January 30 Average December 31 January 1 $ 1.60 $ 1.61 $ 1.64 2019 2020 $ 1.62 1.66 1.64 1.65 1.68

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 18E

Related questions

Question

Transcribed Image Text:On January 1, 2019, Parker, Inc., a U.S.-based firm, acquired 100 percent of Suffolk PLC located in Great Britain for consideration paid

of 52,000,000 British pounds (£), which was equal to fair value. The excess of fair value over book value is attributable to land (part of

property, plant, and equipment) and is not subject to depreciation. Parker accounts for its investment in Suffolk at cost. On January 1,

2019, Suffolk reported the following balance sheet:

Cash

Accounts receivable

$ 2,000,000 Accounts payable

3,000,000 Long-term debt

14,000,000 Common stock

40,000,000 Retained earnings

$59,000,000

$ 1,000,000

$,000,000

44,000,000

6,000,000

Inventory

Property, plant, and equipment (net)

$59,000,000

Suffolk's 2019 income was recorded at £2,000,000. It declared and paid no dividends in 2019.

On December 31, 2020, two years after the date of acquisition, Suffolk submitted the following trial balance to Parker for

consolidation:

Page 537

Cash

$ 1,500,000

Accounts Receivable

5,200,000

Inventory

18,000,000

Property, Plant, and Equipment (net) 36,000,000

Accounts Payable

(1,450,000)

Long-Term Debt

(5,000,000)

Common Stock

(44,000,000)

Retained Earnings, 1/1/20

(8,000,000)

Sales

(28,000,000)

Cost of Goods Sold

16,000,000

Depreciation

2,000,000

Other Expenses

6,000,000

Dividends, 1/30/20

1,750,000

-0-

Other than paying dividends, no intra-entity transactions occurred between the two companies. Relevant U.S. dollar exchange rates for

the British pound follow:

January 1

January 30

Average

December 31

$ 1.60

$ 1.61

$ 1.62

$ 1.64

2019

2020

1.64

1.65

1.66

1.68

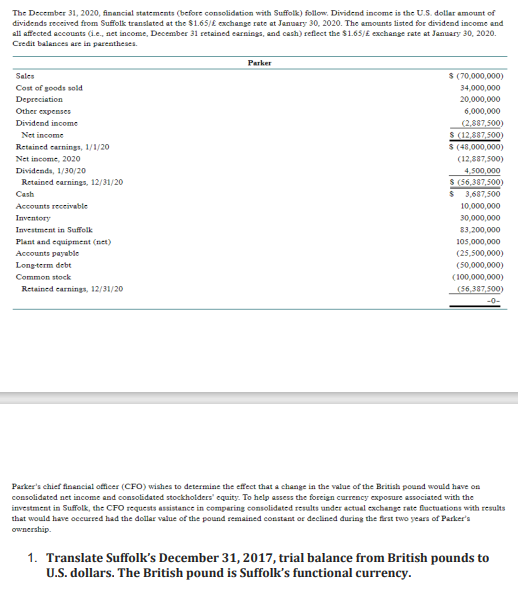

Transcribed Image Text:The December 31, 2020, financial statements (before consolidation with Suffolk) follow Dividend income is the U.S. dollar amount of

dividends received from Suffolk translated at the $1.65/£ exchange rate at January 30, 2020. The amounts listed for dividend income and

all affected accounts (i.e., net income, December 31 retained earnings, and cash) reflect the $1.65/£ exchange rate at January 30, 2020.

Credit balances are in parentheses.

Parker

Sales

$ (70,000,000)

34,000,000

Cost of goods sold

Depreciation

20,000,000

Other expenses

6,000,000

(2,887,500)

Dividend income

Net income

$ (12,887,500)

$ (48,000,000)

Retained earnings, 1/1/20

Net income, 2020

Dividends, 1/30/20

Retained earnings, 12/31/20

(12,887,500)

4,500,000

$ (56,387,500)

3,687,500

10,000,000

Cash

$

Accounts receivable

Inventory

30,000,000

Investment in Suffolk

83,200,000

105,000,000

(25,500,000)

Plant and equipment (net)

Accounts payable

Long-term debt

Common stock

(50,000,000)

Retained earnings, 12/31/20

(100,000,000)

(56,387,500)

-0-

Parker's chief financial officer (CFO) wishes to determine the effect that a change in the value of the British pound would have on

consolidated net income and consolidated stockholders' equity. To help assess the foreign currency exposure associated with the

investment in Suffolk, the CFO requests assistance in comparing consolidated results under actual exchange rate fluctuations with results

that would have occurred had the dollar value of the pound remained constant or declined during the first two years of Parker's

ownership.

1. Translate Suffolk's December 31, 2017, trial balance from British pounds to

U.S. dollars. The British pound is Suffolk's functional currency.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT